7.1 Describe non-current assets and how they are recorded, expensed and reported

Rina Dhillon; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

Assets are items a business owns. For accounting purposes, assets are categorised as current versus non-current. Assets that are expected to be used by the business for more than one year are considered non-current assets (hereafter NCA). They are not intended for resale and are anticipated to help generate revenue for the business in the future. Some common NCA are land, buildings, equipment, furniture and fixtures and vehicles.

To be considered a NCA, the item needs to be used in the normal operation of the business for more than one year, not be near the end of its useful life, and the business must have no plan to sell the item in the near future. The useful life is the time period over which an asset cost is allocated. NCA are are also commonly known as fixed assets.

Businesses typically need many different types of these assets to meet their objectives. These assets differ from the businesses’ products. For example, the computers that Apple Inc. intends to sell are considered inventory (a short-term asset), whereas the computers Apple’s employees use for day-to-day operations are non-current assets. Non-current assets are listed on a business’ balance sheet. Typically, these assets are listed under the category of Property, Plant, and Equipment (PPE), but they may be referred to as fixed assets.

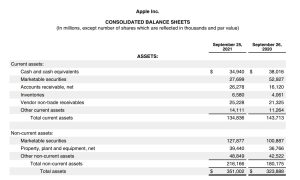

Apple Inc. lists a total of $39,440,000,000 in total Property, Plant and Equipment (net) on its 2021 consolidated balance sheet:

As shown in the notes to the financial statements (see figure below), this net total includes land and buildings, machinery, equipment and internal-use software, and leasehold improvements, resulting in a gross PPE of $109,723,000,000—less accumulated depreciation and amortisation of $70,283,000,000—to arrive at the net amount of $39,440,000,000.

When a business purchases a NCA (used for more than one year), it classifies the asset based on whether the asset is used in the business’s operations. If a NCA is used in the business operations, it will belong in property, plant, and equipment. Let’s now turn our attention to how NCA are recorded when a business purchases a NCA.

Recording non-current assets

Non-current assets should be recorded at the cost of acquiring/purchasing them, and include the costs of bringing the asset into use. When recording an asset, the total cost of acquiring the asset is included in the cost of the asset. This includes additional costs beyond the purchase price, such as shipping costs, taxes, assembly, and legal fees. For example, if a real estate broker is paid $8,000 as part of a transaction to purchase land for $100,000, the land would be recorded at a cost of $108,000.

Essentially, acquisition cost includes all necessary costs incurred in purchasing the asset and having it delivered, installed and ready to use. Examples of costs that should be included are:

– Purchase price

– Taxes and duties paid on the purchase

– Delivery and related transit insurance costs

– Installation costs

– Any costs that are specific to the asset and provide future value are also included (e.g. laptop case for a laptop)

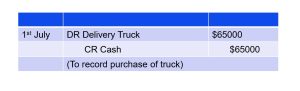

To illustrate, suppose that MAAS Corporation buys a delivery truck on 1st July. Purchase price is $60000, plus additional import duty ($2400), stamp duty ($1800), GPS system ($800) and non-compulsory insurance ($1400). Given this costs, the cost of MAAS’ delivery truck is determined as follows:

Purchase Price $60000

Import duty $2400

Stamp duty $1800

GPS system $800

Total cost $65000

All costs expect for the insurance are necessary to get the asset into its condition and location for intended use and thus included in the cost of the truck. The insurance covers the truck during its operations and is thus an operating expense during the year (debit Prepaid Insurance or Insurance Expense $1400, credit cash $1400). The entry to record the purchase of the truck, assuming payment by cash, is:

Expensing non-current assets

A NCA converts to an expense as it is used or consumed. Over time as the asset is used to generate revenue, the business will need to depreciate the asset. Depreciation, or the expensing of NCA is the process of allocating the cost of a NCA over its useful life, or the period of time that the business believes it will use the asset to help generate revenue. Depreciation is an application of the matching principle; because a non-current asset is used to generate revenues period after period, some of its cost should be expensed in, or matched to, those same periods.

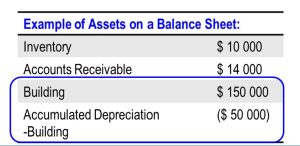

The amount of expense recognised in each period is known as depreciation expense. The cumulative amount of depreciation expense recognised to date is known as accumulated depreciation. Accumulated depreciation is a contra account, meaning it is attached to another account and is used to offset the main account balance that records the total depreciation expense for a fixed asset over its life. In this case, the asset account stays recorded at the historical value but is offset on the balance sheet by accumulated depreciation. Accumulated depreciation sits just below the non-current asset, and its balance is subtracted from the asset account to yield the carrying amount (net book value) of the non-current asset. The carrying amount gets lower over time. Accumulated depreciation is subtracted from the historical cost of the asset on the balance sheet to show the asset at book value – i.e. the amount of the asset that has not been allocated to expense through depreciation:

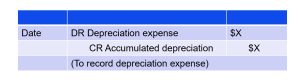

In this case, the asset’s book value is $100000: the historical cost of $150000 less the accumulated depreciation of $50000. Depreciation expense is calculated at the end of an accounting period and recorded with an adjusting journal entry. The general form of the entry to record depreciation is:

Regardless of the NCA being depreciated, the general form of the entry is the same – depreciation expense and accumulated depreciation is increased. Depreciation records an expense for the value of an asset consumed and removes that portion of the asset from the balance sheet.

Reporting non-current assets

Like other expenses, depreciation expense is a common operating expense that appears on the income statement. Most businesses report depreciation expense as a separate line item in the notes to the accounts. For example, Apple Inc. provided the following information about how they depreciate their PPE and reported $9.5 billion in depreciation and amortisation expense :

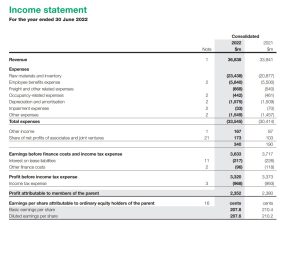

Some businesses report the depreciation expense as a separate line item on the income statement. For example, in 2022 Westfarmers reported depreciation and amortisation expenses of $1575 million as one of the expenses in the income statement:

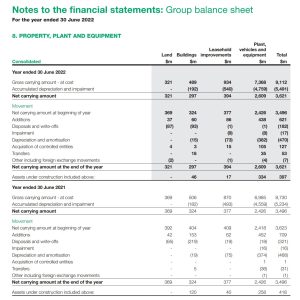

Non-current assets are reported on the balance sheet just below current assets. For example in 2022 Westfarmers reported $3621 million in Property, Plant and Equipment, and in the accompanying note 8, accumulated depreciation is reported under each depreciable non-current asset.

Non-current assets are reported on the balance sheet just below current assets. For example in 2022 Westfarmers reported $3621 million in Property, Plant and Equipment, and in the accompanying note 8, accumulated depreciation is reported under each depreciable non-current asset.

In note 8 above, the $$3621 million is described as net carrying amount, which represents the cost of the PPE that has not been depreciated or amortised yet. It is calculated by subtracting the accumulated depreciation to date from the cost of PPE. So if the cost of the asset is $500 with $100 of accumulated depreciation, the carrying amount or net book value of the asset would be $400 ($500-100).

From the above, we can see that land is not subject to depreciation. While depreciation applies to NCA, not all NCA are depreciated. Depreciation only applies to those assets with limited useful lives, i.e. the asset’s revenue generating ability is limited by wear and tear and/or obsolescence. As land has an unlimited useful life, depreciation is not applied to it.

We will now turn to the process of calculating depreciation, detailed in Section 7.2.