3.3 Record and post adjusting journal entries and prepare an adjusted trial balance and financial statements

Rina Dhillon; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

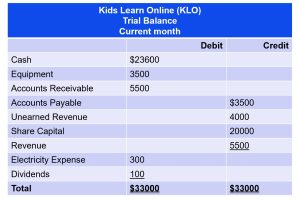

To illustrate the process of making adjusting journal entries from a trial balance and then preparing an adjusted trial balance, the Kids Learn Online (KLO) example from Chapter 2 will be continued. As a result of the business transactions entered into by KLO, the following unadjusted trial balance was prepared (this is taken from Chapter 2):

Notice that it is an ‘unadjusted’ trial balance because adjusting entries have yet to be made. In addition to these accounts and balances, the following information was available on the last day of the month:

Before we record the adjusting entries for KLO, you might question the purpose of more than one trial balance. There are several steps in the accounting cycle that require the preparation of a trial balance: step 4, preparing an unadjusted trial balance; step 6, preparing an adjusted trial balance; and step 9, preparing a post-closing trial balance. You might ask why can we not go from the unadjusted trial balance straight into preparing financial statements for users of these statements? What is the purpose of the adjusted trial balance? Does preparing more than one trial balance mean a mistake was made earlier in the accounting cycle? To answer these questions, let’s first explore the (unadjusted) trial balance, and why some accounts have incorrect balances.

Why Some Accounts Have Incorrect Balances on the Trial Balance

The unadjusted trial balance may have incorrect balances in some accounts. Let’s look at Unearned Revenue as an example. In transaction 3, KLO received $4000 from a customer for an app to be developed. KLO recorded this as a liability because it received payment without providing the service. To clear this liability, the company must perform the service. Assume that as of the end of the month when the accounting books are closed, some of the app development services have been provided. Is the full $4000 still a liability? Since a portion of the service was provided, a change to unearned revenue should occur. KLO needs to correct this balance in the Unearned Revenue account (this is illustrated below).

Having incorrect balances in Unearned Revenue on the unadjusted trial balance is not due to any error on the business’ part. The business followed all of the correct steps of the accounting cycle up to this point. So why are the balances still incorrect?

Journal entries are recorded when an activity or event occurs that triggers the entry. Usually the trigger is from an original source. Recall that an original source can be a formal document substantiating a transaction, such as an invoice, purchase order, or employee time sheet. Not every business transaction produces an original source document that will alert the need to make an entry in the accounting system.

For unearned revenue, for example, when the business receives an advance payment from the customer for services yet provided, the cash received will trigger a journal entry. When the business provides the services for the customer, the customer will not send the business a reminder that revenue has now been earned. Situations such as these are why businesses need to make adjusting entries.

Before beginning adjusting entry examples for KLO, let’s consider some rules governing adjusting entries:

- Every adjusting entry will have at least one income statement account and one balance sheet account.

- Cash will never be in an adjusting entry.

- The adjusting entry records the change in amount that occurred during the period.

What are “income statement” and “balance sheet” accounts? Income statement accounts include revenues and expenses. Balance sheet accounts are assets, liabilities, and equity accounts, since they appear on a balance sheet. The second rule tells us that cash can never be in an adjusting entry. This is true because paying or receiving cash triggers a journal entry. This means that every transaction with cash will be recorded at the time of the exchange. We will not get to the adjusting entries and have cash paid or received which has not already been recorded. If accountants find themselves in a situation where the cash account must be adjusted, the necessary adjustment to cash will be a correcting entry and not an adjusting entry.

With an adjusting entry, the amount of change occurring during the period is recorded. For example, for unearned revenues, the business would record how much of the revenue was earned during the period. Let us now turn our attention to recording the adjusting entries for KLO.

Recording Common Types of Adjusting Entries

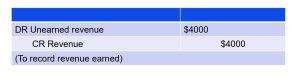

Adjustment 1: Unearned revenue

KLO developed a quizlet app for the customer who paid $4000 at the beginning of the month.

Analysis:

- The customer from Transaction 3 (Chapter 2) gave KLO $4000 in advanced payment for services. By the end of month, KLO had completed the service (developed the quizlet app) and thus earned the whole $4000 of the advanced payment.

- Since the unearned revenue is now earned, Unearned Revenue would decrease and as it is a liability account, it decreases on the debit side.

- KLO can now recognize the $4000 as earned revenue. Revenue increases (credit) for $4000.

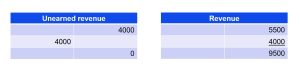

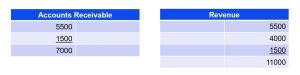

The entry would be posted to the relevant T-accounts as follows (updating the initial T-accounts created in Chapter 2):

In the journal entry, Unearned Revenue has a debit of $4000. This is posted to the Unearned Revenue T-account on the debit side (left side). You will notice there is already a credit balance in this account from the initial customer payment. The $4000 credit (liability has a normal balance of credit) is subtracted from the $4000 debit to get a final balance of $0 (credit). Revenue has a credit balance of $4000. This is posted to the Revenue T-account on the credit side (right side). You will notice there is already a credit balance in this account from other revenue transactions during the month. The $4000 is added to the previous $5500 balance in the account to get a new final credit balance of $9500.

In the journal entry, Unearned Revenue has a debit of $4000. This is posted to the Unearned Revenue T-account on the debit side (left side). You will notice there is already a credit balance in this account from the initial customer payment. The $4000 credit (liability has a normal balance of credit) is subtracted from the $4000 debit to get a final balance of $0 (credit). Revenue has a credit balance of $4000. This is posted to the Revenue T-account on the credit side (right side). You will notice there is already a credit balance in this account from other revenue transactions during the month. The $4000 is added to the previous $5500 balance in the account to get a new final credit balance of $9500.

Impact on the financial statements: Unearned revenue is a liability account and will decrease total liabilities and equity by $4000 on the balance sheet. Revenue will increase overall revenue on the income statement by $4000, which increases net income.

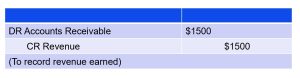

Adjustment 2: Accrued revenue

KLO developed the first half (50%) of an app. The other half of the app will be developed mid-next month. The customer has agreed to pay $3000 for the whole app.

Analysis:

- KLO has developed the first half of an app (i.e. provided 50% of a service). The unadjusted trial balance will not reflect this because KLO has not issued an invoice to the customer so an adjusting journal entry is needed to adjust receivables and revenues up.

- KLO can recognize the $1500 ($3000 x 50%) as revenue. Revenue increases (credit) for $1500.

- The other half of the service is not provided yet so the revenue cannot be recognised yet. However as the customer has agreed to pay $3000 for the whole app (i.e. service), there is an outstanding receivable of $1500 ($3000-$1500). Receivable is an asset, increases (debit) for $1500. Note that the customer has not paid the $3000 yet thus there is no impact on cash.

The entry would be posted to the relevant T-accounts as follows (updating the initial T-accounts created in Chapter 2):

In the journal entry, Accounts Receivable has a debit of $1500. This is posted to the Accounts Receivable T-account on the debit side (left side). You will notice there is already a debit balance in this account from Transaction 4 in Chapter 2. The $1500 debit is added to the $5500 debit to get a final balance of $7000 (debit). Revenue has a credit balance of $1500. This is posted to the Revenue T-account on the credit side (right side). You will notice there is already a credit balance in this account from other revenue transactions during the month and the $4000 from adjustment 1 above. The $1500 is added to the previous $9500 balance in the account to get a new final credit balance of $11000.

In the journal entry, Accounts Receivable has a debit of $1500. This is posted to the Accounts Receivable T-account on the debit side (left side). You will notice there is already a debit balance in this account from Transaction 4 in Chapter 2. The $1500 debit is added to the $5500 debit to get a final balance of $7000 (debit). Revenue has a credit balance of $1500. This is posted to the Revenue T-account on the credit side (right side). You will notice there is already a credit balance in this account from other revenue transactions during the month and the $4000 from adjustment 1 above. The $1500 is added to the previous $9500 balance in the account to get a new final credit balance of $11000.

Impact on the financial statements: Accounts Receivable is an asset account and will increase total assets by $1500 on the balance sheet. Revenue will increase overall revenue on the income statement by $1500, which increases net income.

Adjustment 3: Prepaid expense

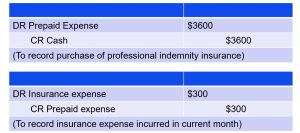

At the beginning of the month, KLO purchased an annual professional indemnity insurance for $3600.

Analysis:

- KLO has paid in advance $3600 for insurance. With this payment KLO has not received the benefits of the insurance yet and thus this future benefits that they will receive should be recognised as an asset in the account Prepaid expense. Prepaid expense would increase and as it is an asset account, it increases on the debit side.

- By the end of month, KLO has received one month’s worth of insurance coverage and thus incurred $300 (3600 x 1/12) of insurance expense. KLO can now recognise this expense as insurance expense. Expense increases (debit) for $300.

- With the recognition of the expense, there is also a reduction of future benefits related to the insurance coverage (we have received this benefit already) and thus prepaid expense needs to be reduced by $300 to reflect this. Prepaid expense (asset) decreases on the credit side by $300.

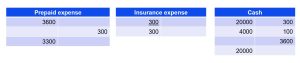

The entry would be posted to the relevant T-accounts as follows (updating the initial T-accounts created in Chapter 2):

In the journal entry, Prepaid expense has a debit of $3600. This is posted to the Prepaid expense T-account on the debit side (left side). As KLO has incurred one month of insurance expense, the prepaid expense account must be reduced to reflect the reduction in future benefits related to the prepayment, with $300 posted on the credit side (right side) to reduce the account by the amount of insurance expense. This $300 credit is deducted from the $3600 debit (asset accounts have normal debit balances) to get a final debit balance of $3300.

In the journal entry, Prepaid expense has a debit of $3600. This is posted to the Prepaid expense T-account on the debit side (left side). As KLO has incurred one month of insurance expense, the prepaid expense account must be reduced to reflect the reduction in future benefits related to the prepayment, with $300 posted on the credit side (right side) to reduce the account by the amount of insurance expense. This $300 credit is deducted from the $3600 debit (asset accounts have normal debit balances) to get a final debit balance of $3300.

Expense has a debit balance of $300. This is posted to the Insurance expense T-account on the debit side, with a final debit balance of $300. The cash payment for the insurance policy will be posted to the Cash T-account on the credit side as a payment reduces the Cash (asset). You will notice there is already a debit balance of $23600 in this account from other cash transactions during the month. The $3600 is deducted from this previous $23600 balance in the account to get a new final debit balance of $20000.

Impact on the financial statements: Prepaid expense is an asset account, and will increase total assets by $3300 ($3600-$300) on the balance sheet. Cash is also an asset account, and will reduce total assets by $3600. Insurance expense will increase overall expenses on the income statement by $300, which reduces net income. Notice that the net effect of this adjustment on the balance sheet is also $300.

Adjustment 4: Accrued expense

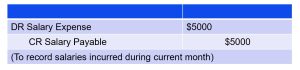

KLO’s daily payroll is $1000 a day (5 day work week). It pays its employees on Saturday for the previous Monday to Friday. The last day of the current month is a Friday.

Analysis:

- Salaries have accumulated for the week and will not be paid in the current period. Since the salaries expense occurred within the accounting period, the expense recognition principle requires recognition in the accounting period.

- Salaries Expense is an expense account that is increasing (debit) for $5000.

- Since KLO has not yet paid salaries for this time period, the business owes the employees this money. This creates a liability for KLO. Salaries Payable increases (credit) for $5000.

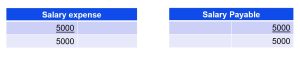

The entry would be posted to the relevant T-accounts as follows (updating the initial T-accounts created in Chapter 2):

In the journal entry, Salaries Expense has a debit of $5000. This is posted to the Salaries Expense T-account on the debit side (left side). Salaries Payable has a credit balance of $5000. This is posted to the Salaries Payable T-account on the credit side (right side). As there were no previous transactions related to these accounts, the final balances are $5000 debit and $5000 credit respectively.

Impact on the financial statements: Salaries Payable is a liability account and will increase total liabilities and equity by $5000 on the balance sheet. Salaries expense will increase overall expenses on the income statement, which decreases net income.

Let’s now summarise the transactions and make sure the accounting equation is balanced by collating a summary of all the T-accounts and checking it against the accounting equation.

T-accounts Summary

Once all adjusting journal entries have been posted to T-accounts, we can check to make sure the accounting equation remains balanced. Following is a summary showing the T-accounts for Kids Learn Online including adjusting entries:

The sum on the assets side of the accounting equation equals $33800, found by adding together the final balances in each asset account (20000 + 3500 + 7000 + 3300). To find the total on the liabilities and equity side of the equation, we need to find the difference between debits and credits. Credits on the liabilities and equity side of the equation total $39500 (3500 + 5000 + 0 + 20000 + 11000). Debits on the liabilities and equity side of the equation total $5700 (300 + 300 + 5000 + 100). The difference $39500 – $5700 = $33800. Thus, the equation remains balanced with $33800 on the asset side and $33800 on the liabilities and equity side. Now that we have the T-account information, and have confirmed the accounting equation remains balanced, we can create the adjusted trial balance in our sixth step in the accounting cycle.

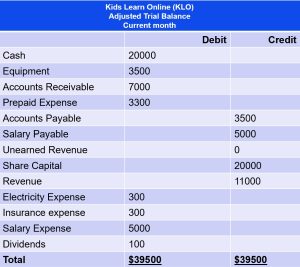

Preparing an adjusted trial balance

Once all of the adjusting entries have been posted to the general ledger, we are ready to start working on preparing the adjusted trial balance. Preparing an adjusted trial balance is the sixth step in the accounting cycle. An adjusted trial balance is a list of all accounts in the general ledger, including adjusting entries, which have nonzero balances. This trial balance is an important step in the accounting process because it helps identify any computational errors throughout the first five steps in the cycle.

As with the unadjusted trial balance, transferring information from T-accounts to the adjusted trial balance requires consideration of the final balance in each account. If the final balance in the ledger account (T-account) is a debit balance, you will record the total in the left column of the trial balance. If the final balance in the ledger account (T-account) is a credit balance, you will record the total in the right column.

Once all ledger accounts and their balances are recorded, the debit and credit columns on the adjusted trial balance are totaled to see if the figures in each column match. The final total in the debit column must be the same dollar amount that is determined in the final credit column.

Let’s now take a look at the adjusted T-accounts and adjusted trial balance for KLO to see how the information is transferred from these T-accounts to the adjusted trial balance.

Once all balances are transferred to the adjusted trial balance, we sum each of the debit and credit columns. The debit and credit columns both total $39500, which means they are equal and in balance. Why Is the Adjusted Trial Balance So Important? As you have learned, the adjusted trial balance is an important step in the accounting process. But outside of the accounting department, why is the adjusted trial balance important to the rest of the organisation? An employee or customer may not immediately see the impact of the adjusted trial balance on his or her involvement with the business.

Once all balances are transferred to the adjusted trial balance, we sum each of the debit and credit columns. The debit and credit columns both total $39500, which means they are equal and in balance. Why Is the Adjusted Trial Balance So Important? As you have learned, the adjusted trial balance is an important step in the accounting process. But outside of the accounting department, why is the adjusted trial balance important to the rest of the organisation? An employee or customer may not immediately see the impact of the adjusted trial balance on his or her involvement with the business.

The adjusted trial balance is the key point to ensure all debits and credits are in the general ledger accounts balance before information is transferred to financial statements. Financial statements drive decision-making for a business. Budgeting for employee salaries, revenue expectations, sales prices, expense reductions, and long-term growth strategies are all impacted by what is provided on the financial statements. So if the business skips over creating an adjusted trial balance to make sure all accounts are balanced or adjusted, it runs the risk of creating incorrect financial statements and making important decisions based on inaccurate financial information.

Preparing financial statements

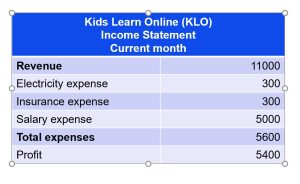

Income Statement

An income statement shows the business’ financial performance for a given period of time. When preparing an income statement, revenues will always come before expenses in the presentation. For KLO, the following is its current month Income Statement, after adjusting entries.

Total revenues are $11000, while total expenses are $5600. Total expenses are subtracted from total revenues to get a net income or profit of $5400. If total expenses were more than total revenues, KLO would have a net loss rather than a net income. This net income figure is used to prepare the statement of retained earnings.

Total revenues are $11000, while total expenses are $5600. Total expenses are subtracted from total revenues to get a net income or profit of $5400. If total expenses were more than total revenues, KLO would have a net loss rather than a net income. This net income figure is used to prepare the statement of retained earnings.

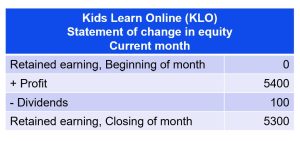

Statement of Change in Equity

The statement of change in equity shows how the equity (or value) of the business has changed over a period of time. It is prepared second to determine the ending retained earnings balance for the period and is prepared before the balance sheet because the ending retained earnings amount is a required element of the balance sheet. The following is the Statement of Change in Equity for KLO:

Net income information is taken from the income statement, and dividends information is taken from the adjusted trial balance. The statement of change in equity always leads with beginning retained earnings. Beginning retained earnings carry over from the previous period’s ending retained earnings balance. Since this is the first month of business for KLO, there is no beginning retained earnings balance. Notice the net income of $5400 from the income statement is carried over to the statement of change in equity. Dividends are taken away from the sum of beginning retained earnings and net income to get the ending retained earnings balance of $5300 for the current month. This ending retained earnings balance is transferred to the balance sheet.

Net income information is taken from the income statement, and dividends information is taken from the adjusted trial balance. The statement of change in equity always leads with beginning retained earnings. Beginning retained earnings carry over from the previous period’s ending retained earnings balance. Since this is the first month of business for KLO, there is no beginning retained earnings balance. Notice the net income of $5400 from the income statement is carried over to the statement of change in equity. Dividends are taken away from the sum of beginning retained earnings and net income to get the ending retained earnings balance of $5300 for the current month. This ending retained earnings balance is transferred to the balance sheet.

Balance Sheet

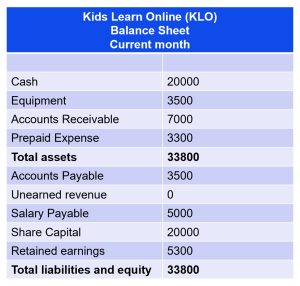

The balance sheet is the third statement prepared after the statement of change in equity and lists what the business owns (assets), what it owes (liabilities), and what the shareholders control (equity) on a specific date. Remember that the balance sheet represents the accounting equation, where assets equal liabilities plus stockholders’ equity. The following is the Balance Sheet for KLO:

Ending retained earnings information is taken from the statement of change in equity, and asset, liability, and shareholder capital information is taken from the adjusted trial balance. The accounting equation is balanced, as shown on the balance sheet, because total assets equal $33800 as do the total liabilities and equity. One important accounting principle to remember is that just as the accounting equation (Assets = Liabilities + Owner’s equity) must be equal, it must remain equal after you make adjusting entries.