3.4 Purpose of the closing process and prepare closing entries

Rina Dhillon; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

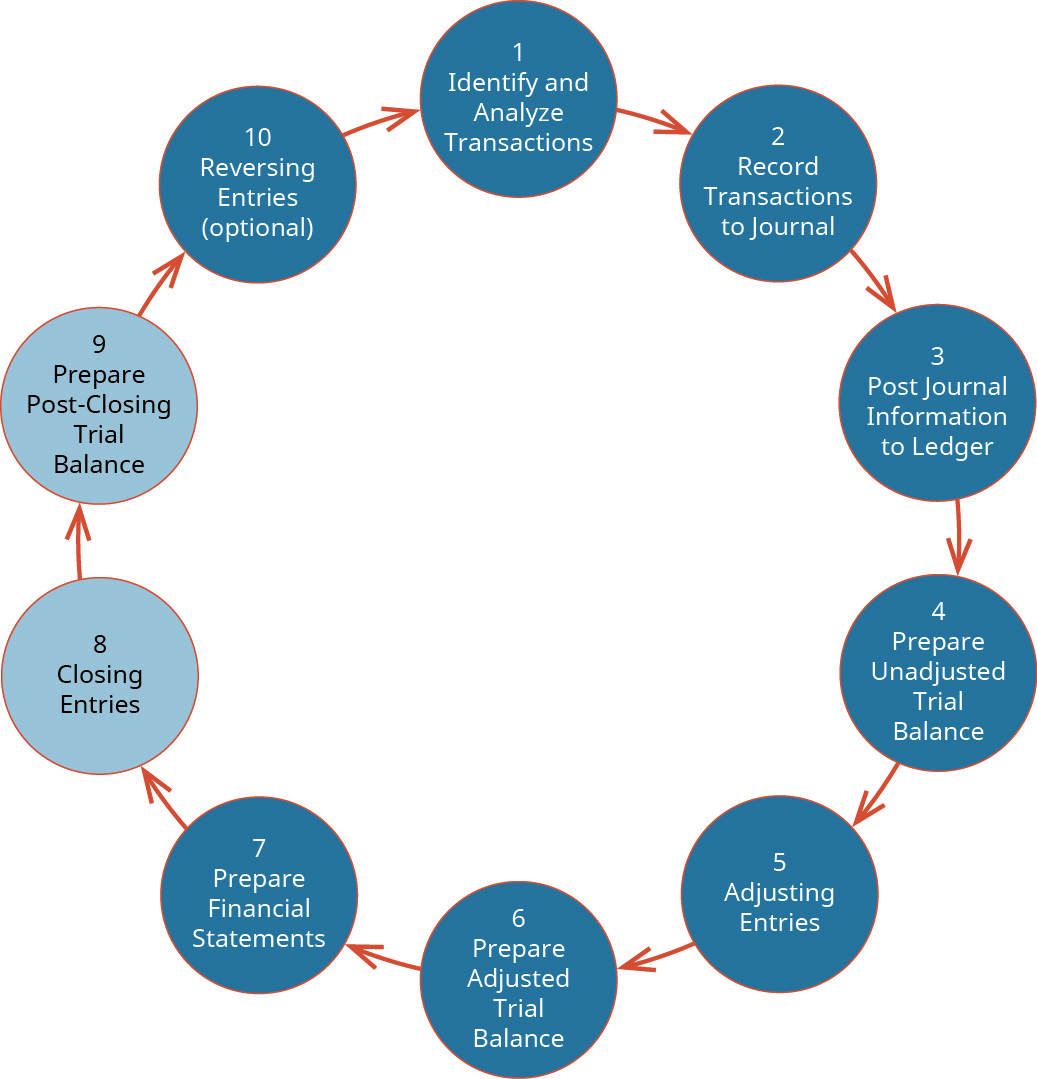

In this section, we explore the final steps (steps 8 and 9) of the accounting cycle, the closing process. We do not cover step 10, reversing entries. This is an optional step in the accounting cycle that you will learn about in future courses should you decide to do an accounting major/minor. Steps 1 through 4 were covered in Chapter 2 and Steps 5 through 7 were covered in Section 3.3.

This process begins with journalising and posting the closing entries. These posted entries will then translate into a post-closing trial balance, which is a trial balance that is prepared after all of the closing entries have been recorded.

Introduction to the Closing Entries

After financial statements are prepared, businesses conduct the closing process. Businesses are required to close their books at the end of each accounting period. Closing entries prepare a company for the next accounting period by clearing any outstanding balances in certain accounts that should not transfer over to the next period. Closing, or clearing the balances, means returning the account to a zero balance. Having a zero balance in these accounts is important so a business can compare performance across periods, particularly with income. It also helps the business keep thorough records of account balances affecting retained earnings. Revenue, expense, and dividend accounts affect retained earnings and are closed so they can accumulate new balances in the next period. This transfer to retained earnings is required for three main reasons.

First, revenue, expense and dividend accounts are temporary accounts, which means they accumulate balances only for the current accounting period. After the period ends and the financial statements are generated, all temporary accounts must reset to zero for the start of the next accounting period.

Second, the closing process updates the retained earnings account to its correct end of period balance. Recall that the balance in the retained earnings comes from the statement of change in equity and not the adjusted trial balance. The transfer to retained earnings is the mechanism that updates the actual retained earnings account balance in the general ledger.

Lastly, the closing entries leave the revenue, expense and dividend accounts with zero balances to begin the next accounting period and transaction amounts that are entered in these temporary accounts relate only to the new accounting period. To further clarify this, balances are closed to ensure all revenues and expenses are recorded in the proper period and then start over the following period. The revenue and expense accounts should start at zero each period because we are measuring how much revenue is earned and expenses incurred during the period. However, the cash balances, as well as the other balance sheet (permanent) accounts, are carried over from the end of a current period to the beginning of the next period.

For example, a store has an inventory account balance of $100,000. If the store closed at 11:59 p.m. on January 31, 2022, then the inventory balance when it reopened at 12:01 a.m. on February 1, 2022, would still be $100,000. The balance sheet accounts, such as inventory, would carry over into the next period, in this case February 2022. The accounts that need to start with a clean or $0 balance going into the next accounting period are revenue, expense, and any dividends from January 2022. To determine the income (profit or loss) from the month of January, the store needs to close the income statement information from January 2022. Zeroing January 2022 would then enable the store to calculate the income (profit or loss) for the next month (February 2022), instead of merging it into January’s income and thus providing invalid information solely for the month of February.

The closing process is carried out with several journal entries, known as closing entries. These entries, which are made in the journal and posted to the ledger, eliminates the balances in all temporary accounts and transfer those balances to the retained earnings account. The usual practice is one entry is made for revenue, one for expenses and a final entry for dividends. Thus, three entries usually occur during the closing process. The first entry closes revenue accounts to the retained earnings account. The second entry closes expense accounts to the retained earnings account. The third entry closes the dividend account to the retained earnings account. The information needed to prepare closing entries comes from the adjusted trial balance.

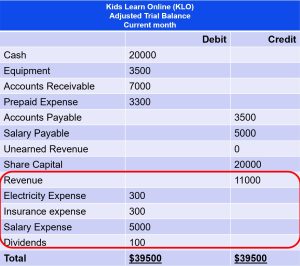

To illustrate, the temporary accounts from Kids Learn Online (KLO)’s adjusted trial balance is closed below through the eighth step in the accounting cycle, which includes journalising and posting the entries to the ledger.

KLO’s adjusted trial balance for the current month is presented below and the temporary accounts are highlighted to demonstrate how these accounts will be closed.

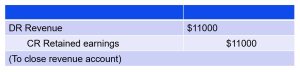

The first entry requires revenue accounts to close to the retained earnings account. KLO has only one revenue account with a $11000 credit balance. To eliminate that balance and transfer it to retained earnings account, the following closing entry is required:

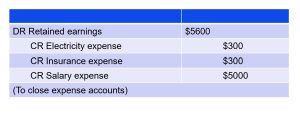

The second entry requires expense accounts to close to the retained earnings account. KLO has three expense accounts with a total debit balance of $5600 (300 + 300 + 5000). To eliminate that balance and transfer it to retained earnings account, the following closing entry is required:

The second entry requires expense accounts to close to the retained earnings account. KLO has three expense accounts with a total debit balance of $5600 (300 + 300 + 5000). To eliminate that balance and transfer it to retained earnings account, the following closing entry is required:

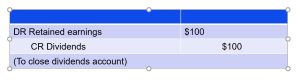

Finally, the third entry requires dividends to close to the retained earnings account. Expense and dividend accounts are closed in a similar fashion. If dividends were not declared, closing entries would cease at this point. If dividends are declared, to get a zero balance in the dividends account, the entry will show a credit to dividends and a debit to retained earnings. KLO has $100 of dividends with a debit balance on the adjusted trial balance and thus the closing entry will be as follows:

Finally, the third entry requires dividends to close to the retained earnings account. Expense and dividend accounts are closed in a similar fashion. If dividends were not declared, closing entries would cease at this point. If dividends are declared, to get a zero balance in the dividends account, the entry will show a credit to dividends and a debit to retained earnings. KLO has $100 of dividends with a debit balance on the adjusted trial balance and thus the closing entry will be as follows:

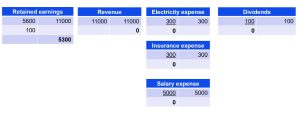

All three closing entries would be posted to the appropriate T-accounts as follows:

All three closing entries would be posted to the appropriate T-accounts as follows:

Notice that after the closing entries are posted, all revenue, expense and dividend accounts have a zero balance and are now ready to begin the next accounting period. In addition, retained earnings has a $5300 credit balance. This is the same figure found on the statement of change in equity and balance sheet prepared in the previous section. The statement of change in equity shows the period-ending retained earnings after the closing entries have been posted. When you compare the retained earnings ledger (T-account) to the statement of change in equity, the figures must match (i.e. the retained earnings account now has the correct balance at the end of the period). It is important to understand retained earnings is not closed out, it is only updated. Retained Earnings is the only account that appears in the closing entries that does not close.

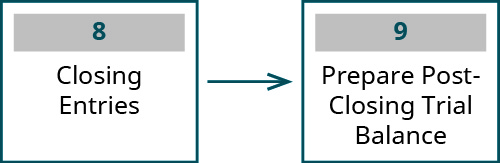

Now that we have closed the temporary accounts, as a final check that all accounts have been closed properly, a new trial balance – called a post-closing trial balance – is prepared as part of step 9 in the accounting cycle.

Preparing a Post-closing trial balance

The ninth, and typically final, step of the process is to prepare a post-closing trial balance. The word “post” in this instance means “after.” You are preparing a trial balance after the closing entries are complete. Like all trial balances, the post-closing trial balance has the job of verifying that the debit and credit totals are equal. The post-closing trial balance has one additional job that the other trial balances do not have. The post-closing trial balance is also used to double-check that the only accounts with balances after the closing entries are permanent accounts. If there are any temporary accounts on this trial balance, you would know that there was an error in the closing process. This error must be fixed before starting the new period.

The process of preparing the post-closing trial balance is the same as you have done when preparing the unadjusted trial balance and adjusted trial balance. Only permanent account balances should appear on the post-closing trial balance. These balances in post-closing T-accounts are transferred over to either the debit or credit column on the post-closing trial balance. When all accounts have been recorded, total each column and verify the columns equal each other.

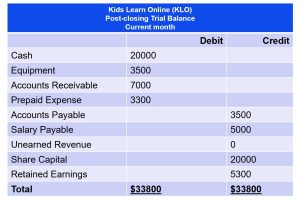

The post-closing trial balance for KLO is shown below:

Notice that only permanent accounts are included. All temporary accounts with zero balances were left out of this trial balance. Unlike previous trial balances, the retained earnings figure is included, which was obtained through the closing process.

At this point, the accounting cycle is complete, and the business can begin a new cycle in the next accounting period. It is worth mentioning that there is one step in the process that a business may or may not include, step 10, reversing entries. Reversing entries reverse an adjusting entry made in a prior period at the start of a new period. We do not cover reversing entries in this chapter, but you might approach the subject in future accounting courses.

Concluding Remarks: The Importance of Understanding How to Complete the Accounting Cycle

Many students who enroll in an introductory accounting course do not plan to become accountants. They will work in a variety of jobs in the business field, including managers, sales, and finance. In a real company, most of the mundane work is done by computers. Accounting software can perform such tasks as posting the journal entries recorded, preparing trial balances, and preparing financial statements. Students often ask why they need to do all of these steps by hand in their introductory class, particularly if they are never going to be an accountant. It is very important to understand that no matter what your position, if you work in business you need to be able to read financial statements, interpret them, and know how to use that information to better your business. If you have never followed the full process from beginning to end, you will never understand how one of your decisions can impact the final numbers that appear on your financial statements. You will not understand how your decisions can affect the outcome of your business.

As mentioned previously, once you understand the effect your decisions will have on the bottom line on your income statement and the balances in your balance sheet, you can use accounting software to do all of the mundane, repetitive steps and use your time to evaluate the business based on what the financial statements show.

Test Your Knowledge

Additional Resources (optional)

Several internet sites can provide additional information for you on adjusting entries. One very good site where you can find many tools to help you study this topic is Accounting Coach which provides a tool that is available to you free of charge. Visit the website and take a quiz on accounting basics to test your knowledge.

If you like quizzes, crossword puzzles, fill-in-the-blank, matching exercise, and word scrambles to help you learn the material in this course, go to My Accounting Course for more. This website covers a variety of accounting topics including financial accounting basics, accounting principles, the accounting cycle, and financial statements, all topics introduced in the early part of this textbook.