3.1 How profit is measured and reported under the accrual and cash bases of accounting

Rina Dhillon; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

Accrual versus cash basis of accounting

When recording transactions, it is important and necessary to record them in the correct accounting period. To do otherwise would result in a misstatement of assets, liabilities, equity, revenues and expenses. If you recall from the previous chapter, we prepare the income statement first where the profit flows into the statement of change in equity (SoCiE) and the ending retained earnings from the SoCiE to the balance sheet. Given the importance of the profit figure in ensuring that the financial statements represent the true economic reality of the business, it is essential that revenues and expenses are recorded correctly and that the revenue and expense account balances are up to date.

Revenues and expenses can be recorded or recognised on either a cash or an accrual basis. In cash-basis accounting, expenses and revenue are recorded when cash is paid or received.

By contrast, the accrual basis of accounting records revenue and expenses when the transaction happens, such as before a cash settlement. This is an application of the revenue recognition principle and the expense recognition principle (also known as the matching principle) introduced and discussed in Chapter 2, Section 2.4 of the Accounting and Accountability textbook.

Keep in mind that there are several factors that a business should consider before picking an accounting method. Variables like the size of the business and the industry play a determining role in the way the accounting books should be kept. In addition, think about:

- how complicated the business transactions and processes are

- whether the business has the resources to manage accrual accounting

- whether using a computerised accounting system will make a difference.

The following sections expand on these accounting methods and outline the types of businesses best suited to each one.

The Cash Accounting Method

The cash accounting method is quite simple in its application. In fact, the core concept is similar to that of a personal bank account. Income/Revenues such as salary are recorded only when you are paid. Expenses such as paying your credit card are recorded only when you transfer the money. Recognising transactions after cash changes hands allows a business to track its financial activity in real time and provides the business with a current picture of its current cash flow status.

There are plenty of advantages to using this accounting method. Besides allowing for real-time cash flow management, this method offers several potential tax benefits. In fact, a business can legally lower its tax liability by simply controlling the timing of the cash payments. This method doesn’t come without disadvantages, though. Since cash-basis accounting doesn’t show liabilities (what a business is owing to others), a cash-rich business with a high accounts payable can appear more solvent than it actually is.

Due to its simplicity, the cash accounting method is ideal for small businesses or sole proprietorship (discussed in detail in Chapter 4, but essentially a business owned and controlled by one owner) that don’t sell goods or handle inventory management. Cash accounting tracks the actual money coming in and out of your business. In cash accounting, when a business:

- gets an invoice for something – it does not record the cost until the invoice has been paid

- sends an invoice to a customer – it does not record the sale until payment has been received.

For example, if a business sends an invoice on Tuesday, and does not get payment in the account until Thursday, the business will record the income under Thursday’s date in the accounting system.

Advantages and Disadvantages of cash accounting

Cash accounting:

- is a simple system that keeps track of a business’ cash flow

- suits smaller businesses if they mostly have cash transactions (for example, a hairdresser or small restaurants)

- gives a picture of how much money a business has in its cash register and bank accounts.

However, it doesn’t show money that is owed to the business or money the business owes to others.

The Accrual Accounting Method

Compared to the cash-basis method, accrual accounting is relatively more complex. Recording income and expenses as the transaction occurs involves the use of accounts payable and accounts receivable and involves accounting for long-term liabilities, such as unearned revenue. Moreover, the accrual method requires monthly bank reconciliation to ensure that the amount in the bank account matches the closing balance.

Unlike cash-basis accounting, payments expected to be received in the future are recognised as present income. This provides a more accurate picture of a business’s financial health and its long-term profitability. The disadvantage of this method is that it doesn’t do a great job of tracking cash flow, which can lead to cash shortages when a business is experiencing a downturn.

Accrual accounting is the preferred method for businesses ranging from e-commerce to manufacturing. If a business uses accrual accounting, it records expenses and sales when they take place, instead of when cash changes hands. This way of accounting shows the amounts a business owes to others (i.e. liabilities – usually in the form of accounts payable) and the amounts owing to the business (i.e. assets – usually in the form of accounts receivable). For example, if you’re a builder and send an invoice for a project you’ve completed, you record the sale in your books even though you haven’t been paid yet.

Advantages and Disadvantages of accrual accounting

Accrual accounting:

- is more complicated than cash accounting

- suits businesses that does not get paid straight away (for example, lawyers who provide a service then invoice for it later)

- tracks the business’ true financial position by showing money owed to the business and money the business owes others

As the accrual basis provides a better representation of income for a given accounting period, the accrual basis of accounting is required by Generally Accepted Accounting Principles (GAAP). The accrual method is considered to better match revenues and expenses and standardises reporting information for comparability purposes. Having comparable information is important to external users of information trying to make investment or lending decisions, and to internal users trying to make decisions about company performance, budgeting, and growth strategies. Because GAAP require the accrual basis, income statements report accrual-based profits/losses.

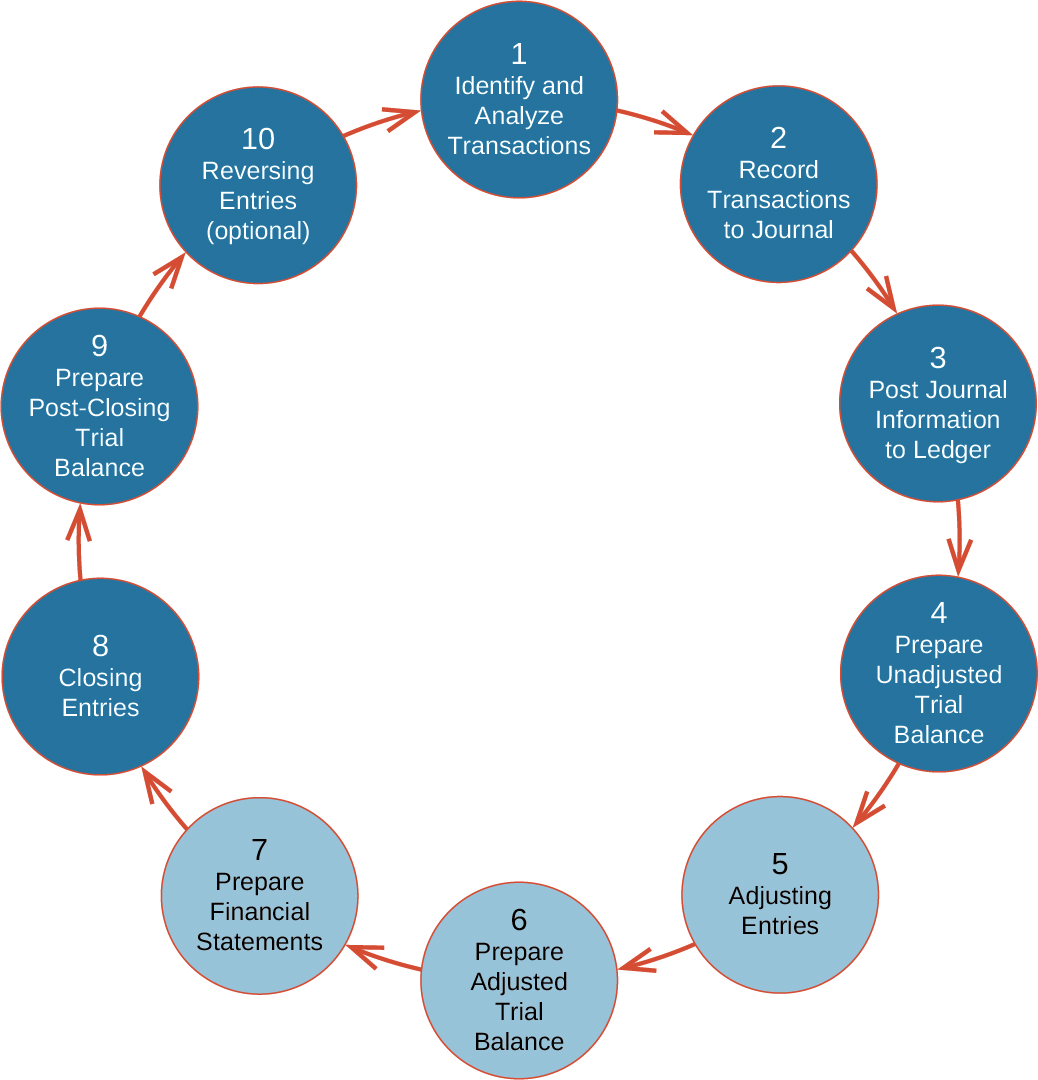

To ensure that revenues and expenses (and hence profit) are properly recorded under an accrual basis, adjusting journal entries are used. Adjusting journal entries are entries made in the general journal to record revenues that have been earned and expenses that have been incurred but not recorded in the accounting system. The process of recording and posting adjusting entries is the fifth step in the accounting cycle (see diagram below) and occurs at the end of each accounting period. In Section 3.3, we will examine Steps 5, 6 and 7 of the accounting cycle in detail which cover adjusting entries (journalise and post), preparing an adjusted trial balance, and preparing the financial statements. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

In every industry, adjusting entries are made at the end of the period to ensure revenue matches expenses. Even businesses with an online presence need to account for items sold that have not yet been shipped or are in the process of reaching the end user. Adjusting journal entries occur after the unadjusted trial balance (i.e. trial balance without adjusting entries) is prepared. After adjusting entries are journalised and posted, an adjusted trial balance is then generated, and from which financial statements are prepared.

While adjusting entries can significantly differ across businesses, there are four basic scenarios in which adjusting journal entries are necessary. We now turn our attention to these four basic circumstances.