4.2 Characteristics of each form of business structure

Rina Dhillon and Adapted by Stephen Skripak with Ron Poff

Sole Proprietorship

In a sole proprietorship or a sole trader, as a single owner, you have complete control over your business. You make all important decisions and are generally responsible for all day-to-day activities. The cost of establishing and running a sole trading business is also low. In exchange for assuming all the risk of failure and reaping all the rewards of success, you get all the income earned by the business. The income from the business is reported on the owner’s personal tax return, along with other income like salaries.

For many people, however, being a sole trader is not suitable. The flip side of enjoying complete control is having to supply all the different talents that may be necessary to make the business a success. And when you are gone, the business dissolves. You also have to rely on your own resources for financing: in effect, you are the business and any money borrowed by the business is loaned to you personally. Even more important, the sole proprietor bears unlimited liability for any losses incurred by the business. The principle of unlimited personal liability means that if the business incurs a debt or suffers a disaster (say, getting sued for causing an injury to someone), the owner is personally liable. As a sole proprietor, you put your personal assets (your bank account, your car, sometimes even your home) at risk for the sake of your business. You can lessen your risk with insurance, yet your liability exposure can still be substantial. Given that Ben and Jerry decided to start their ice cream business together (and therefore the business was not owned by only one person), they could not set their company up as a sole proprietorship.

Partnership

A partnership is a business that is formed when two or more proprietors join together to own a business. Though the vast majority of partnerships are small, some are quite large. For example, the big four public accounting firms are partnerships. There are about 2900 partners between the big four as of July 2021, with Deloitte remaining the largest partnership – 900 partners at the start of the 2021 financial year, then PwC – 777, EY -638 and KPMG -604 (Tadros and Wootton, 2022). Setting up a partnership is more complex than setting up a sole proprietorship, but it is still relatively easy and inexpensive. The cost varies according to size and complexity. It’s possible to form a simple partnership without the help of a lawyer or an accountant, though it’s usually a good idea to get professional advice. Professionals can help you identify and resolve issues that may later create disputes among partners.

The Partnership Agreement

The impact of disputes can be lessened if the partners have executed a well-planned partnership agreement that specifies everyone’s rights and responsibilities. The agreement might provide such details as the following:

- Amount of cash and other contributions to be made by each partner

- Division of partnership income (or loss)

- Partner responsibilities—who does what

- Conditions under which a partner can sell an interest in the business

- Conditions for dissolving the partnership

- Conditions for settling disputes

A major problem with partnerships, as with sole proprietorships, is unlimited liability: in this case, each partner is personally liable not only for his or her own actions but also for the actions of all the partners. If your partner in an architectural business makes a mistake that causes a structure to collapse, the loss your business incurs impacts you just as much as it would him or her. And here’s the really bad news: if the business doesn’t have the cash or other assets to cover losses, you can be personally sued for the amount owed. In other words, the party who suffered a loss because of the error can sue you for your personal assets.

A partnership has several advantages over the sole proprietorship. First, it brings together a diverse group of talented individuals who share responsibility for running the business. Second, it makes financing easier: the business can draw on the financial resources of a number of individuals. The partners not only contribute cash to the business but can also use personal resources to secure bank loans. Finally, continuity need not be an issue because partners can agree legally to allow the partnership to survive if one or more partners die.

Still, there are some negatives. First, as discussed earlier, partners are subject to unlimited liability. Second, being a partner means that you have to share decision making, and many people aren’t comfortable with that situation. Not surprisingly, partners often have differences of opinion on how to run a business, and disagreements can escalate to the point of jeopardising the continuance of the business. Third, in addition to sharing ideas, partners also share profits. This arrangement can work as long as all partners feel that they’re being rewarded according to their efforts and accomplishments, but that isn’t always the case. While the partnership form of ownership is viewed negatively by some, it was particularly appealing to Ben Cohen and Jerry Greenfield. Starting their ice cream business as a partnership was inexpensive and let them combine their limited financial resources and use their diverse skills and talents.

Company

A company (also commonly known as corporation) differs from a sole proprietorship and a partnership because it is a legal entity that is entirely separate from the parties who own it. It can enter into binding contracts, buy and sell property, sue and be sued, be held responsible for its actions, and be taxed. Once businesses reach any substantial size, it is advantageous to organise as a company so that its owners can limit their liability. Companies tend to be far larger, on average, than businesses using other forms of ownership.

Companies are owned by shareholders who invest money in the business by buying shares. The portion of the company they own depends on the percentage of shares they hold. For example, if a company has issued 100 shares, and you own 30 shares, you own 30 percent of the company. The shareholders elect a board of directors, a group of people (primarily from outside the company) who are legally responsible for governing the company. This governance comes from the board overseeing the major policies and decisions made by the company, setting company goals and holding management accountable for achieving them, and hiring and evaluating the top executives. The board also approves the distribution of profit to shareholders in the form of cash payments called dividends (which will be explored in Section 4.6).

The corporate form of business offers several advantages, including limited liability for shareholders, greater access to financial resources, and continuity. The most important benefit is the limited liability to which shareholders are exposed: they are not responsible for the obligations of the corporation, and they can lose no more than the amount that they have personally invested in the company. If the company did not have enough money to pay the debt, the individual shareholders will not be obligated to pay anything. They would have lost all the money that they had invested in the business, but no more.

Incorporation also makes it possible for businesses to raise funds by selling shares. This is a big advantage as a company grows and needs more funds to operate and compete. Depending on its size and financial strength, the company also has an advantage over other forms of business in getting bank loans. An established company can borrow its own funds, but when a small business needs a loan, the bank usually requires that it be guaranteed by its owners.

Another advantage of incorporation is continuity. As a company has a legal life separate from the lives of its owners, it can (at least in theory) exist forever. Transferring ownership of a company is also easier: shareholders simply sell their shares to others. Some owners, however, want to restrict the transferability of their shares and so choose to operate as a privately-held corporation. The shares in these companies are held by only a few individuals, who are not allowed to sell it to the general public. Companies with no such restrictions on selling shares are called public companies – shares are publicly traded on the stock exchange (like the Australian Stock Exchange) and are available for sale to the general public.

Like sole proprietorships and partnerships, companies have both positive and negative aspects. In sole proprietorships and partnerships, for instance, the individuals who own and manage a business are the same people. Management may not necessarily own shares in the company, and shareholders may not necessarily work for the company and thus this situation can be troublesome if the goals of the two groups differ significantly. Managers, for example, are often more interested in career advancement than the overall profitability of the company. Shareholders, on the other hand, might care more about profits without regard for the well-being of employees. This situation is known as the agency problem, a conflict of interest inherent in a relationship in which one party is supposed to act in the best interest of the other. It is often quite difficult to prevent self-interest from entering into these situations.

Another drawback to companies—one that often discourages small businesses from incorporating—is the fact that they are more costly to set up. Additionally, companies are subject to levels of regulation and governmental oversight that can place a burden on small businesses. Finally, companies are subject to what is generally called “double taxation.” Companies are taxed by the government’s tax office on their profits. When these profits are distributed as dividends, the shareholders pay taxes on these dividends. Company profits are thus taxed twice—the company pays the taxes the first time and the shareholders pay the taxes the second time.

Five years after starting their ice cream business, Ben Cohen and Jerry Greenfield evaluated the advantages and disadvantages of the corporate form of ownership, and the advantages won. The primary motivator was the need to raise funds to build a $2 million manufacturing facility. Not only did Ben and Jerry decide to switch from a partnership to a corporation, but they also decided to issue shares to the public (and thus become a public corporation). Ben and Jerry was acquired by Unilever in 2000.

Other Types of Business Ownership

In addition to the three commonly adopted forms of business structures —sole proprietorship, partnership, and companies—some business owners select other forms of organisation to meet their particular needs such as association (Unincorporated and Incorporated), Cooperative, Franchise, Joint Venture, Not-For-Profit (NFP) and Trust.

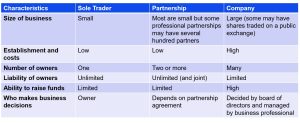

Summary of characteristics of each form of business structure

The table below provides a summary of the main characteristics of the three forms of business structure, discussed above.

In the next section, we turn our attention to how equity is recorded and reported in each type of business structure.