8.3 Preparing the operating activities section of the statement of cash flows using the direct method

Rina Dhillon; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

The direct method is used by most reporting entities in Australia. Businesses using this method need to also prepare a reconciliation of cash flows from operations to profits or losses, which has the same information as is shown in the indirect method (discussed in detail in Section 8.4). As previously mentioned, the net cash flows for all sections of the statement of cash flows are identical when using the direct method or the indirect method. The difference is just in the way that net cash flows from operating activities are calculated and presented.

The direct method requires that each item of income and expense be converted from the accrual basis value to the cash basis value for that item. Businesses calculate and report cash receipts from operating activities and cash payments for operating activities. Cash receipts are calculated by converting revenues from the income statement to cash collections. Cash payments are calculated by converting expenses from the income statement to cash payments. This is accomplished by adjusting the accrual amount for the revenue or expense by any related current operating asset or liability. Revenue and expense items that are not related to those current asset and liability accounts would not need an adjustment.

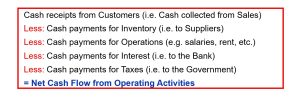

When reporting Operating Cash Flows under the Direct Method, businesses calculate and report cash receipts and cash payments according to transaction types:

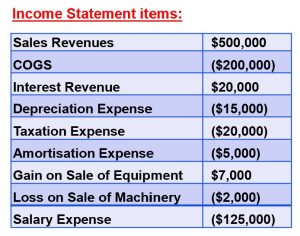

In the following section, we demonstrate the calculations needed to assess the component pieces of the operating section using the direct method above with the following information from the income statement, balance sheet and notes:

Notes:

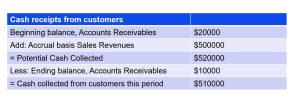

Cash receipts from customers is different from the sales revenue that is recorded on the accrual basis financial statements. To reconcile the amount of sales revenue reported on the income statement to the cash collected from sales, calculate the maximum amount of cash that could have been collected this period (potential cash collected) by combining (a) the amount that was due from customers on the first day of the period (beginning accounts receivable) and (b) total sales revenue recorded this period. If there were no outstanding accounts receivable balance at the end of the period, then one could reasonably assume that this total was collected in full during this period. Thus, the amount of cash collected from customers this period can be determined by subtracting the ending accounts receivable balance from the total potential cash that could have been collected.

The above calculation logic would apply for any cash collected for receipts related to a receivable, including cash collected from interest.

Cash Paid to Suppliers for Inventory

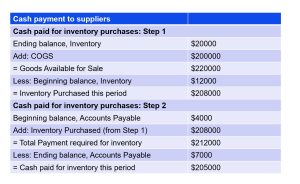

Cash paid for inventory is different from the cost of goods sold that is recorded on the accrual basis financial statements. To reconcile the amount of cost of goods sold reported on the income statement to the cash paid to suppliers for inventory, it is necessary to perform two calculations. The first part of the calculation determines how much inventory was purchased, and the second part of the calculation determines how much of those purchases were paid for during the current period.

First, calculate the maximum amount of inventory that was available for sale this period by combining (a) the amount of inventory that was on hand on the last day of the period (ending inventory) and (b) total cost of goods sold recorded this period. If there were no inventory balance at the beginning of the period, then one could reasonably assume that this total was purchased entirely during the current period. Thus, the amount of inventory purchased this period can be determined by subtracting the beginning inventory balance from the total goods (inventory) available for sale.

Second, calculate the maximum amount of cash that could have been paid for inventory this period (total payment required for inventory costs) by combining (a) the amount that was due to suppliers on the first day of the period (beginning accounts payable) and (b) total inventory purchases this period, from the first inventory calculation. If there were no outstanding accounts payable balance at the end of the period, then one could reasonably assume that this total was paid in full during this current period. Thus, the amount paid for inventory can be determined by subtracting the ending accounts payable balance from the total payment required for inventory. The final number of the second calculation is the actual cash paid to suppliers for inventory.

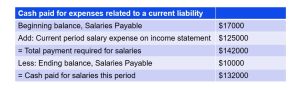

Cash Paid for Salaries

Cash paid for salaries is different from the salaries expense that is recorded on the accrual basis financial statements. To reconcile the amount of salaries expense reported on the income statement to the cash paid for salaries, calculate the maximum amount of cash that could have been paid for salaries this period (total payment required for salaries) by combining (a) the amount that was due to employees on the first day of the period (beginning salaries payable) and (b) total salaries expense recorded this period. If there were no outstanding salaries payable balance at the end of the period, then one could reasonably assume that this total was paid in full during this current period. Thus, the amount of cash paid for salaries in this accounting period can be determined by subtracting the ending salaries payable balance from the total payment required for salaries.

The above calculation logic would apply for any cash payments for expenses related to a current liability such as taxes, as well as prepaid assets such as cash paid for insurance.

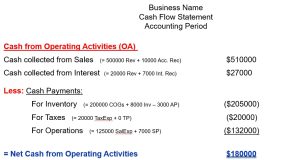

Based on the above calculations, the operating activities section of the statement of cash flows would be shown as follows:

A summary of adjustments used to generate the numbers (and as explained in detail using the calculation logic for cash receipts and cash payments above) is provided below:

Let’s look at the adjustments listed above and walk through the rationalisation behind each calculation.

Cash collected from sale = Sales Revenue – Increase in A/R or + Decrease in A/R

The accounts receivable account increases when sales are made but no cash is collected, thus we will minus an increase in A/R as we have not collected the cash yet. The reverse is true when accounts receivable decreases in that a decrease would signal the receipt of cash from customers and thus we will plus a decrease in A/R.

Treatment of other Income Statement items

There are a number of non-cash transactions which appear in the Income Statement. These include depreciation expense, amortisation expense; and gain/loss on sale of non-current assets ( which will be reported as a cash inflow from investing activities). These items are ignored under the Direct Method, because they do not have an impact on cash. Depreciation and amortisation expense is a non-cash charge, meaning that cash is not affected (a business does not pay cash when they depreciate an asset) when depreciation and amortisation is recorded in the accounting system. Thus it is always the case that depreciation and amortisation expense is not included when preparing the operating activities section under the direct method.

With a gain or loss on the sale of a non-current asset, because the sale is an investing activity, all cash received from the sale will be reported as a cash inflow from investing activities, and not included when preparing the operating activities section under the direct method.

However, these items are included in the preparation of the reconciliation, which is identical to the Indirect Method and discussed in the next section. When reporting operating cash flows under the indirect method, businesses calculate and report net cash flows from operating activities by adjusting the net profit/loss from an accrual basis to a cash basis. This requires three main types of adjustments – (1) non-cash effects on net income; (2) gains and losses from investing and/or financing activities; and (3) changes in current assets and liabilities. Section 8.4 will illustrate and discuss these adjustments by preparing the operating activities section of the statement of cash flows using the indirect method.