1.2 The accounting system

Rina Dhillon

The accounting information system

An accounting information system is a means by which accounting information about a business’s activities is identified, recorded, analysed and reported so that it can be summarised in accounting reports. Recall from the Accounting and Accountability textbook that accounting is the process by which a business records its inflows and outflows of resources (p.9). Accounting can be viewed as a vital part of the information system for a business. Internal and external stakeholders of the business have to decide how to allocate scarce resources and to do so in an efficient and effective manner, requires important financial and non-financial information. It is the role of the accounting system to provide much of this information. There are generally four processes involved in an accounting system:

- identifying and capturing relevant accounting information (information identification);

- recording the information in a systematic manner (information recording);

- analysing and interpreting the information (information analysis); and

- reporting the information in a manner that is useful and meets the needs of users (information reporting).

There are 3 major components in the process of capturing accounting information:

- Accounting transactions which are economic events that affect a company’s assets, liabilities or equity.

-

An account which is an accounting record that accumulates the business activity of a specific item and yields the item’s balance.

-

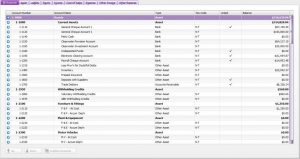

Chart of accounts (COA) which are the various accounts that a company uses to capture its business activities, i.e. list of all asset, liability, equity, revenue, expense, and dividend accounts which are used by the business

An example of these 3 components is provided below, using the chart of accounts from the MYOB software, a popular accounting system used by many small businesses in practice:

A business usually sets up its COA, starting off with the cash account (usually assigned the lowest number), followed by all other asset accounts, all liability accounts, the owner’s equity account, revenue accounts and the expenses account. A numbering system is used in the COA as it helps identify and classify an account.

The type of accounting systems that you will find in businesses can vary widely. It ranges from manual to more complex cloud-based systems. In general, there are two types of accounting systems: (1) single entry system where a business records transaction as a line item in a ledger and (2) double entry system where every accounting transaction is recorded both as a debit and a credit (you will be introduced to debits and credits in the next chapter) in separate accounts. The second system is more commonly used as it ensures that a business’ books balance. Irrespective of the types, all accounting systems are built to capture and report the effects of a business’ accounting transactions.