5.1 Describe the recording of receivables

Rina Dhillon

A receivable represents a business’ claim on the assets of another entity. The most significant receivables for most businesses are accounts receivable. An account receivable is an amount owed by a customer who has purchased a business’ product or service. Sometimes these receivables are referred to as trade receivables because they arise from the trade of the business. Two accounting problems associated with accounts receivables are:

(1) recognising and recording accounts receivable

(2) valuing accounts receivable

In this section, we focus on how accounts receivables are recorded.

Recording accounts receivables

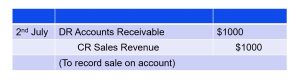

Initial recognition of accounts receivables is relatively simple – receivables are recorded at the time of the sale. For a service business, this means a receivable is recorded when a service is provided on account. For a merchandise business, accounts receivables are recorded at the point of sale of goods on account. To illustrate, suppose that on 2nd July, Kenco Ltd sells $1,000 of products to a customer on account (ignore the effects on Kenco’s inventory and cost of goods sold). Kenco would record the revenue and receivable arising from the sale with the following journal entry:

With this sale, both asset (Accounts Receivable) and equity (Sales Revenue) are increased by debiting Accounts Receivable and crediting Sales Revenue. When Kenco collects the receivable, it will increase cash (debit) and eliminate the receivable (credit):

Effect of sales returns and allowances on accounts receivables

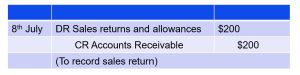

Receivables are also reduced as a result of sales discounts and sales returns. In some cases, a customer will return a product instead of pay for it and this affects the accounts receivable balance. Assume on 8th July, the customer returned $200 of products that were the wrong colour (again ignore the effects on Kenco’s inventory and cost of goods sold). This transaction will reduce accounts receivable by $200 upon the receipt of the returned goods and will be recorded as follows:

The entry decreases accounts receivable (credit) for the sales price of the goods. However, instead of decreasing the Sales revenue account directly, the entry increases Sales returns and allowances. Sales returns and allowances is a contra-revenue account, meaning that its balance is subtracted from sales, thus debit to show the reduction in sales. Businesses use this account to keep record of returns in each period and like the sales revenue account, the Sales return and allowances is a temporary account that is closed (i.e. made zero) at the end of each period.

In addition to returns, some businesses sometimes provide discounts to customers if they pay within a certain time period. This practice of providing a discount encourages early payment by the buyer. For example, terms of 3/7, n/30 provides the buyer with a 3% discount if paid within 7 days and nothing (n actually means net) if paid in the 30 days as required. If the buyer chooses to pay within the discount period, the seller’s accounts receivable is reduced.

To illustrate this, assume Kenco grants terms of 2/10, n/30. The terms mean the buyer will get a 2% discount if paid within 10 days of purchase. On 10th July, the customer pays the remaining $800 ($1000 – $200 return above) bill. By paying within 8 days (recall from above that the sale was made on 2nd July), the customer qualifies for a 2% discount and thus saves $16 ($800 x 2%) and pays only $784 ($800-16). Kenco would record the receipt of payment by raising the following entry:

The entry increases Cash for the $784 payment and decreases Accounts Receivable for the full $800 balance. The difference of $16, which relates to the discount for timely payment, goes to the Sales Discount account. Like the Sales return and allowance account, Sales Discount is a contra-revenue account that is subtracted from sales revenue when calculating net sales. Businesses use this temporary account to keep record of discounts in each period and this account balance is closed at the end of each period.

The entry increases Cash for the $784 payment and decreases Accounts Receivable for the full $800 balance. The difference of $16, which relates to the discount for timely payment, goes to the Sales Discount account. Like the Sales return and allowance account, Sales Discount is a contra-revenue account that is subtracted from sales revenue when calculating net sales. Businesses use this temporary account to keep record of discounts in each period and this account balance is closed at the end of each period.