2.2 Purpose and structure of debits and credits

Rina Dhillon

Debits and Credits

A debit entry is a financial amount recorded (debited) on the left hand side of an account. The word debit comes from the Latin word debitum, which means what is due to the business. Debit is commonly abbreviated with a Dr. A credit entry, on the other hand, is a financial amount recorded (credited) on the right hand side of an account. Credit comes from the Latin word creditum, which means what is entrusted to a business. Credit is commonly abbreviated with a Cr. Debits and credits do not mean increase or decrease or good or bad as is commonly thought, instead they are directional signs that are used repeatedly in the recording process to describe where entries are made in accounts. We are said to be debiting an account when we enter an amount on the left hand side of an account and crediting an account when we make an entry to the right hand side of an account.

As mentioned in the previous section, whether a business records increases or decreases on the left or right side of an account depends on the type of account, specifically where the account “sits” within the accounting equation, and is based on the rules of debit and credit. Let’s examine the accounts within the accounting equation and the debit and credit rules that apply to these accounts.

Rules of debits and credits

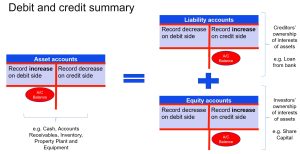

The rules of debits and credits for assets, liabilities and owner’s equity relate to the side of the accounting equation on which the account is located:

(1) Asset accounts (accounts on the left hand side of the accounting equation) are increased by debit (Dr) entries (amounts recorded on the left hand side of the T-account) and decreased by credit (Cr) entries.

(2) Liability and equity accounts (accounts on the right hand side of the accounting equation) are increased by credit (Cr) entries (amounts recorded on the right hand side of the T-account) and decreased by debit (Dr) entries.

These two rules can appear to be simple, however applying them can be daunting at first because different account types have different normal balances. At any given time, an account may have a number of debit and credit entries. The balance of an account is determined by the difference between the total increases and total decreases in the account. In general, total increases are more than total decreases and thus asset accounts normally have debit balances (total increases or debits exceeds total decreases or credits in the account) and liability and equity accounts normally have credit balances (total increases or credits exceeds total decreases or debits in the account).

The equity in relation to rule 2 above is further complicated by temporary owner’s equity accounts – revenues, expenses and dividends (or owner’s withdrawals). For revenue, expense and dividend accounts, the debit and credit rules relate to whether the transaction increases or decreases owner’s equity. Temporary owner’s equity accounts have the following rules:

a) Revenue accounts have normal credit balances and are increased by credit (Cr) entries and decreased by debit (Dr) entries (as revenues increase owner’s equity)

b) Expense accounts have normal debit balances and are increased by debit (Dr) entries and decreased by credit (Cr) entries (as expenses decrease owner’s equity)

c) Dividends accounts have normal debit balances and are increased by debit (Dr) entries and decreased by credit (Cr) entries (as dividends decrease owner’s equity)

Remember that debits and credits are opposite of each other, so whichever rule is applied to one, the opposite rule must be applied to the other. Thus in summary, to record an increase in an account balance: record on the same side as the normal balance and to record a decrease to an account balance: record on the opposite side of the normal balance:

As introduced in the previous section, a business uses a dual entry system for recording accounting transactions. The double entry rule states that in recording a transaction, the total amount of debit entries must equal the total amount of credit entries for the transaction. Thus to ensure that the accounting equation remains balanced at all times, we must always ensure that:

Debits (Dr) = credits (Cr)

Transaction debits = Transaction credits

Sum of all debits posted = Sum of all credits posted

Now that you are familiar with the rules of recording transactions in various accounts using the rules of debits and credits, we will turn our attention to the actual process of recording accounting transactions in a dual-entry system. Accounting transactions are not directly recorded in T-accounts. Instead businesses complete an eight step process during each accounting period to identify, record and report the accounting information from its transactions. These steps are also known as the accounting cycle:

The major steps involved in the accounting cycle include: (1) identifying business transactions; (2) recording or journalising transactions in the general journal; (3) posting the journal entries to the accounts in the general ledger; (4) preparing a trial balance; (5) recording and posting adjusting entries; (6) preparing an adjusted trial balance; (7) preparing the financial statements; and (8) recording and posting closing entries.

In this chapter, we will look closely at steps 2-4. We will better understand the processes related to steps 5-8 in Chapter 3.