4.5 Describe various business transactions that can happen in a company

Rina Dhillon

Company and the issuance of shares

One of the characteristics of a company is its ability to sell shares to investors to raise funds. The amount raised by the issuance of shares is called shareholder capital (or issued capital) because the cash contributed by investors in exchange for the company issuing shares is also in exchange for an ownership claim on the company’s assets.

The most common type of shares are called ordinary shares. Investors who purchase ordinary shares are called shareholders and are effectively owners of the company. When a company issues ordinary shares, it usually grants to shareholders the following rights:

(1) The right to vote

This right ensures that a shareholder can vote on major issues. This voting powers include electing company directors, approving (or not) remuneration report, and proposals for fundamental changes affecting the company such as mergers or liquidation. Voting usually takes place at the company’s annual general meeting (AGM). If the shareholder cannot attend, they can do so via proxy.

(2) The right to receive dividends in proportion to ownership

This right ensures that a shareholder has a claim on a portion of the assets owned by the company. As these assets generate profits and as the profits are reinvested in additional assets, shareholders see a return in the form of dividends and as the value of their shares increases as share prices rise. Shareholders will receive an appropriate amount of any dividends declared by the company. For example, if a shareholder owns 15% of a company’s ordinary shares, they have the right to receive 15% of any dividends the company distributes.

(3) The right to residual claim over company assets in proportion to ownership

Should the company wound up, this right ensures that a shareholder receives an appropriate amount of assets upon liquidation. For example, if a shareholder owns 15% of a company’s ordinary shares when the company ceases operations, they have the right to receive 15% of all residual assets.

(4) The right of preemption

This right allows shareholders to subscribe for new shares or purchase existing shares that another shareholder sells before the shareholder offers them to third parties. This right ensures that shareholders can maintain their ownership percentage when new shares are issued.

Recording the issuance of shares

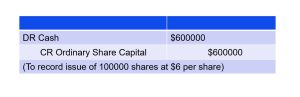

To illustrate how shares are recorded, assume Sydney Accounting Pty Ltd issues 100000 shares for $6 per share. The issue will be recorded as follows:

This journal entry increases cash for the amount received (100000 x $6 = $600000) and increases Ordinary Share Capital by the same amount. Ordinary Share Capital represents equity of a company and therefore its issuance is recorded as part of the equity reserves in the balance sheet. This recording represents a full share issue. An alternative is issuing shares by instalment which we discuss in detail below.

Issuing shares by instalment

Sometimes companies issue shares by instalment, requiring applicants for shares (investors) to pay some money on application and more money later in the process. There are three key reasons why companies might issue shares that require payment in instalments. First, this method of issuing shares ensures only serious applicants submit requests for shares, with their intention signaled by an initial payment of the instalment. Second, the issuance of shares by instalment increases the pool of potential shareholders, with the lower initial payment being more affordable to more investors. Lastly, receiving the money for shares in instalment allows the company to receive capital over time, instead of all immediately and this can be a great benefit when projects are funded over a period of time and thus timing the instalment payments to be received in conjunction with project timelines.

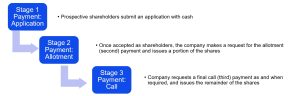

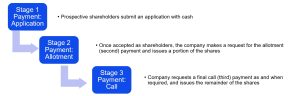

The issuance of shares by instalment usually has payment for the shares in 3 stages, summarised and depicted in the diagram below:

Stage 1 involves prospective shareholders (investors) filling out an application form that comes with the prospectus issued by the company inviting the public to apply for shares. The investor will provide the appropriate application money with their application and thus this payment is called Application.

Stage 2 involves the company alloting the shares to applicants after receiving their share application money. The allotment of shares implies that the company has accepted the application and have decided to accept them as shareholders and thus give shares to them. A letter of allotment is sent to applicants and will provide information regarding the number of shares allotted to the shareholder and the amount to be paid by them – this payment is called Allotment

Stage 3 is known as call on share, where the remaining amount of shares allotted are called up by the company. The company requests a final call (third) payment and issues the remainder of the shares.

Now let us see how we record the journal entries for application, allotment and call using Sydney Accounting as an example but instead of a full share issue of 100000 shares at $6, let us assume a share issue by instalment and that the $6 is received in the following manner: $3 payable on application, $2 on allotment and $1 on call.

Stage 1: Application

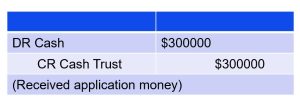

When the company receives the application money, this money should be initially banked in a separate bank account – a trust account, which we will call Cash Trust – because some of this money may be refunded (for example if there was an oversubscription, where more shares were applied for that are available for sale). The money received is called Application and thus the following journal entry would be recorded when the application money is received:

This entry increases the asset Cash Trust and increases the liability Application. Application is a liability because the money has an obligation attach to it in the form of either paying it back or giving the applicants shares.

Stage 2: Allotment

When the shares are allotted, the applications are accepted as purchasing the shares and thus these shares are issued to these accepted shareholders. Once the shares are allotted, the application cash that is in the Cash Trust account can be transferred to the company’s normal bank account as now Sydney Accounting can claim the application money as theirs and thus debit Cash and credit Cash Trust:

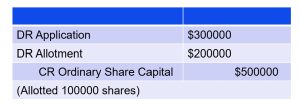

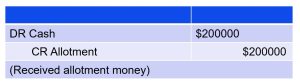

At the same time, the allotment money ($2 x 100000 = $200000) becomes due and thus the journal entry will be as follows:

This entry decreases (debit) the liability Application because we no longer have that obligation to refund the application money having accepted those applicants as shareholders and alloting them with shares. There is an increase to the asset Allotment and equity Ordinary Share Capital. Allotment is an asset because once the shares are issued, the company has a legal right to receive that money, which is a future benefit owing to the company (similar to an accounts receivable). Issuing the shares increases equity and thus credit Ordinary Share Capital.

When Sydney Accounting receives the allotment money, the following journal will be entered:

This entry reduces the asset Allotment and increases the asset Cash (similar to the receipt of account receivable).

Stage 3: Call

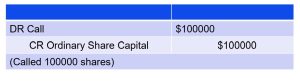

When a call is made, it follows the same concept as allotment. When the call is made, the following would be recorded:

This entry increases the asset Call and equity Ordinary Share Capital. Call, like allotment, is an asset because once the shares are issued, the company has a legal right to receive that money. Issuing the shares increases equity and thus credit Ordinary Share Capital.

When Sydney Accounting receives the call money, the following journal will be entered:

This entry reduces the asset Call and increases the asset Cash (similar to allotment).

The net effect of the instalment process (looking at all the debits to Cash and all the credits to Ordinary Share Capital is similar to a full share issue detailed above:

DR Cash $600000 ($300000+200000+100000)

CR Ordinary Share Capital $600000 ($500000+100000)

Once shares are fully issued, a company would need to decide if they would like to share profits with their shareholders in the form of a dividend payment. Dividends are paid on a regular basis, and they are one of the ways shareholders earn a return from investing in shares. We examine the two most common types of dividends – cash and share – in the next section.