Incorporate opening balances into transaction recording

Amanda White

In recording transactions, it is entirely possible to end up with unusual balances like negative cash or negative liabilities balances after processing transactions. A business may have a month where there is more expenditure than revenue. But does that mean the business is in financial difficulty?

Without any idea of the context for transactions – it is impossible for us to know the real financial health of a business. Opening balances for accounts like cash, inventory, liabilities and equity help provide context for the transactions that we are observing in a business.

The question then becomes, how do we get opening balances? Where do they come from and how do we incorporate them?

Opening balances

The opening balance of any set of accounts is the state of the accounting equation at the beginning of the period. The period could be the month, the quarter or the year. So the opening balance is where we start before any transactions are recorded.

Opening balances are stored in an accounting system for its assets, liabilities and equity. Where do they come from? The opening balances for one period, are the closing balances from the previous period. For example – consider an Australian company with a 30 June end of financial year. The closing balances are the values for assets, liabilities and equity at the 30th of June. The next financial year starts on the 1st of July – the opening balances on the 1st of July are the closing balances from the 30th of June.

There should be no difference between the closing balance of one financial year and the opening balance of the next financial year. The numbers should be exactly the same.

We know that revenues and expenses are contained WITHIN equity – however, their balances do not forward when we close a financial period at the end, before the new one starts. This is because the revenues and expenses are transactions, rather than a permanent asset, liability or equity. At the end of each period, we take the net value of revenue less expenses and that amount becomes part of a new account called “Retained earnings”, that forms part of equity. We will dig into this more in other sections of this chapter. But for now, all you need to remember is that every asset (cash, inventory, equipment, accounts receivable etc), liability (accounts payable, unearned revenue, bank loans etc) and equity (share capital and the new account I’ve just introduced called retained earnings) will have an opening balance.

Incorporating opening balances into transaction recording

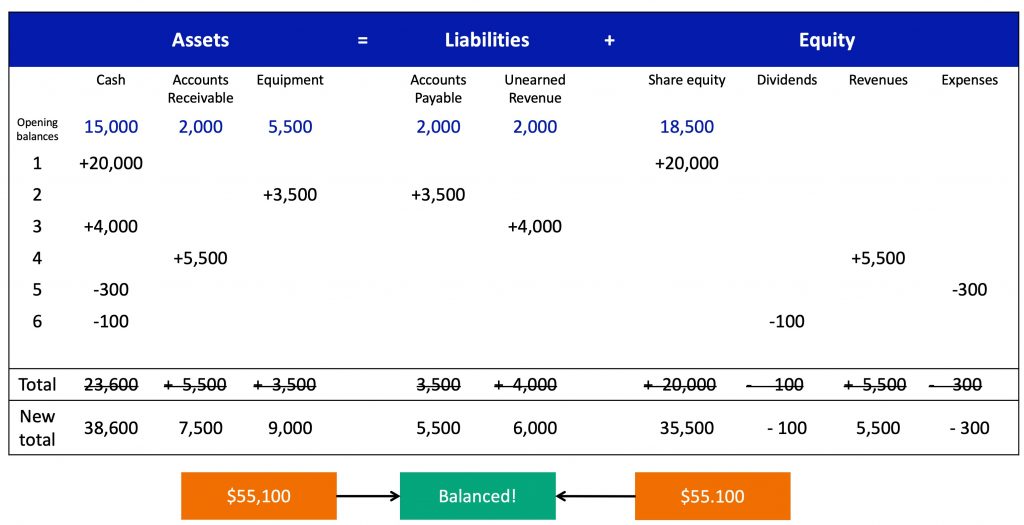

To incorporate an opening balance – all that is required in any accounting transaction spreadsheet or table is to add one additional line – in the table below, it is the text in blue. This is the balance of cash, accounts receivables, equipment, accounts payable, unearned revenue and share equity from the last day of the prior financial period. These balances are then carried forward to become the opening balance for this reporting period.

To calculate the closing balance for the reporting period – we add the opening balance to the transactions.

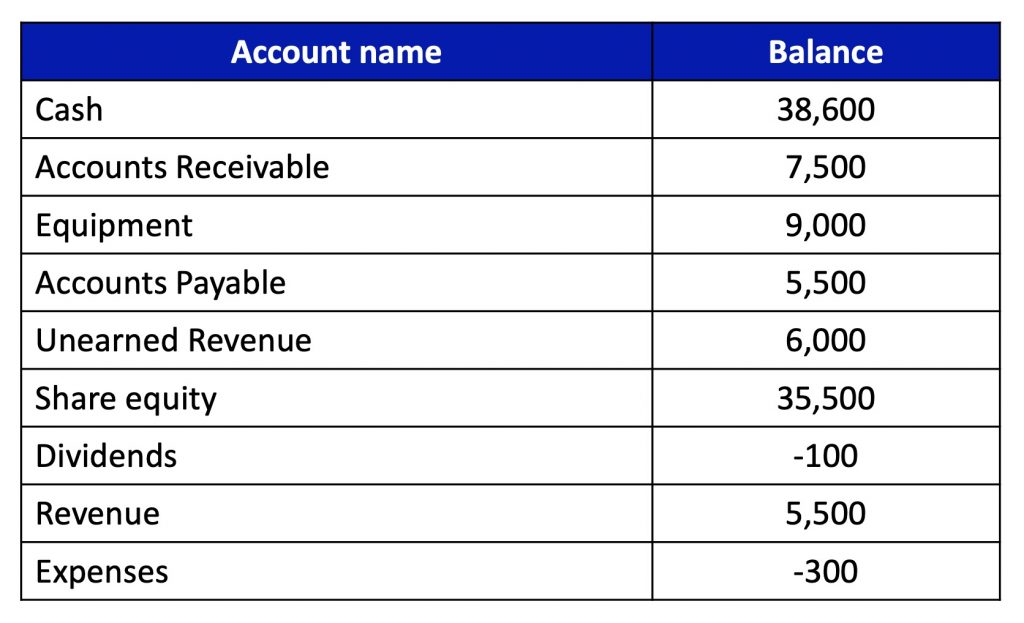

Creating a trial balance

Once we’ve incorporated the opening balance for each account that we use when recording transactions – accountants create something called a Trial Balance (often called a ‘TB’ in the accounting/business world). The accounting equation spreadsheet above has been re-formatted to create a trial balance as shown below. In the next section, we will learn how to use the trial balance to create three of the financial statements.

The trial balance contains the closing balance for every single account used by the company – whether it be a permanent account like an asset, liability or equity, or a temporary holding account like revenues, expenses or dividends. When accountants construct a set of financial statements for a client (if their accounting software doesn’t already do so) – the first thing they will ask for is the trial balance.