5.2 Reporting accounts receivable

Rina Dhillon

As accounts receivable are expected to be collected quickly (usually within a month or 2 with most payment terms being n/30 or n/60), they are classified and reported as current assets on the balance sheet. However, in reality, businesses do not collect all their receivables because customers do not always pay their bills (on time or in full). There are many reasons why this might happen: (1) the customer might be facing financial difficulties (this is especially true for small businesses in recent times with the covid-19 pandemic: refer to the Reserve Bank of Australia Report here); (2) relocated or closed down without paying; and (3) just refuses to pay for various common reasons.

Given the above, businesses must follow the conservatism principle and report their accounts receivables at net realisable value (or at fair value). Net realisable value is the amount of cash that a business expects to collect from its total or gross accounts receivable balance, calculated by subtracting from gross receivables the amount that a business does not expect to collect (known as uncollectible receivables).

For example, if we return to the Kenco example before, let’s assume that Kenco has $3000 of gross receivables but does not expect to collect $200 of them and thus has accounts receivable with a net realisable value of $2800 ($3000-200).

Keeping It Real

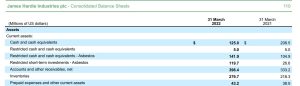

To illustrate the reporting of receivables, let’s examine the receivables balance of James Hardie Industries, a global building materials company and the largest global manufacturer of fibre cement products, in the balance sheet and the notes to the financial statements:

As depicted above, the total receivables balance is $398.4M and this comprises trade receivables of $336.4M, income tax receivables of $29.8M, other receivables of $35.6M less a provision for doubtful trade receivables of 3.4M. This 3.4M was derived by an opening balance from March 2021 of $6.1M less an adjustment to provision of $2.2M and a bad debt write off of $0.5M. The amount that a company does not expect to collect can be termed in many ways: Provision for bad and doubtful debts, allowance for bad debts, allowance for doubtful debts, provision for impairment loss, etc. How businesses estimate and record the allowance or provision for uncollectible receivables will be examined in the next section.

As depicted above, the total receivables balance is $398.4M and this comprises trade receivables of $336.4M, income tax receivables of $29.8M, other receivables of $35.6M less a provision for doubtful trade receivables of 3.4M. This 3.4M was derived by an opening balance from March 2021 of $6.1M less an adjustment to provision of $2.2M and a bad debt write off of $0.5M. The amount that a company does not expect to collect can be termed in many ways: Provision for bad and doubtful debts, allowance for bad debts, allowance for doubtful debts, provision for impairment loss, etc. How businesses estimate and record the allowance or provision for uncollectible receivables will be examined in the next section.