8.2 Describe the process of preparing the statement of cash flows

Rina Dhillon; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

Preparing the Cash Flow Statement

As you would have learnt in Chapter 3, the income statement, statement of changes in equity and balance sheet are prepared with numbers from an adjusted trial balance. However, the statement of cash flows is prepared with information collected from a variety of sources, including examination of the changes in all non-cash accounts.

In order to explain a business’ change in cash, we must first explain the changes in the business’ non-cash accounts. To do that, you need information from the following sources: (1) comparative statement of financial position (balance sheet); (2) statement of comprehensive income (income statement); and (3) additional information on changes in account balances, for example the change in dividends account would require us to know if the business distributed dividends in cash (which will impact the cash flow statement) or shares (no impact on cash).

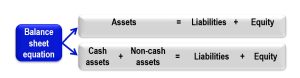

Let’s us break this three sources detailed above by first considering the accounting (balance sheet) equation:

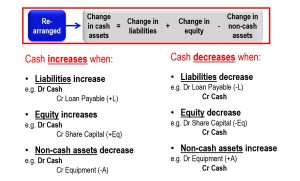

We can isolate cash from the accounting equation by breaking it out from other non-cash assets. Focusing on the change in account balances and moving non-cash assets from the left side of the equation to the right side, the above equation can be rewritten as follows:

The above re-arranged equation shows that the change in cash for a given accounting period is equal to the changes in all other non-cash (liabilities, equity and non-cash assets) accounts.

The balance sheet will provide the beginning and ending balances of all accounts, but here we focus on the non-cash accounts from which changes for the accounting period are calculated. The income statement provides the business’ revenue and expense balances for the accounting period and are important for preparing the operating activities section of the cash flow statement. As mentioned above, additional information on changes in account balances is also needed to determine if a change in account balance is a cash or non-cash transaction. The understanding of whether a transaction is cash or non-cash enables the preparer of the cash flow statement to correctly only include changes in account balances that affect cash. This is illustrated in the summary below:

As shown above, cash increases when liabilities increase, equity increase and non-cash assets decrease. Why is this so? Let’s start with when liabilities increase. For example, if a business borrows money from the bank, the bank provides the business with cash (cash inflow) and with this cash increase, the business has a legal obligation (i.e. liability) to pay it back at a mutually agreed date. This is similar in the case of when equity increases. For example, if a business issues shares in exchange for cash, shareholders provide the business with cash (cash inflow) and with this cash, the business gives the shareholder ownership interest (i.e. equity) in the business. In the instance of when non-cash assets such as non-current assets decreases, this would happen if for example the business sell their equipment (non-current asset). When the business sells their asset, the buyer will provide the business with cash (cash inflow) in exchange for purchasing the equipment.

On the other hand, cash decreases when liabilities decrease, equity decrease and non-cash assets increase. Why is this so? Let’s start with when liabilities decrease. For example, if a business pays back the loan that it borrows from the bank, there will be a cash outflow (decrease) from the business to the bank to settle the loan obligation (i.e. liability). This is similar in the case of when equity decreases. For example, if a business buy backs its shares, there is a cash outflow from the business to the shareholders for the purchase of shares by the business. In the instance of when non-cash assets such as non-current assets increases, this would happen if for example the business buys new equipment (non-current asset). When the business buys the equipment, there is a cash outflow from the business to the seller of the asset for the purchase of the equipment by the business.

Another way of thinking of cash flows is to ask what is happening to CASH? Is cash coming into the business (cash receipts) or going out of the business (cash payments)?

Cash Inflows (increases) include cash receipts from:

– Customers who purchased inventory on credit (Accounts Receivable)

– Sale of Property, Plant and Equipment (PPE)

– Issuance of shares or bonds

– Borrowing money in the form of a loan

Cash Outflows (decreases) include cash payments for:

Purchase of inventory

Payment to employees for their services

Purchase of Property, Plant and Equipment (PPE)

Repayment of loans or bonds

Buy-back of shares

Payment of cash dividends

So that the statement of cash flows is as informative as possible, the cash flow statement groups and reports the cash inflows and outflows outlines above in three distinct activities: cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. Financial statement users are able to assess a company’s strategy and ability to generate a profit and stay in business by assessing how much a company relies on operating, investing, and financing activities to produce its cash flows. Let’s look at each of these activities closely.

Cash Flows from Operating Activities

Cash flows from operating activities arise from the activities a business uses to produce net income – i.e. cash inflows and outflows arising from the business’ operations. For example, operating cash flows include cash sources from sales and cash used to purchase inventory and to pay for operating expenses such as salaries and utilities. Operating cash flows also include cash flows from rent paid, interest revenue, interest expense, and tax paid. Basically, any cash flow associated with a business’ revenues and expenses should be considered an operating cash flow (net cash flow from operating activities can be thought of a net profit or loss on a cash basis). Operating cash flows are reported first on the statement of cash flows. This is followed by cash flows from investing activities.

Cash Flows from Investing Activities

Cash flows from investing activities are cash business transactions related to a business’ investments in long-term assets – i.e. cash inflows and outflows arising from the acquisition and disposal of non-current assets. They can usually be identified from changes in the property, plant and equipment (PPE or Fixed Assets) section of the balance sheet. Some examples of investing cash flows are payments for the purchase of land, buildings, equipment, and other investment assets and cash receipts from the sale of land, buildings, equipment, and other investment assets. After reporting on investing cash flows, cash flows from financing activities are reported.

Cash Flows from Financing Activities

Cash flows from financing activities are cash transactions related to the business raising money from debt or shares, or repaying that debt – i.e. cash inflows and outflows associated with the generation and return of capital. They can be identified from changes in non-current liabilities and equity (other than interest payments which are reported in operating cash flows). Examples of financing cash flows include cash inflows from issuance of shares or borrowings, cash payments for dividend distributions, principal repayment or redemption of notes or loans payable, or repurchase of shares.

Net Increase (Decrease) in Cash

After a business reports its operating, investing and financing cash flows, it sums the three and reconciles the business’ beginning and ending cash balances. Below the Cash Flow Statement for the period ending 30th June 2022 is provided for Westfarmer Group, an Australian listed company with diverse business operations within the residential, apparel and general merchandise, office supplies, health and beauty, chemicals, energy and safety industries:

In 2022, Westfarmers showed a substantial decrease in cash. Westfarmers in 2022 reports a net cash inflow from operating activity of $2301 million, a net cash outflow from investing activities of $1191 million and a net cash outflow from financing activities of $3428 million. This resulted in a net decrease in cash of $2318 ($2301-1191-3428) million and is largely driven by the distribution of surplus cash by way of a $2.3 billion capital return to shareholders and the payment of $1.9 billion of dividends as reported in the financing section of the cash flow statement.

Methods to Preparing the Statement of Cash Flows

The statement of cash flows can be prepared using the direct or indirect method. Like most companies, Westfarmers reports operating cash flows using the direct method (as depicted in the statement above). AASB 107 paragraph 18 allows businesses to report cash flows from operating activities using either:

(a) the direct method, whereby major classes of gross cash receipts and gross cash payments are disclosed; or

(b) the indirect method, whereby profit or loss is adjusted for the effects of transactions of a non-cash nature, any deferrals or accruals of past or future operating cash receipts or payments, and items of income or expense associated with investing or financing cash flows.

While AASB 107 allows the indirect method, the standard encourages businesses to “report cash flows from operating activities using the direct method”. The reason for this is “the direct method provides information which may be useful in estimating future cash flows and which is not available under the indirect method” (AASB 107, paragraph 19).

In Australia, when businesses use the direct method, they are required to provide a reconciliation of cash flows from operating activities to profit and loss, which is similar to the calculation of cash flows from operations used under the indirect method. For example, Westfarmers’ reconciliation was disclosed in Note 4 of their financial statements and provided below:

As illustrated above, the indirect method reconciles net profit to cash flows by subtracting non cash expenses and adjusting for changes in current assets and liabilities, which reflects timing differences between accrual-based net income and cash flows. A non cash expense is an expense that reduces net income but is not associated with a cash flow; the most common example is depreciation expense (which was discussed in Chapter 7).

Indirect method: (Cash Flow = Net Profit +/- Non-cash transactions)

The direct method, on the other hand, lists net cash flows from revenue and expenses, whereby accrual basis revenue and expenses are converted to cash basis receipts and payments.

Direct method: (Cash Flow = Cash Receipts +/- Cash Payments)

It is important to note that both indirect and direct methods will yield the same net cash flows from operating activities as seen above in the example of Westfarmers – $2301 million. The only difference between the methods is the manner in which cash flows are reported. Because AASB 107 encourages businesses to use the direct method, but also to disclose the reconciliation of cash flows from operations to net profit, we will discuss the direct method first in Section 8.3, followed by the indirect method in Section 8.4 which will calculate cash flows from operations in the same manner that the cash flow reconciliation is prepared.