8.4 Preparing the operating activities section of the statement of cash flows using the indirect method

Rina Dhillon; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

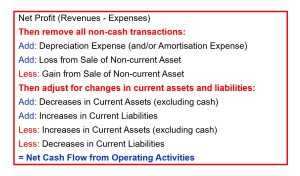

In this section, specific entries are explained to demonstrate the items that support the preparation of the operating activities section of the Statement of Cash Flows (Indirect Method) for the same financial data presented in Section 8.3 – Preparing the operating activities section of the statement of cash flows using the direct method. The general structure of a cash flow statement prepared using the indirect method is as follows:

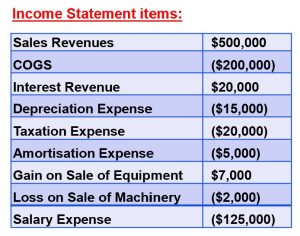

The income statement, balance sheet and notes used in Section 8.3 is replicated below followed by an explanation of specific entries that would relate to reporting cash flows from operating activities under the indirect method.

The income statement, balance sheet and notes used in Section 8.3 is replicated below followed by an explanation of specific entries that would relate to reporting cash flows from operating activities under the indirect method.

Notes:

Start with Net Profit

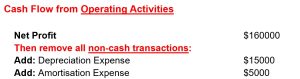

The operating activities cash flow is based on the company’s net profit, with adjustments for items that affect cash differently than they affect net profit. The net profit on the income statement can be calculated by adding all the revenues which totals $527000 ($500000+20000+7000) and subtracting all the expenses which totals $367000 ($200000+15000+20000+5000+2000+125000) is $160000. On the statement of cash flows, this amount will be shown in the Cash Flows from Operating Activities section as Net Profit.

Add back non-cash expenses

Net profit includes deductions for non-cash expenses. To reconcile net profit to cash flow from operating activities, these non-cash items must be added back, because no cash was expended relating to that expense. The non-cash expenses on the income statement, which must be added back, is the depreciation expense of $15000 and the amortisation expense of $5000. On the statement of cash flows, these amounts will be shown in the Cash Flows from Operating Activities section as an adjustment to reconcile net profit to net cash flow from operating activities.

Reverse the Effect of Gains and/or Losses

Gains and/or losses on the disposal of non-current assets are included in the calculation of net profit, but cash obtained from disposing of non-current assets is a cash flow from an investing activity. The entire cash inflow associated with the transaction will be reported as an investing cash flow and thus the effect of the gain or loss must be removed from net profit so that operating cash flows are not affected by the transaction (i.e. to avoid double counting). Because the disposition gain or loss is not related to normal operations, the adjustment needed to arrive at cash flow from operating activities is a reversal of any gains or losses that are included in the net profit total.

A gain is subtracted from net profit and a loss is added to net profit to reconcile to cash from operating activities. The income statement includes a gain on sale of equipment, in the amount of $7000, so a reversal is accomplished by subtracting the gain from net profit. In addition, the income statement includes a loss on sale of machinery of $2000, so a reversal is carried out by adding the loss from net profit. On the statement of cash flows, these amounts will be shown in the Cash Flows from Operating Activities section as Loss from Sale of Non-current Asset and Gain from Sale of Non-current Asset.

Adjust for Changes in Current Assets and Liabilities

Because the balance sheet and income statement reflect the accrual basis of accounting, whereas the statement of cash flows considers the incoming and outgoing cash transactions, there are continual differences between (1) cash collected and paid and (2) reported revenue and expense on these statements. Changes in the various current assets and liabilities can be determined from analysis of the company’s comparative balance sheet, which lists the current period and previous period balances for all assets and liabilities. The following four possibilities offer explanations of the type of difference that might arise, and demonstrate examples from the statement of cash flows, which represent typical differences that arise relating to these current assets and liabilities.

Increase in Non-cash Current Assets

Increases in current assets indicate a decrease in cash, because either (1) cash was paid to generate another current asset, such as inventory, or (2) revenue was accrued, but not yet collected, such as accounts receivable. In the first scenario, the use of cash to increase the current assets is not reflected in the net profit reported on the income statement. In the second scenario, revenue is included in the net profit on the income statement, but the cash has not been received by the end of the period. In both cases, current assets increased and net income was reported on the income statement greater than the actual net cash impact from the related operating activities. To reconcile net profit to cash flow from operating activities, subtract increases in current assets.

The comparative balance sheet had one instance of increases in current assets – an increase of $8000 in inventory. This increase can be explained as additional cash that was spent, but which was not reflected in the expenses reported on the income statement.

Decrease in Non-cash Current Assets

Decreases in current assets indicate lower net profit compared to cash flows from (1) prepaid assets and (2) accrued revenues. For decreases in prepaid assets, using up these assets shifts these costs that were recorded as assets over to current period expenses that then reduce net profit for the period. Cash was paid to obtain the prepaid asset in a prior period. Thus, cash from operating activities must be increased to reflect the fact that these expenses reduced net profit on the income statement, but cash was not paid this period. Secondarily, decreases in accrued revenue accounts indicates that cash was collected in the current period but was recorded as revenue on a previous period’s income statement. In both scenarios, the net profit reported on the income statement was lower than the actual net cash effect of the transactions. To reconcile net profit to cash flow from operating activities, add decreases in current assets.

The comparative balance sheet shows a decrease of $10000 in accounts receivable during the period, which normally results only when customers pay the balance they owe the business. The balance sheet also shows a decrease of $7000 in interest receivable during the period, which happens only when the business receives the interest in cash. Thus, the decrease in receivable identifies that more cash was collected than was reported as revenue on the income statement. Thus, an add back is necessary to calculate the cash flow from operating activities.

Increase in Current (Operating) Liability

Increases in current liabilities indicate an increase in cash, since these liabilities generally represent (1) expenses that have been accrued, but not yet paid, or (2) unearned revenues that have been collected, but not yet recorded as revenue. In the case of accrued expenses, costs have been reported as expenses on the income statement, whereas the unearned revenues would arise when cash was collected in advance, but the revenue was not yet earned, so the payment would not be reflected on the income statement. In both cases, these increases in current liabilities signify cash collections that exceed net profit from related activities. To reconcile net profit to cash flow from operating activities, add increases in current liabilities.

The comparative balance sheet had an increase in the current operating liability for accounts payable, in the amount of $3000. The payable arises, or increases, when an expense is recorded but the balance due is not paid at that time. An increase in accounts payable therefore reflects the fact that expenses on the income statement are greater than the cash outflow relating to that expense. This means that net cash flow from operating is greater than the reported net profit, regarding this cost.

Decrease in Current (Operating) Liability

Decreases in current liabilities indicate a decrease in cash relating to (1) accrued expenses, or (2) unearned revenues. In the first instance, cash would have been expended to accomplish a decrease in liabilities arising from accrued expenses, yet these cash payments would not be reflected in the net profit on the income statement. In the second instance, a decrease in unearned revenue means that some revenue would have been reported on the income statement that was collected in a previous period. As a result, cash flows from operating activities must be decreased by any reduction in current liabilities, to account for (1) cash payments to creditors that are higher than the expense amounts on the income statement, or (2) amounts collected that are lower than the amounts reflected as income on the income statement. To reconcile net income to cash flow from operating activities, subtract decreases in current liabilities.

The comparative balance sheet had a decrease of $7000 in the current operating liability for salaries payable. The fact that the payable decreased indicates that the business paid down on amounts payable from previous periods. Therefore, the business had to have paid more in cash payments than the amounts shown as expense on the Income Statements, which means net cash flow from operating activities is lower than the related net profit.

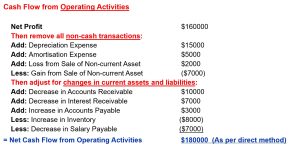

On the statement of cash flows, the above increases and decreases in current assets and current liabilities will be shown in the Cash Flows from Operating Activities section as an adjustment to reconcile net profit to net cash flow from operating activities:

For the above scenario, beginning with net profit of $160000, and reflecting adjustments of $20000 ($15000+5000+2000-7000+10000+7000+3000-8000-7000), delivers a net cash flow from operating activities of $180000. This $180000 is the same amount as calculated under the direct method in Section 8.3.

In summary, using the indirect method, operating net cash flow is calculated as follows:

- Begin with net profit from the income statement.

- Add back non cash expenses, such as depreciation and amortisation

- Remove the effect of gains and/or losses from disposal of long-term assets, as cash from the disposal of long-term assets is shown under investing cash flows.

- Adjust for changes in current assets and liabilities to remove accruals from operating activities, i.e. to reflect how changes in current assets and liabilities impact cash in a way that is different than is reported in net profit.

Net cash flow from operating activities is the net profit of the company, adjusted to reflect the cash impact of operating activities. Positive net cash flow generally indicates adequate cash flow margins exist to provide continuity or ensure survival of the business. The magnitude of the net cash flow, if large, suggests a comfortable cash flow cushion, while a smaller net cash flow would signify an uneasy comfort cash flow zone.

When a business’ net cash flow from operations reflects a substantial negative value, this indicates that the company’s operations are not supporting themselves and could be a warning sign of possible impending downfall for the business. Alternatively, a small negative cash flow from operating might serve as an early warning that allows management to make needed corrections, to ensure that cash sources are increased to amounts in excess of cash uses, for future periods.

After preparing the operating activities section of the cash flow statement, we then prepare the investing activities section which is illustrated in the next section, Section 8.5.