8.6 Bringing it all together – Statement of Cash Flows

Rina Dhillon

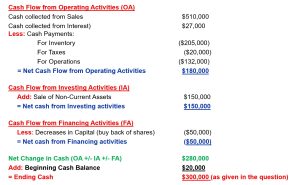

Complete Statement of Cash Flows: Direct Method

The complete statement of cash flows, using the direct method, is shown above. The net change in cash of $280000 ($180000+150000-50000) is calculated by adding the cash flows from operating activities, investing activities and financing activities. This net change in cash is added to the opening cash balance of $20000 to get to an ending cash balance of $300000 which corresponds to the notes to the financial statements which stipulated that “Cash was $20,000 at the start of the year and $300,000 at the end of the year”. The net increase in cash of $280000 ($300000-20000) coincides with the net change in cash in the cash flow statement.

As mentioned from the very start of this chapter, cash is the most important asset for a business as it is needed for almost all business transactions (to buy inventory, pay employees, repay loans, etc.), While cash is important to a business, where a business’ cash comes from (the source) is equally important. Net cash inflows from operating activities (e.g. cash from customers) are generally better than cash inflows from financing activities (e.g. cash from a bank loan).

Managing cash is important in any type of business. Without cash, a business can no longer survive and must declare bankruptcy. Poor cash management, and as a result a lack of cash, is the main reason why most small businesses fail. In addition, the few constraints that managers must work around in any business project is a limited budget of cash. Thus, it helps to know how to manage these cash flows. Lastly, large cash reserves are a strong measure of financial success and are valued on the stock market.

Additional resources

Test Your Knowledge