Recording transactions related to non-current assets

Amanda White

Non-current assets are those assets we think will have a life and provide economic value to the business for longer than a 12 month period. Inventory is a current asset because we expect to sell that inventory within the next 12 months (things like wine and art are a little more complicated but we don’t delve into those!). Non-current assets include property, plant and equipment (often shortened to PPE) or an intangible asset like a patent for a new form of medication. Non-current assets also include items like land.

Purchase of non-current assets

In essence, we purchase non-current assets like we purchase other items – they are an increase in the asset, and either:

- a decrease in the cash asset

- an increase in a liability because of a loan taken out for purchase

There is some more complex accounting related to how we record the purchase of non-current assets, especially PPE, but we will not cover that in this introductory text. You’ll learn more about this in Accounting, Business and Society.

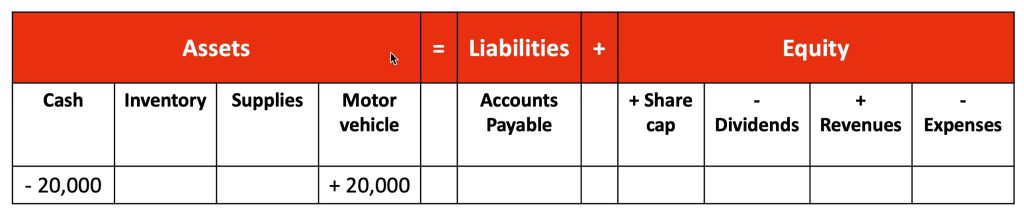

Below is an example where the business has purchased a motor vehicle for $20,000 in cash. We decrease our cash asset and increase our motor vehicle asset.

Since both transactions are on the assets side of the equation, we need a positive and negative amount that will sum to zero because the liabilities plus equities side of the transaction is also zero.

Recognising the use of property, plant and equipment (PPE)

Imagine the business has purchased a delivery truck. Every day that you use that truck, you use up some of the truck’s useful life until one day, the truck is too old to run. How do we recognise that over a longer period of time, we slowly use up our PPE? There is an accounting accrual concept called “depreciation“.

There are both simple and complex formulas to calculate how much depreciation should be recognised each month or year – you’ll learn this in Accounting, Business and Society. However at the introductory level, it is sufficient to know that depreciation exists and to understand the basic process to record depreciation.

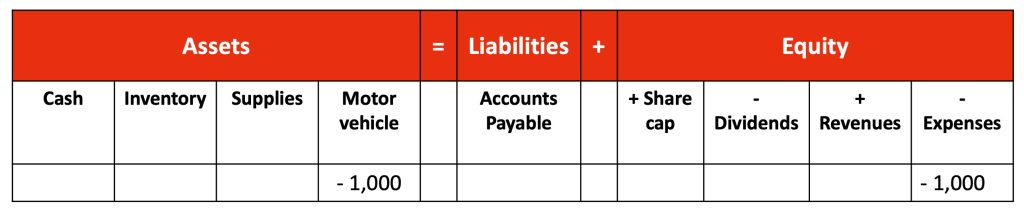

The process to record depreciation looks like this:

If you’ve already studied some accounting – the transaction above might not look correct. And you’d be technically right – in practice, accountants create a sub-account under motor vehicle called accumulated depreciation for the asset. It acts like a tally of all depreciation over the life of the asset – allowing us to keep the original value of the asset recorded, and then a sub-tally of all of the depreciation recorded over time.

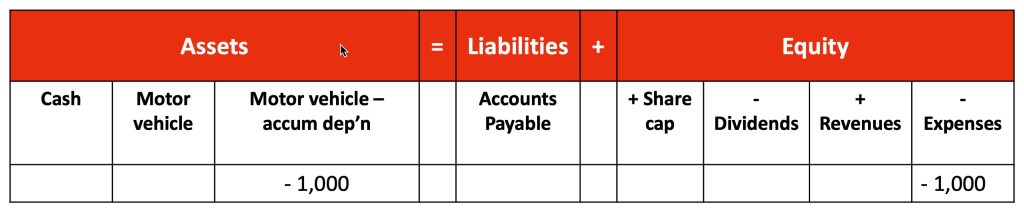

Recording using the accumulated depreciation process looks like this:

When we report the value of the asset in our financial statements – we report the NET value – the original asset amount minus the accumulated depreciation.

So what method should we use to record depreciation?

At the introductory level – we’ll stick with the simplified method. This is because the impact on the financial statements at the introductory level is exactly the same, no matter which method you use.

If you continue to further accounting subjects, you will consider the sale of non-current assets. This is where you’ll be required to use the more complex method so that you can calculate whether the business has made a gain or a loss on selling that non-current asset.