6.1 Describe inventory and how it is recorded, expensed, and reported

Rina Dhillon; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

The importance of inventory accounting

Inventory. (credit: modification of “warehouse pallet food” by “jaymethunt”/Pixabay, CC0)

Did you ever decide to start a healthy eating plan and meticulously planned your shopping list, including foods for meals, drinks, and snacks? Maybe you stocked your pantry and fridge with the best healthy foods you could find, including lots of fresh fruit and vegetables, to make sure that you could make tasty and healthy smoothies when you got hungry. Then, at the end of the week, if everything didn’t go as you had planned, you may have discovered that a lot of your produce was still uneaten but not very fresh anymore. Stocking up on goods, so that you will have them when you need them, is only a good idea if the goods are used before they become worthless.

Just like with someone whose preparation for healthy eating can backfire in wasted produce, businesses have to balance a fine line between being prepared for any volume of inventory demand that customers request and being careful not to overstock those goods so the company will not be left holding excess inventory they cannot sell. Not having the goods that a customer wants available is bad, of course, but extra inventory is wasteful. That is one reason why inventory accounting is important. But first what is inventory?

What is inventory?

Inventory is a tangible resource that is held by a business which is intended for resale, in the normal course of operations. What is considered inventory is dependent on the type of business. For a retailer such as Woolworths or Myer, inventory is the stock (merchandise) on the shelves or stored in their distribution centres or warehouses. For manufacturers, inventory also includes the raw materials and work in process related to producing a finished good. In addition, what is classified as inventory for one type of business might classified as something else in another type of business. Let’s take the example of a car dealership like Toyota, cars are their inventory (current asset) while for most of other businesses, cars are non-current assets that is not considered inventory as there is no intention to resell the car. The phrase “intended for resale” differentiates inventory from other assets

The verb “inventory” refers to the act of counting or listing goods. As an accounting term, inventory refers to all stock in the various production stages (especially in the case of a manufacturer) and is a current asset. By keeping stock, both retailers and manufacturers can continue to sell or manufacture goods. Inventory is a major asset for most businesses and thus recording it correctly is very important.

Recording inventory

Following the cost principle, inventory is recorded at its acquisition cost. Acquisition cost includes all costs incurred to get the inventory delivered and prepared for resale. It also includes any reductions provided by the seller or vendor after purchase. Items affecting the cost of inventory include, but are not limited to:

(1) purchase price

(2) any taxes or duties paid, costs for shipping the product and insurance during transit

(3) labour required to assemble the product

(4) returns and allowances

(5) purchase discounts from the vendor (seller)

While inventory is recorded at cost, how it is recorded in the accounting system depends on the inventory system that a business uses. There are two primary systems used to account for inventory: the periodic inventory system and the perpetual inventory system.

Perpetual Inventory System

A perpetual inventory system updates the inventory account balance on an ongoing basis, each time an inventory is bought and sold – that is perpetually. Thus, purchases of inventory are recorded directly into the inventory account and the cost of goods sold is updated each time inventory is sold. As transactions occur, the perpetual system requires that every sale is recorded with two entries, first recording the sales transaction as an increase to Cash or Accounts Receivable (if sale is on account) and an increase to Sales Revenue, and then recording the cost associated with the sale as an increase to Cost of Goods Sold (which is an expense account) and a decrease to Inventory. The journal entries made at the time of sale immediately shift the costs relating to the goods being sold from the inventory account on the balance sheet to the cost of goods sold account on the income statement. Little or no adjustment is needed to inventory at period end because changes in the inventory balances are recorded as both the sales and purchase transactions occur. These are example entries for an inventory sales transaction when using perpetual inventory system:

A purchase of inventory for sale by a business under the perpetual inventory system would necessitate the following journal entry:

Periodic Inventory Method

A periodic inventory system, in contrast, updates the inventory balances at the end of the reporting period – that is periodically. At that point, a journal entry is made to adjust the inventory asset balance to agree with the physical count of inventory, with the corresponding adjustment to the expense account, cost of goods sold. This adjustment shifts the costs of all inventory items that are no longer held by the company to the income statement, where the costs offset the revenue from inventory sales, as reflected by the gross margin. As sales transactions occur throughout the period, the periodic system requires that only the sales entry be recorded because costs will only be updated during end-of-period adjustments when financial statements are prepared.

However, any additional goods for sale acquired during the month are recorded as purchases. Thus instead of recording purchases into the inventory account, they are recorded in an account called Purchases – which is a temporary account that is closed to Inventory at the end of the period. The following are examples of typical journal entries for periodic transactions. The first is an example entry for an inventory sales transaction and the second records the purchase of additional inventory when using the periodic inventory system.

Note: Periodic system requires no corresponding cost entry at the time of sale, since the inventory is adjusted only at period end.

A purchase of inventory for sale by a business under the periodic inventory system would necessitate the following journal entry:

While this section will focus on how inventory is recorded using the perpetual system, we will demonstrate how cost of goods sold is calculated using both inventory systems in the next section.

To illustrate the recording of inventory, assume In Style Fashion purchases $20000 of inventory on account (on credit) on 12th July. The purchase would be recorded as follows:

In this entry, inventory (asset) increases and so does accounts payable (liability).

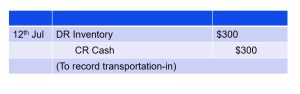

In certain instances, a business must pay for the transportation related to the purchase of the inventory. Like buying from Amazon, we are interested in how it costs in total, not just the price. Such additional costs of purchasing inventory is called transportation-in and are added to the overall cost of inventory. To demonstrate, assume In Style Fashion pays a third-party carrier $300 to transport the inventory to its warehouse. In Style Fashion records the payment as follows:

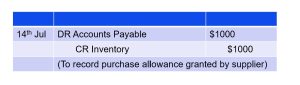

In some cases (and like sales returns and allowances – expect now it is from the perspective of the buying business rather than the business that sells), a business will return inventory to the seller or supplier – called a purchase return – or seek a decrease in the cost of the inventory due to defects – called a purchase allowance. Both instances will reduce the cost of the inventory purchased. To illustrate, assume that on 14th July, In Style Fashion is granted a $1000 reduction in the cost of the merchandise due to blemishes on the inventory. In Style Fashion records the reduction of the inventory cost and payable as follows:

Even though In Style Fashion still keeps the inventory, the cost of inventory has decreased due to the purchase allowance and this is recognised by reducing the amount payable to the supplier in Accounts payable (debit) and reducing the cost of inventory (credit).

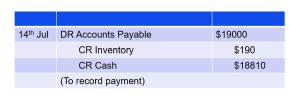

Additionally, similar to businesses providing sales discounts, business who purchase goods sometimes receive discounts from suppliers if payments are made within a certain time period. This purchase discounts would reduce the cost of the inventory. To demonstrate, assume, In Style Fashion pays its remaining $19,000 ($20000-1000) bill to the vendor on 19th July and qualifies for a 1% early payment discount (or $19,000 x 1% = $190). The entry to record payment would be as follows:

The above entry decreases Accounts Payable (debit) for the full $19000 and decreases Cash (credit) by the $18810 paid. The difference is a reduction to the cost of inventory by $190 because of the purchase discount.

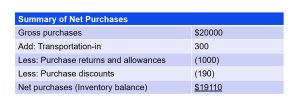

Given the above, In Style Fashion’s net purchases of inventory can be calculated as follows:

Expensing inventory

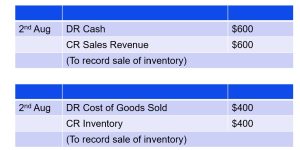

Inventory becomes an expense when it is sold. The account ‘cost of goods sold’ or ‘cost of sales’ is used to capture the amount of inventory expensed during a period. To illustrate the expensing of inventory, assume on 2nd August In Style Fashion sells inventory that cost the business $400 to a customer for $600 cash. In Style Fashion would record the sale with the following two entries:

The first entry records the effect of the sale on In Style Fashion’s cash and revenues. Both Cash (asset) and Sales Revenue (equity) increase by the amount of sale ($600). The second journal records the effects of the sale on In Style Fashion’s inventory and expense. Cost of Goods Sold (expense) increases by the same amount as the cost of the inventory sold. Inventory (asset) decreases by the same amount.

The net effect of these two entries on assets and equity is a $200 ($600-400) increase which equal to the gross profit (Revenue $600 – Expense $400) that In Style Fashion earned on the sale.

Reporting inventory

A business’ financial statements report the combined cost of all items sold as an offset to the proceeds from those sales, producing the net number referred to as gross margin (or gross profit). This is presented in the first part of the results of operations for the period on the income statement. The unsold inventory at period end is an asset to the company and is therefore included on the balance sheet. As inventory is expected to be sold within a year, it is reported on the balance sheet as a current asset.

The total cost of all the inventory that remains at period end, reported as inventory on the balance sheet, plus the total cost of the inventory that was sold or otherwise removed (through shrinkage, theft, or other loss), reported as cost of goods sold on the income statement represent the entirety of the inventory that the business had to work with during the period, or goods available for sale.

Keeping It Real

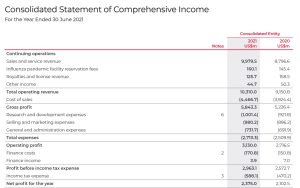

To illustrate the reporting of inventory, let’s examine the cost of sales and inventory balances of CSL, an Australian multinational specialty biotechnology company, in the income statement and balance sheet respectively:

As depicted above, the total cost of sales for 2021 was $4466.7M and the inventory balance as at 30th June 2021 was $3780.6M. In order to better understand what this $3780.6M comprises, we can look at Note 4 to the financial statements:

Note 4 illustrates that the inventory balance is made up of 1309.1M of raw material inventory, 1249.6M of work in process inventory and 1221.9M of finished goods inventory. This is expected as CSL does not only market biomedical products to treat and prevent serious human medical conditions, but it also manufactures their own products. In the manufacturing environment, there would be separate inventory calculations for the various process levels of inventory, such as raw materials, work in process, and finished goods. The manufacturer’s finished goods inventory is equivalent to the retailers’ inventory account in that it includes finished goods that are available for sale.

The next section examines how businesses determines the cost of inventory sold, the ‘Cost of Goods Sold’ (sometimes also referred to as Cost of Sales, as is the case in CSL above).