Expanding the accounting equation

Mitchell Franklin; Patty Graybeal; Dixon Cooper; and Amanda White

Before we explore how to analyse transactions, we first need to understand what governs the way transactions are recorded.

As you have learned, the accounting equation represents the idea that a business needs assets to operate, and there are two major sources that contribute to operations: liabilities and equity. The business borrows the funds, creating liabilities, or the business can take the funds provided by the profits generated in the current or past periods, creating retained earnings or some other form of equity. Recall the accounting equation’s basic form.

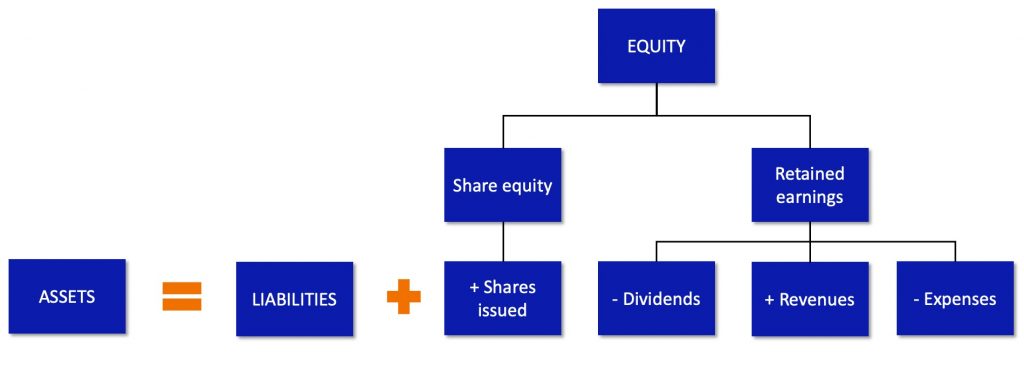

Expanded Accounting Equation

The expanded accounting equation breaks down the equity portion of the accounting equation into more detail. This expansion of the equity section allows a business to see the impact to equity from changes to revenues and expenses, and to owner investments and payouts. It is important to have more detail in this equity category to understand the effect on financial statements from period to period. For example, an increase to revenue can increase net income on the income statement, increase retained earnings on the statement of retained earnings, and change the distribution of shareholder’s equity on the balance sheet. This may be difficult to understand where these changes have occurred without revenue recognised individually in this expanded equation.

The expanded accounting equation is shown here.

Note that this expanded accounting equation breaks down Equity into four categories: shares issued, dividends, revenues, and expenses. This considers each element of share equity and retained earnings individually to better illustrate each one’s impact on changes in equity.

A business can now use this equation to analyse transactions in more detail. But first, it may help to examine the many accounts that can fall under each of the main categories of Assets, Liabilities, and Equity, in terms of their relationship to the expanded accounting equation. We can begin this discussion by looking at the chart of accounts.

Breaking down the expanded accounting equation

Refer to the expanded accounting equation above. We begin with the left side of the equation, the assets, and work toward the right side of the equation to liabilities and equity.

Assets and the expanded accounting equation

On the left side of the equation are assets. Assets are resources a business owns that have an economic value. Assets are represented on the balance sheet financial statement. Some common examples of assets are cash, accounts receivable, inventory, supplies, prepaid expenses, notes receivable, equipment, buildings, machinery, and land.

Cash includes paper currency as well as coins, cheques, bank accounts, PayPal accounts. Anything that can be quickly liquidated into cash is considered cash. Cash activities are a large part of any business, and the flow of cash in and out of the business is reported on the statement of cash flows. Note that cryptocurrencies are not considered cash. For accounting purposes, any form of cryptocurrency is considered an asset in the same way as a Renaissance painting.

Accounts receivable is money that is owed to the business, usually from a customer. The customer has not yet paid with cash for the provided good or service but will do so in the future. Common phrasing to describe this situation is that a customer purchased something “on account,” meaning that the customer has asked to be billed and will pay at a later date: “Account” because a customer has not paid us yet but instead has asked to be billed; “Receivable” because we will receive the money in the future.

Inventory refers to the goods available for sale. Service companies do not have goods for sale and would thus not have inventory. Merchandising and manufacturing businesses do have inventory.

Examples of supplies (office supplies) include pens, paper, and pencils. Supplies are considered assets until an employee uses them. At the point they are used, they no longer have an economic value to the business, and their cost is now an expense to the business.

Prepaid expenses are items paid for in advance of their use. They are considered assets until used. Some examples can include insurance and rent. Insurance, for example, is usually purchased for more than one month at a time (six months typically). The business does not use all six months of the insurance at once, it uses it one month at a time. However, the business prepays for all of it up front. As each month passes, the business will adjust its records to reflect the cost of one month of insurance usage.

Notes receivable is similar to accounts receivable in that it is money owed to the business by a customer or other entity. The difference here is that a note typically includes interest and specific contract terms, and the amount may be due in more than one accounting period.

Equipment examples include desks, chairs, and computers; anything that has a long-term value to the business that is used in the office. Equipment is considered a long-term asset, meaning you can use it for more than one accounting period (a year for example). Equipment will lose value over time, in a process called depreciation. You will learn more about this topic in Chapter 3, and Accounting, Business and Society.

Buildings, machinery, and land are all considered long-term assets. Machinery is usually specific to a manufacturing business that has a factory producing goods. Machinery and buildings are often called PPE – Property Plant and Equipment. Machinery and buildings are also depreciated. Unlike other long-term assets such as machinery, buildings, and equipment, land is not depreciated. The process to calculate the loss on land value could be very cumbersome, speculative, and unreliable; therefore, the treatment in accounting is for land to not be depreciated over time. It remains recorded at its historical (purchase) cost.

Liabilities and the expanded accounting equation

The accounting equation emphasises a basic idea in business; that is, businesses need assets in order to operate. There are two ways a business can finance the purchase of assets. First, it can sell shares of its stock to the public to raise money to purchase the assets, or it can use profits earned by the business to finance its activities. Second, it can borrow the money from a lender such as a financial institution. You will learn about other assets as you progress through the book. Let’s now take a look at the right side of the accounting equation.

Liabilities are obligations to pay an amount owed to a lender (creditor) based on a past transaction. Liabilities are reported on the balance sheet. It is important to understand that when we talk about liabilities, we are not just talking about loans. Money collected for gift cards, subscriptions, or as advance deposits from customers could also be liabilities. Essentially, anything a business owes and has yet to pay within a period is considered a liability, such as salaries, utilities, and taxes.

For example, a business uses $400 worth of utilities in May but is not billed for the usage, or asked to pay for the usage, until June. Even though the business does not have to pay the bill until June, the business owed money for the usage that occurred in May. Therefore, the business must record the usage of electricity, as well as the liability to pay the utility bill, in May.

Eventually that debt must be repaid by performing the service, fulfilling the subscription, or providing an asset such as merchandise or cash. Some common examples of liabilities include accounts payable, notes payable, and unearned revenue.

Accounts payable recognises that the business owes money and has not paid. Remember, when a customer purchases something “on account” it means the customer has asked to be billed and will pay at a later date. In the case of accounts payables, the business is the “customer” and will have to pay the money owed in the future, so we use the word “payable.” The debt owed is usually paid off in less than one accounting period (less than a year typically) if it is classified as an account payable.

A notes payable is similar to accounts payable in that the business owes money and has not yet paid. Some key differences are that the contract terms are usually longer than one accounting period, interest is included, and there is typically a more formalised contract that dictates the terms of the transaction.

Unearned revenue represents a customer’s advanced payment for a product or service that has yet to be provided by the business. Since the business has not yet provided the product or service, it cannot recognise the customer’s payment as revenue, according to the revenue recognition principle. Thus, the account is called unearned revenue. The business owing the product or service creates the liability to the customer.

Equity and the expanded accounting equation

Shareholders’ equity refers to the owners’ (shareholders) investments in the business and earnings. These two components are contributed capital and retained earnings.

The owners’ investments in the business typically come in the form of issued shares and are called contributed capital. Owners/shareholders can invest by contributing cash or some other asset.

Another component of shareholders’ equity is the business’s earnings. These retained earnings are what the business holds onto at the end of a period to reinvest in the business, after any distributions to ownership occur. Stated more technically, retained earnings are a business’s cumulative earnings since the creation of the business minus any dividends that it has declared or paid since its creation. One tricky point to remember is that retained earnings are not classified as assets. Instead, they are a component of the shareholders’ equity account, placing it on the right side of the accounting equation.

Distribution of earnings to ownership (shareholders) is called a dividend. The dividend could be paid with cash or be a distribution of more business shares to current shareholders. Either way, dividends will decrease retained earnings.

Also affecting retained earnings are revenues and expenses, by way of net income or net loss. Revenues are earnings from the sale of goods and services. An increase in revenues will also contribute toward an increase in retained earnings. Expenses are the cost of resources associated with earning revenues. An increase to expenses will contribute toward a decrease in retained earnings. Recall that this concept of recognising expenses associated with revenues is the expense recognition or matching principle. Some examples of expenses include bill payments for utilities, employee salaries, and loan interest expense. A business does not have an expense until it is “incurred.” Incurred means the resource is used or consumed. For example, you will not recognise utilities as an expense until you have used the utilities. The difference between revenues earned and expenses incurred is called net income (loss) and can be found on the income statement. Net income is also commonly called “profit”.

Net income reported on the income statement flows into the statement of retained earnings. If a business has net income (earnings) for the period, then this will increase its retained earnings for the period. This means that revenues exceeded expenses for the period, thus increasing retained earnings. If a business has net loss for the period, this decreases retained earnings for the period. This means that the expenses exceeded the revenues for the period, thus decreasing retained earnings.

You will notice that shareholders’ equity increases as new shares in the business are issued and as revenues grow; and decreases from dividend payouts and expenses. Shareholders’ equity is reported on the balance sheet in the form of share equity and retained earnings. The statement of retained earnings computes the retained earnings balance at the beginning of the period, adds net income or subtracts net loss from the income statement, and subtracts dividends declared, to result in an ending retained earnings balance reported on the balance sheet.

Now that you have a basic understanding of the accounting equation, and examples of assets, liabilities, and shareholders’ equity, you will be able to analyse the many transactions a business may encounter and determine how each transaction affects the accounting equation and corresponding financial statements.

The first step to do so is to learn how to identify and analyse business events or transactions. Then it will be a matter of identifying the accounting components and recording the transaction. That will be covered in the next section.

Test your understanding