7.4 Understand and record the disposal of non-current assets

Rina Dhillon; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

Disposal of NCA

When a business decides that it no longer needs a non-current asset (NCA), it usually disposes of the asset in one of three ways depending on whether the asset has value or no value. When a NCA has no value, it will be disposed of and sometime there will be a cost related to this disposal. When a NCA still has value, it will either be sold or traded in for another asset, often a newer model. In this section, we focus on what happens when a NCA is sold. Essentially, the accounting for the disposal of a non-current asset consists of the following three steps:

- Update accumulated depreciation on the asset

- Calculate gain or loss on the disposal

- Record the disposal

When an asset is sold, the business must account for its depreciation up to the date of sale. This means that as a first step, the business may be required to record a depreciation entry before the sale of the asset to ensure it is current. An important thing to take note of is partial-year depreciation. A business may only own depreciable assets for a portion of a year in the year disposal (or even purchase). Businesses must be consistent in how they record depreciation for assets owned for a partial year. A common method is to allocate depreciation expense based on the number of months the asset is owned at time of disposal. For example, a business with a 30th June financial year, disposes an asset with an annual depreciation of $10000 on 1st January. In this instance, the depreciation expense would thus be $5000 ($10000 × 6/12), instead of $10000.

After ensuring that the carrying amount of an asset is current, the second step is the business must determine if the asset has sold at a gain, at a loss, or at book value. This is determined by comparing the asset’s carrying amount to the proceeds from the asset’s sale, if any. When the proceeds exceed the carrying amount, a gain on disposal is recognised. When the carrying amount exceeds the proceeds, a loss on disposal is recognised. An important takeaway from this is that a non-current asset may be sold for more or less than its recorded book value (i.e. carrying amount), which will result in a gain or loss, which must be recognised.

The third and final step is to prepare the journal entry that decreases the asset account and its related accumulated depreciation. If the asset is sold and cash is received, the journal entry must also record the increase in cash. Finally, any gain or loss on disposal must be recorded. The general format of the journal entry would be as follows:

Let us look at an example of a gain and loss alternative using the MAAS Corporation data.

Recall that MAAS’ truck has a depreciable base of $50000 and an economic life of five years. If MAAS sells the truck at the end of the third year, the business would have taken three years of depreciation amounting to $30000 ($10000 × 3 years). With an original cost of $65000, and after subtracting the accumulated depreciation of $30000, the truck would have a book value of $35000. If the business sells the truck for $37,000, it would realise a gain of $2000 as shown below:

Cost of Truck $65000

Less: Accumulated Depreciation $30000

Carrying amount $35000

Proceeds from sale $37000

Less: Carrying amount $35000

Gain on Sale $2000

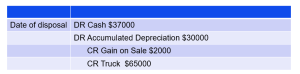

Because the sale proceed of $37000 exceeds the asset’s carrying amount of $35000, the business generates a $2000 gain (revenue). The journal entry to record the sale is shown below:

The above entry decreases the Truck account by $65000 (removing the asset from the books) and decreases the truck’s accumulated depreciation account by $30000 to eliminate the account. As the business no longer has the asset, it should no longer maintain accumulated depreciation for the asset. It also increase cash by $37000 to reflect the proceeds (asset) received from selling the truck. Finally, the entry increases the Gain on Sale account to reflect the gain on sale.

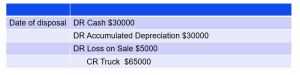

Suppose instead of selling the truck for $37000, MAAS was only able to sell it for $30000. In this instance, the asset’s carrying amount of $35000 exceeds the sale proceeds of $30000 and thus the business will generate a $5000 loss (expense). The journal entry to record the sale is shown below:

Like the gain example, the above entry first decreases the Truck account by $65000 to eliminate the account (i.e. remove the asset from the books). A common mistake is to think that the NCA, in this instance truck, should be decreased by its carrying amount of $35000. It is important to remember that NCA are recorded and maintained at costs (as discussed in Section 7.1) and thus the balance in the truck account is $65000 prior to disposal. The entry also decreases the truck’s accumulated depreciation by $30000 to eliminate the account. The entry increases the cash account by $30000 to reflect the proceeds (asset) received from selling the truck. Lastly, a debit to the loss on sale account reflects the loss on sale (expense or decrease in equity).

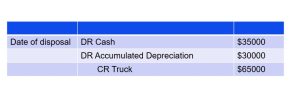

What if MAAS sells the truck at exactly book value? In this case, the business will realise neither a gain nor a loss and the journal entry to record the sale would be as follows:

Keeping It Real

The management of non-current/fixed assets can be quite a challenge for any business, from sole proprietorships to global corporations. Not only do businesses need to track their asset purchases, depreciation, sales, disposals, and capital expenditures, they also need to be able to generate a variety of reports. Read this Finances Online post for more details on software packages that help businesses steward their fixed assets no matter what their size.