4.7 Share Buybacks

Rina Dhillon

The practice of a company buying back its own shares is common in publicly listed companies and companies do this for several reasons. First, share buybacks are a tax effective way of returning capital to some shareholders, while reducing the overall cost of capital. Each ordinary share represents a small stake in the ownership of the issuing company, including the right to vote on the company policy and financial decisions. If a business has a managing owner and one million shareholders, it actually has 1,000,001 owners. Companies issue shares to raise equity capital to fund expansion, but if there are no potential growth opportunities, holding on to all that unused equity funding means sharing ownership for no good reason. Many shareholders demand returns on their investments in the form of dividends, which is a cost of equity —so the business is essentially paying for the privilege of accessing funds it isn’t using. Therefore, buying back some or all of the outstanding shares can be a simple way to pay off (i.e.return capital to) investors and reduce the overall cost of capital.

Second, share buybacks is an efficient way to reduce the number of outstanding shares on the market, which increases the ownership stake of shareholders – in other words to consolidate ownership. Companies issue shares to raise funding for projects. Several types of shares can be issued, but the two most popular are ordinary and preferred shares. Ordinary shares come with voting privileges and ownership. Preferred shares differ in that dividends are paid out to these shareholders before ordinary shareholders, and these shareholders are higher in the priority queue for payout during a bankruptcy proceeding. A company with thousands of stocks issued essentially has thousands of voting owners. A buyback reduces the number of owners, voters, and claims to capital.

Thirdly, a company might buyback shares because it believes the market has discounted its share value too much (i.e. company’s shares are undervalued) or to improve its financial ratios (for example earnings per share (EPS), which is an indicator of a company’s profitability, is calculated as a company’s profit divided by the average number of ordinary shares issued). Undervaluation occurs for several reasons, often due to investors’ inability to see past a business’ short-term performance, sensationalist news items, or a general bearish sentiment. If a stock is dramatically undervalued, the issuing company can repurchase some of its shares at this reduced price and then re-issue them once the market has corrected, thereby increasing its equity capital without issuing any additional shares.

Lastly, share buybacks might be part of an employee share or management incentive scheme. Details of a recent buyback by Qantas Group can be found here.

Share buybacks are usually done “off-market” where a company offers to buy and the shareholder need to simply sign the buyback form and all transfer details are handled by the company. A recent example of this is when the Commonwealth Bank of Australia (CBA) completed a $6 billion off-market buy-back of CBA ordinary shares in October 2021.

“On-market” share buybacks involve the company purchasing shares that are available for sale on the Australian Securities Exchange (ASX). In early 2022, the National Australian Bank (NAB) successfully completed a $2.5 billion on-market share buy-back, which resulted in the buy-back of 86,925,469 ordinary shares.

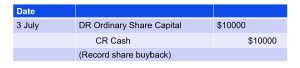

Recording Share Buyback

Let’s assume that Sydney Accounting Pty Ltd purchases 1,000 shares of its own ordinary shares on 3 July when the share is trading for $10 per share. Sydney Accounting would record the purchase as follows: