8.1 Describe the purpose and format of the statement of cash flows

Rina Dhillon; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

Most financial accounting processes focus on the accrual basis of accounting, which reflects revenue earned, regardless of whether that revenue has been collected or not, and the related costs involved in producing that revenue, whether those costs have been paid or not. Yet the single-minded focus on accrued revenues and expenses, without consideration of the cash impact of these transactions, can jeopardise the ability of users of the financial statements to make well-informed decisions.

You may have heard of the phrase “cash is king,” meaning that a business’ cash flow is more important than its net income in determining investment opportunities. An important resource of any business is cash – if a business cannot generate sufficient cash, its ability to continue operations is very limited. In practice, poor cash flow management skills or a lack of understanding of cash flow is the reason 82% of small businesses fail. Financial statement users should be able to develop a picture of how well a business’ net income generates cash and the sources and uses of a business’ cash.

From the statement of cash flows, it becomes possible to reconcile income on the income statement to the cash actually generated during the same period. Having cash is not only important, but the source and use of cash are also important, specifically where the cash is coming from. If the business is generating cash from operations (selling products and services), that is positive. If the business only has cash as it is taking out loans and selling assets, one must be careful in such instances.

Statement of Cash Flows

The statement of cash flows (cash flow statement) is a financial statement listing the cash inflows and cash outflows for the business for a period of time. The cash flow statement is a financial statement that summarises a company’s inflows and outflows of cash over a period of time. Cash flow represents the cash receipts and cash disbursements as a result of business activity. Cash Inflows represent money coming in from operations, investments and financing arrangements (cash ‘received’) and cash Outflows represents money going out for operations, investments and financing arrangements (cash ‘paid’). This statement enables users of the financial statements to determine how well a business’ income generates cash and to predict the potential of a business to generate cash in the future.

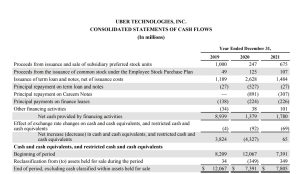

As demonstrated in Chapter 3, accrual accounting creates timing differences between income statement accounts and cash. A revenue transaction may be recorded in a different accounting period than the accounting period the cash related to that revenue is received. One purpose of the statement of cash flows is that users of the financial statements can see the amount of cash inflows and outflows during a year in addition to the amount of revenue and expense shown on the income statement. This is important because cash flows often differ significantly from accrual basis net income. For example, in 2021 Uber showed a loss of approximately $485 million, yet Uber’s cash balance increased by $65 million. Much of the change can be explained by timing differences between income statement accounts and cash receipts and distributions.

A related use of the statement of cash flows is that it provides information about the quality of a business’ net income. A business that has records that show significantly less cash inflow on the statement of cash flows than the reported net income on the income statement could very well be reporting revenue for which cash will never be received from the customer or underreporting expenses.

A third use of the statement of cash flows is that it provides information about a business’ sources and uses of cash not related to the income statement. For example, in 2021 Uber spent $298 million on purchasing property and equipment and $2314 million acquiring other businesses (refer to p.80-81 of Uber’s 2021 annual report), indicating that Uber was expanding even as it was losing money. The statement of cash flows identifies the sources of cash as well as the uses of cash, for the period being reported, which leads the user of the financial statement to the period’s net cash flows, which is a method used to determine profitability by measuring the difference between an entity’s cash inflows and cash outflows.

The statement answers the following two questions: What are the sources of cash (where does the cash come from)? What are the uses of cash (where does the cash go)? A positive net cash flow indicates an increase in cash during the reporting period, whereas a negative net cash flow indicates a decrease in cash during the reporting period. The statement of cash flows is also used as a predictive tool for external users of the financial statements, for estimated future cash flows, based on cash flow results in the past.

Purpose and Format of Statement of Cash Flows

Essentially, the statement of cash flows provides information about cash inflows and cash outflows during a period and provides information about net cash changes between two balance sheet dates.

Net Cash Flow = Cash Inflows – Cash Outflows

Net cash flow informs users how and why a company’s cash changed during the period by reporting cash flows into three categories: Operating, Investing and Financing. A business is said to have a net cash inflow if the total amount of money coming into the business (cash inflows) is more than the total amount of money going out of the business (cash outflows) and a net cash outflow is cash outflows is more than cash inflows

Net Cash INFLOW = Cash Inflows > Cash Outflows

= (More money coming in than going out)

Net Cash OUTFLOW = Cash Inflows < Cash Outflows

= (More money going out than coming in)

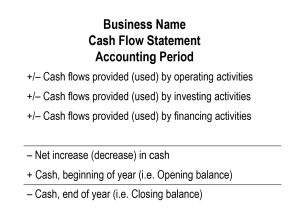

The basic structure of the statement of cash flows is as follows:

The statement of cash flows is prepared by following these steps:

Step 1: Determine Net Cash Flows from Operating Activities

Operating net cash flow includes cash received and cash paid relating to the business’ operations

Step 2: Determine Net Cash Flows from Investing Activities

Investing net cash flow includes cash received and cash paid relating to long-term assets.

Step 3: Present Net Cash Flows from Financing Activities

Financing net cash flow includes cash received and cash paid relating to long-term liabilities and equity.

Step 4: Reconcile Total Net Cash Flows to Change in Cash Balance during the Period

To reconcile beginning and ending cash balances:

- The net cash flows from the first three steps are combined to be total net cash flow.

- The beginning cash balance is presented from the prior year balance sheet.

- Total net cash flow added to the beginning cash balance equals the ending cash balance.

Step 5: Present Non cash Investing and Financing Transactions

Transactions that do not affect cash but do affect long-term assets, long-term debt, and/or equity are disclosed, either as a notation at the bottom of the statement of cash flow, or in the notes to the financial statements.

Note that from this point of this chapter, the term cash represents cash and cash equivalents (include, but are not limited to bank certificates of deposit, banker’s acceptances, treasury bills, and other money market instruments with maturity periods of 90 days or less).