4.3 Characteristics of equity and how it is recorded and reported in each business structure

Rina Dhillon

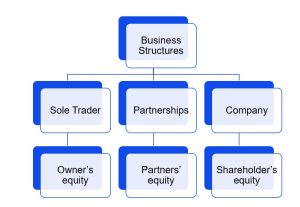

The section provides a brief overview of the main components of the financial statement for a sole proprietorship, partnership and company business structure. Most accounting transactions applies to the ‘business’, and is the same regardless of the way the business is structured. However, from an accounting perspective the major difference between the different forms of businesses is in the equity section of the balance sheet. This is summarised in the diagram below:

Each form of business structure records and reports business transactions separately from the personal transactions of the owner(s). If the owner uses business funds for personal use, this will be shown as a reduction in cash and a distribution of profits (i.e. reducing equity) and not an expense for the business. In addition, how we represent equity is slightly different, in a sole proprietorship, it is called owner’s equity, in a partnership, it is called partners’ equity and in a company, it is called shareholder’s equity. Let’s look at the business reports for each type of structure to better understand how equity is recorded and reported in each business structure.

Sole Proprietorship Reports

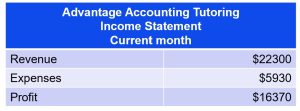

The simplified financial statements presented below has been prepared for a sole trading business, Advantage Accounting Tutoring. This business is owned by a sole trader, Nicola Poulos, and the income statement shows revenues less expenses for Poulos’ Advantage Accounting Tutoring business.

The income statement reports a profit of $16370 for the current month, the first month of operations. Below the balance sheet in the current month is provided:

As illustrated above, the profit is reported on the balance sheet as an addition to capital. The capital represent the contribution by the owner of the business (N Poulos) and the profit (loss) shown belongs to this sole owner.

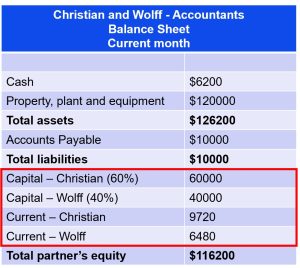

Partnership Reports

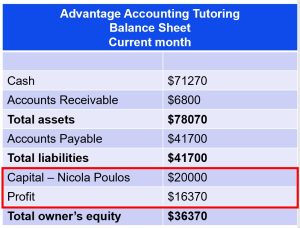

The financial statements presented below illustrates the financial performance (income statement) and financial position (balance sheet) of the partnership, Christian and Wolff – Accountants. In comparison to a sole trader, the main difference in the distribution of profit (loss) here is split according to each of the partner’s original capital contributions, as would be agreed upon and written in a partnership agreement.

The partnership made a profit of $30200 and after deducting the salaries of the two partners – Christian and Wolff – $16200 remained to be distributed based on each partner’s capital invested into the business. Upon examining the balance sheet for Christian and Wolff – Accountants, Christian contributed 60%, calculated as $60000/($60000+$40000) and Wolff contributed 40%, calculated as $40000/($60000+$40000):

The main difference in the balance sheet for a partnership, when compared to a sole trader, is that there are two capital accounts – one for each partner. If there are three partners, the balance sheet would show three capital accounts. There are also two current accounts which represents the combined sum of all years’ profits that have been left in the partnership less the drawings taken out of the business by each partner.

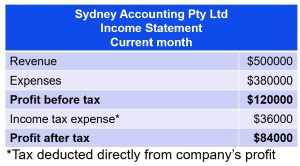

Company Reports

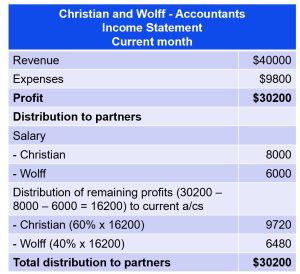

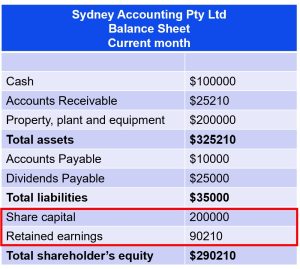

The simplified financial statements below illustrates the income statement and balance sheet of Sydney Accounting Pty Ltd for the current month. Here, the company’s income statement shows tax being directly deducted from the company’s profit. As discussed in Section 4.2, sole proprietorships and partnerships do not pay tax directly on the business profits – it is up to the individual owners to include the business income in their individual tax returns.

In a company’s balance sheet, the shareholder’s equity section shows share capital instead of owners’ or partners’ capital and also reports retained earnings, which represent the sum of the profits retained in the business after the deduction of dividends or allocation to another equity account.

The above company reports are for private companies. Public companies that are limited by shares prepare their financial statements in accordance with the Corporation Act and accounting standards – including the Australian equivalents to International Financial Reporting Standards (IFRS). The Big Four Accounting Firm, KPMG, provides the format for financial statements based on a fictitious for-profit multinational corporation in accordance with Australian Accounting Standards here. The balance sheet can be found on pages 32-33 and the income statement on pages 34-36.

We now shift our focus on partnership accounting by exploring the various business transactions that can happen in a partnership in Section 4.4.