2.4 Record and post accounting transactions and prepare a trial balance and financial statements

Rina Dhillon; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

The following section uses the Kids Learn Online (KLO) transactions recorded in Chapter 2 of the AAA textbook to demonstrate how to record transactions in the journal, post information to the ledger, prepare a trial balance and financial statements.

Recording transactions in the journal and posting to the ledger

KLO entered into 6 transactions:

- Issues $20,000 of share equity in exchange for cash.

- Purchases computer equipment on account (to be paid for later) for $3,500, payment due within the month.

- Receives $4,000 cash in advance from a customer for an app not yet developed (we will offer these services at a later date).

- Provides $5,500 in app development services to a customer on credit (the customer will pay the business at a later date)

- Pays a $300 electricity bill with cash.

- Distributed $100 cash in dividends to shareholders.

A three-step process will be used to demonstrate how to record each transaction and post it to the ledger. First, the accounts affected by the transaction will be identified (Step 1 of Accounting Cycle) and the relevant debit and credit rules will be applied. Second, the transaction will be recorded in the journal (Step 2 of Accounting Cycle). Third, the transaction will be posted to the ledger (Step 3 of Accounting Cycle). This three-step process can be used when recording and posting any accounting transaction.

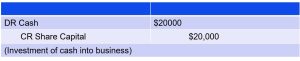

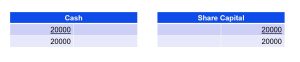

Transaction 1: Issues $20,000 of share equity for cash

Step 1: The business has received cash, so the cash account increases. Cash is an asset, so the cash account needs to be debited to increase it. In exchange for the cash, the business has issued shares, so the share capital account also increases. Share capital is an equity account, so the Share Capital account needs to be credited to increase it.

Step 2: The following journal entry will be recorded (please note as there is no transaction date, we have omitted it below but if a date was provided, it will be the first thing we document)

Step 3: The following information will be posted to the ledger

Transaction 2: Purchases computer equipment on account (to be paid for later) for $3,500, payment due within the month.

Step 1: The business purchased computer equipment, which is an asset, so the equipment account are debited to increase it. The purchase of the equipment was made on account, meaning it did not pay for the equipment immediately and asked for payment to be billed instead and paid later. Since the business owes money and has not yet paid, this is a liability, specifically labeled as accounts payable, and thus needs to be credited to increase it.

Step 2: The following journal entry will be recorded

Step 3: The following information will be posted to the ledger

Transaction 3: Receives $4,000 cash in advance from a customer for an app not yet developed

Step 1: We receive cash so the cash account increases. Cash is an asset, so we debit the cash account to increase it. Because KLO has not yet developed the required service (the app), there is a liability to the customer to provide the service called unearned revenue. Unearned revenue is a liability and therefore needs to be credited to increase it.

Step 2: The following journal entry will be recorded

Step 3: The following information will be posted to the ledger

Transaction 4:Provides $5,500 in app development services to a customer who asks to be billed for the services

Step 1: KLO has provided the service to the customer so its revenue increases. Revenues increase equity and so the revenue account needs to be credited to increase it. The customer asked to be billed for the service, meaning the customer owes money and has not yet paid, signaling an accounts receivable. Accounts receivable is an asset, so the accounts receivable account needs to be debited to increase it.

Step 2: The following journal entry will be recorded

Step 3: The following information will be posted to the ledger

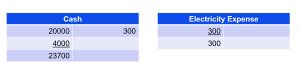

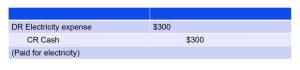

Transaction 5: Pays a $300 electricity (utility) bill with cash.

Step 1: Cash is paid so the cash account decreases. Cash is an asset, so the cash account needs to be credited to decrease it. The decrease in cash results from utility payments for services that were used and paid for within the accounting period, thus recognised as an expense. Expenses decreases equity, so debit electricity expense account to increase it. Recall that equity accounts have normal credit balances so to show a decrease we would do the opposite which is to debit as we have for the electricity expense account.

Step 2: The following journal entry will be recorded

Step 3: The following information will be posted to the ledger

Transaction 6: Distributed $100 cash in dividends to stockholder

Step 1: Cash is paid so the cash account decreases. Cash is an asset, so the cash account needs to be credited to decrease it. The cash payment is a distribution of business assets to the owners, so the dividend account increases. Similar to expenses, dividends decrease equity, so the dividends account needs to be debited to increase it.

Step 2: The following journal entry will be recorded

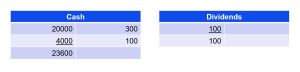

Step 3: The following information will be posted to the ledger

Let’s summarise the transactions and make sure the accounting equation is balanced by collating a summary of all the T-accounts and checking it against the accounting equation.

Let’s summarise the transactions and make sure the accounting equation is balanced by collating a summary of all the T-accounts and checking it against the accounting equation.

T-Accounts Summary

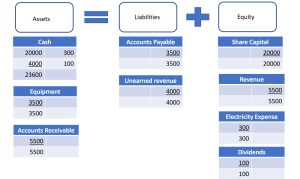

Once all journal entries have been posted to T-accounts, we can check to make sure the accounting equation remains balanced. A summary showing the T-accounts, analysed using the accounting equation, for Kids Learn Online is presented below.

The sum on the assets side of the accounting equation equals $32,600, found by adding together the final balances in each asset account (23600 + 3500 + 5500). To find the total on the liabilities and equity side of the equation, we need to find the difference between debits and credits. Credits on the liabilities and equity side of the equation total $33,000 (3500 + 4000 + 20,000 + 5500). Debits on the liabilities and equity side of the equation total $400 (100 + 300). The difference $33,000 – $400 = $32,600. Thus, the equation remains balanced with $32,600 on the asset side and $32,600 on the liabilities and equity side. Now that we have the T-account information, and have confirmed the accounting equation remains balanced, we can create the trial balance.

Preparing a trial balance

Once all the monthly transactions have been analyzed, journalised, and posted to the ledger (in practice this is performed on a continuous day-to-day basis over the accounting period), we are ready to start working on preparing a trial balance. Preparing a trial balance is the fourth step in the accounting cycle. As discussed in the previous section, a trial balance is a list of all accounts in the general ledger that have balances. Preparing a trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

Note that for this step, we are considering our trial balance to be unadjusted, which means it includes accounts before they have been adjusted. As you see in step 6 of the accounting cycle, we create another trial balance that is adjusted after posting adjusting entries in step 5. We will delve into these processes in the next chapter.

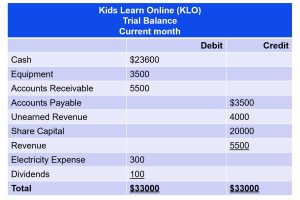

When constructing a trial balance in practice, we must consider a few formatting rules, akin to those requirements for financial statements:

- The header must contain the name of the company, the label of a Trial Balance, and the accounting period.

- Accounts are listed in the accounting equation order with assets listed first followed by liabilities and finally equity.

- Amounts at the top of each debit and credit column should have a dollar sign.

- When amounts are added, the final figure in each column should be underscored.

- The totals at the end of the trial balance need to have dollar signs and be double-underscored.

Transferring information from T-accounts to the trial balance requires consideration of the final balance in each account. If the final balance in the ledger account (T-account) is a debit balance, you will record the total in the left column of the trial balance. If the final balance in the ledger account (T-account) is a credit balance, you will record the total in the right column. Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other. The final total in the debit column must be the same dollar amount that is determined in the final credit column. For example, if you determine that the final debit balance is $33,000 then the final credit balance in the trial balance must also be $33,000. If the two balances are not equal, there is a mistake in at least one of the columns. A trial balance for Kids Learn Online (KLO) is provided below:

Let’s now take a closer look at the T-accounts and trial balance for KLO to see how the information is transferred from the T-accounts to the trial balance. For example, Cash has a final balance of $23,600 on the debit side. This balance is transferred to the Cash account in the debit column on the trial balance. Equipment ($3500), Accounts Receivable ($5500), Electricity Expense ($300) and Dividends ($100) also have debit final balances in their T-accounts, so this information will be transferred to the debit column on the trial balance. Accounts Payable ($3500), Unearned Revenue ($4000), Share Capital ($20000) and Revenue ($5500) all have credit final balances in their T-accounts. These credit balances would transfer to the credit column on the trial balance.

Once all balances are transferred to the trial balance, we will sum each of the debit and credit columns. The debit and credit columns both total $33000, which means they are equal and in balance. However, just because the column totals are equal and in balance, we are still not guaranteed that errors are not present. In other words, as long as equal debits and credits are posted, even to the incorrect account or in the incorrect amount, the total debits will equal the total credits. Thus, numerous mistakes may exist even though the trial balance columns agree. For example, the trial balance may balance even when any of the following occurs:

(a) a transaction is not journalised

(b) a journal entry is posted twice

(c) errors are made in recording the amount of a transaction

(d) a correct journal entry is not posted to the ledger

(e) incorrect accounts are used in journalising or posting

Thus it is very important to make sure that in every step of the accounting cycle that all transactions are entered correctly and accurately to minimise the occurrences of the above errors. Once the trial balance is completed, the final output of the accounting system can be prepared – the financial statements.

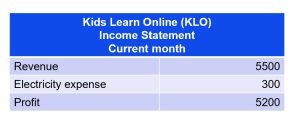

Preparing financial statements

As demonstrated in Chapter 5 of the AAA textbook, the income statement must be prepared first, followed by the statement of changes in equity and then the balance sheet. The income statement illustrates a business’ revenues and expenses. KLO’s trial balance contains only one revenue account and one expense account, therefore its income statement for the current month would appear as follows:

With net profit calculated, KLO’s retained earnings section of the statement of changes in equity (SoCiE) can be prepared. Recall from Chapter 5 of the AAA textbook, that the statement takes the beginning balance of retained earnings, adds profits and subtracts dividends to result in the current balance in retained earnings. For the purpose of preparing the SoCiE for the current month, we will assume the beginning balance of retained earnings is zero. KLO’s trial balance shows a $100 balance in dividends. Putting these two balances with profit, as calculated in the income statement above, yields the following SoCiE for KLO:

With net profit calculated, KLO’s retained earnings section of the statement of changes in equity (SoCiE) can be prepared. Recall from Chapter 5 of the AAA textbook, that the statement takes the beginning balance of retained earnings, adds profits and subtracts dividends to result in the current balance in retained earnings. For the purpose of preparing the SoCiE for the current month, we will assume the beginning balance of retained earnings is zero. KLO’s trial balance shows a $100 balance in dividends. Putting these two balances with profit, as calculated in the income statement above, yields the following SoCiE for KLO:

With retained earnings calculated, the business’ balance sheet can be prepared. A balance sheet shows the position of the business at a single point in time – in other words it provides a snapshot of the balances of the business’ assets, liabilities and equity. KLO’s trial balance shows three asset accounts (Cash, equipment and accounts receivables), two liability accounts (accounts payable and unearned revenue) and one equity account (share capital). These six accounts, together with the amounts of retained earnings from the SoCiE above, will be included on the balance sheet. Thus, the current month balance sheet for KLO would be depicted as follows:

With retained earnings calculated, the business’ balance sheet can be prepared. A balance sheet shows the position of the business at a single point in time – in other words it provides a snapshot of the balances of the business’ assets, liabilities and equity. KLO’s trial balance shows three asset accounts (Cash, equipment and accounts receivables), two liability accounts (accounts payable and unearned revenue) and one equity account (share capital). These six accounts, together with the amounts of retained earnings from the SoCiE above, will be included on the balance sheet. Thus, the current month balance sheet for KLO would be depicted as follows:

After the unadjusted trial balance and financial statements are prepared, a business might look at its financial statements to get an idea of the business’ position before adjustments are made to certain accounts. A more complete picture of the business’ position develops after adjustments occur, and an adjusted trial balance has been prepared. These next steps in the accounting cycle are covered in the next chapter: Recording adjusting entries.

Test yourself