The history of counting and accounting across the world

Amanda White

How old is the practice of accounting?

Luca Pacioli who lived from 1446 to 1517 is considered the father of modern accounting – that is, he devised the recording system of accounting that is still used today. However, think back – what civilisations came before the Italian renaissance? The Egyptians? Ancient China? Mesopotamia?

Mahmoud Ezzamel in 1997 published an academic research paper that describes how ancient Egyptians used accounting to track their redistributive economic system (Ezzamel 1997). A redistributive economic system is one where all wealth flows in to a central authority and then redistributed. This wouldn’t have been possible without some form of accounting.

It has been theorised by researchers that accounting came first in terms of recording, then supplemented by writing to explain that accounting. And even that money came into existence because it was a way to represent value in a standardised manner (Ezzamel and Hoskin 2002).

No matter what ancient civilisation – China, Greece, Persia, India, Rome (to name a few) – they all had some method of accounting so that accountability could be ensured.

Important comment

As a non-Indigenous writer, there is no way in which I can or would ever dream of speaking for Indigenous Australians. In the following commentary I am speaking of Indigenous cultures. I welcome Indigenous scholars to get in touch with me to contribute to this section of the text.

The world’s oldest continuous civilisation

Indigenous Australians (both Aboriginal and Torres Strait Islander) are part of the world’s oldest continuous civilisation. Did they have a system of accounting and accountability? Was a system of accounting and accountability required?

Bruce Pascoe in his book Dark Emu builds the argument that pre-colonial Indigenous Australians were more than the nomadic hunter-gatherers taught in Australian high schools. That Aboriginal Australians engaged in agriculture, farming and constructed permanent dwellings. There were regular gatherings in which tribes stockpiled food and supplies in advance. All of this implies that there was some sort of system related to counting, budgeting and planning – but was it accounting?

Greer and Patel (2000) put forward the following in their abstract:

The views of Greer and Patel are quite controversial with the idea that core values of Indigenous Australians are not compatible with accounting and accountability. However, their paper was published in 2000 – over 20 years ago. If we think back to the definition of accounting in the previous section:

Perhaps there are ways to combine the perspectives of the traditional custodians of the lands of Australia with broader definitions of accounting to be a force for good not only for an individual business or organisation, but people and our environment.

The impact of cultural norms on accounting practices

While accounting is considered universal, how accountants implement accounting principles and practices have been shown to differ with cultural and societal norms. For example, Gao and Handley-Schachler (2003) report on how feng shui, Confucianism and Buddhism have affected the developing of accounting practices in China.

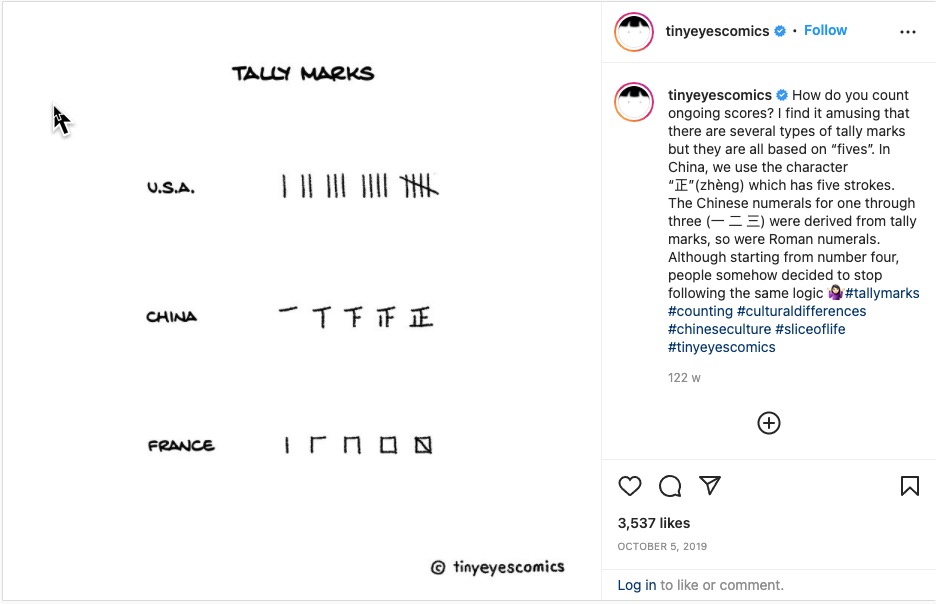

Cultural norms can be seen in the simplest of numerical traditions. Think about how we quickly tally numbers – artist Siyu Cao from Tiny Eyes Comics produced this example.

Copyright Siyu Cao – Tiny Eyes Comics – permission granted 10/2/2022.

Another example is the use of payments to government or regulatory officials to speed up the processing of an approval or to increase the chance of receiving an approval. In many cultures this is clearly considered an illegal bribe. In others, it is considered simply a regular and usual cost of doing business because graft/bribes are a culturally accepted norm. The globalisation of business and the increasing power of the ordinary person, however, has resulted in this type of practice being condemned by many as inappropriate. I once was contacted by a former student who had returned to her home country and asked me for advice on how to convince the managers of a large construction company that bribes were not permitted to be recorded as a legitimate business expense!

References

Carnegie, G., Parker, L., Tsahuridu, E. (2021). It’s 2020: What is Accounting Today?, Australian Accounting Review, 96(31), 65-73. doi: 10.1111/auar.12325

Ezzamel, M. (1997). ACCOUNTING, CONTROL AND ACCOUNTABILITY: PRELIMINARY EVIDENCE FROM ANCIENT EGYPT. Critical Perspectives On Accounting, 8(6), 563-601. https://doi.org/10.1006/cpac.1997.0123

Ezzamel, M., & Hoskin, K. (2002). Retheorizing accounting, writing and money with evidence from Mesopotamia and ancient Egypt. Critical Perspectives On Accounting, 13(3), 333-367. https://doi.org/10.1006/cpac.2001.0500

(2003). The influences of Confucianism, Feng Shui and Buddhism in Chinese accounting history, Accounting, Business & Financial History, 13(1), 41-68, DOI: 10.1080/09585200210164566d

Greer, S. and Patel, C. (2000), “The issue of Australian indigenous world‐views and accounting”, Accounting, Auditing & Accountability Journal, 13(3), 307-329. https://doi.org/10.1108/09513570010334793