6.4 Demonstrate how inventory is estimated

Rina Dhillon; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

A business must sometimes estimate inventory values. These estimates could be needed for interim reports, when physical counts are not taken. The need could result from a natural disaster that destroys part or all of the inventory or from an error that causes inventory counts to be compromised or omitted (for example theft or spoilage). Some specific industries (such as retail businesses) also regularly use these estimation tools to determine cost of goods sold.

In the above cases, businesses can estimate its ending inventory using the gross profit (margin) method or the retail method. Although these methods are predictable and simple, and both rely on gross profit margins (also known as mark ups), it is also less accurate since it is based on estimates rather than actual cost figures. Let’s look at each of this method closely.

Gross profit method

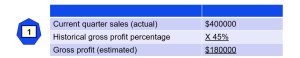

The gross profit method is used to estimate inventory values by applying a standard gross profit percentage to the company’s sales totals when a physical count is not possible. The resulting gross profit can then be subtracted from sales, leaving an estimated cost of goods sold. Then the ending inventory can be calculated by subtracting cost of goods sold from the total goods available for sale. To illustrate the gross profit method, assume that In Style Fashion is preparing financial statement and need to estimate the cost of goods sold and ending inventory. In Style Fashion has generated $400000 of sales and historically, the gross profit percentage has averaged 45%. Assuming that this financial period is similar to previous periods, In Style Fashion can estimate that gross profit on current sales is $180000:

In Style Fashion can then use this estimated gross profit to estimate the cost of goods sold for the period to be $220000:

With this estimated cost of goods sold, In Style Fashion can calculate its ending inventory using the general cost of goods model. Based on prior financial reports, In Style Fashion can determine that the business started the period with $200000 in inventory. Looking at purchase records, they can make out how much inventory they purchased during the period, in this instance $90000 of inventory. This means that In Style Fashion has $290000 in inventory available for sale during the period. With the estimated $220000 cost of goods sold, they can estimate ending inventory to be $70000:

Let’s now turn our attention to the retail inventory method.

Retail Inventory method

Likewise, the retail inventory method estimates the cost of goods sold, much like the gross profit method does, but uses the retail value of the portions of inventory rather than the cost figures used in the gross profit method. Essentially, once ending inventory is counted (usually through a stock take), the total sales value of the inventory is reduced by the profit margin. Clothing shops often use the retail inventory method, utilising the current selling price of the garment (say a dress) and reducing prices to cost by the application of average department mark-up ratios. We can usually determine the selling price from price list or cash register or Point Of Sale (POS) system. To illustrate using a simple example, if a business has a gross profit margin of 45.25% (calculated by gross profit/operating revenue), then cost of goods sold is 54.75% (100%-45.25%).

You can read more about the retail method in AASB 102 Inventories paragraph 22.

Lower-of-Cost-and-Net-Realisable-Value

Reporting inventory values on the balance sheet using the accounting concept of conservatism (which discourages overstatement of net assets and net income) requires inventory to be calculated and adjusted to a value that is the lower of the cost calculated using the business’ chosen valuation method or the market value based on the market or replacement value of the inventory items.

Thus, if traditional cost calculations produce inventory values that are overstated, the lower-of-cost-and-net-realisable-value LCNRV (sometimes called the lower of cost or market) requires that the balance in the inventory account should be decreased to the more conservative replacement value rather than be overstated on the balance sheet.

LCNRV is applied at the end of each accounting period by comparing inventory costs to net realisable value (NRV). AASB 102 Inventories does not allow decreases in one category of inventory to be offset against gains in another. In addition, the loss on inventory is usually reported as part of cost of goods sold in the income statement, and in the balance sheet, inventory is reported as a current asset at LCNRV.

Test your knowledge