Creating a flexible budget

Mitchell Franklin; Patty Graybeal; Dixon Cooper; and Amanda White

What is a flexible budget?

In Chapter 9, Using budgets to evaluate performance, we discussed the idea of a flexible budget – the restating of our original budget, but using the sales quantities that were actually recorded. This results in two budgets. The first is the static budget – our original budget – labelled static because it does not move or change. We use our projected sales quantities and prices, materials, labour and overhead to generate our budgeted profit. The second budget is our flexible budget – using all of the same assumptions about sales price, cost of raw materials and cost of labour – but adjusted for the actual units sold.

How do we create a flexible budget?

A flexible budget is one based on different volumes of sales. A flexible budget flexes the static budget for each anticipated level of production. This flexibility allows management to estimate what the budgeted numbers would look like at various levels of sales. Flexible budgets are prepared at the end of each analysis period (usually monthly), rather than in advance, since the idea is to compare the operating income to the expenses deemed appropriate at the actual production level.

Example – Lobster Instant Noodles

Example – Lobster Instant Noodles

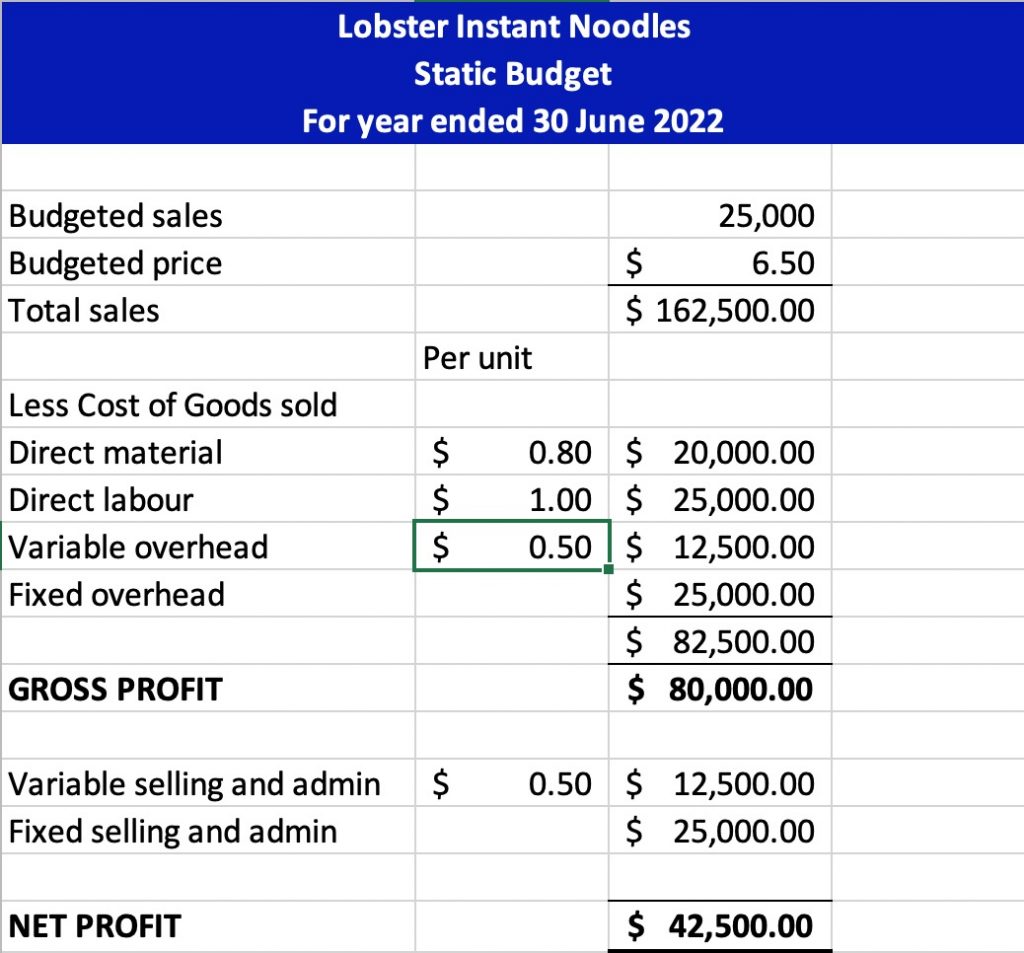

Lobster Instant Noodles make instant ramen noodles in cups that are commonly eaten by university students across the world. Simply add boiling water, close the lid for 3 minutes and you’ve got an instant meal. The business had planned to sell 25,000 units in 2022 at a price of $6.50. There were direct variable costs for materials $0.80, labour $1.00, overhead $0.50 and selling and administration $0.50. There were also fixed costs of $25,000 related to the factory and $25,000 related to selling and administration.

The static budget for Lobster Instant Noodles in 2022 is as follows:

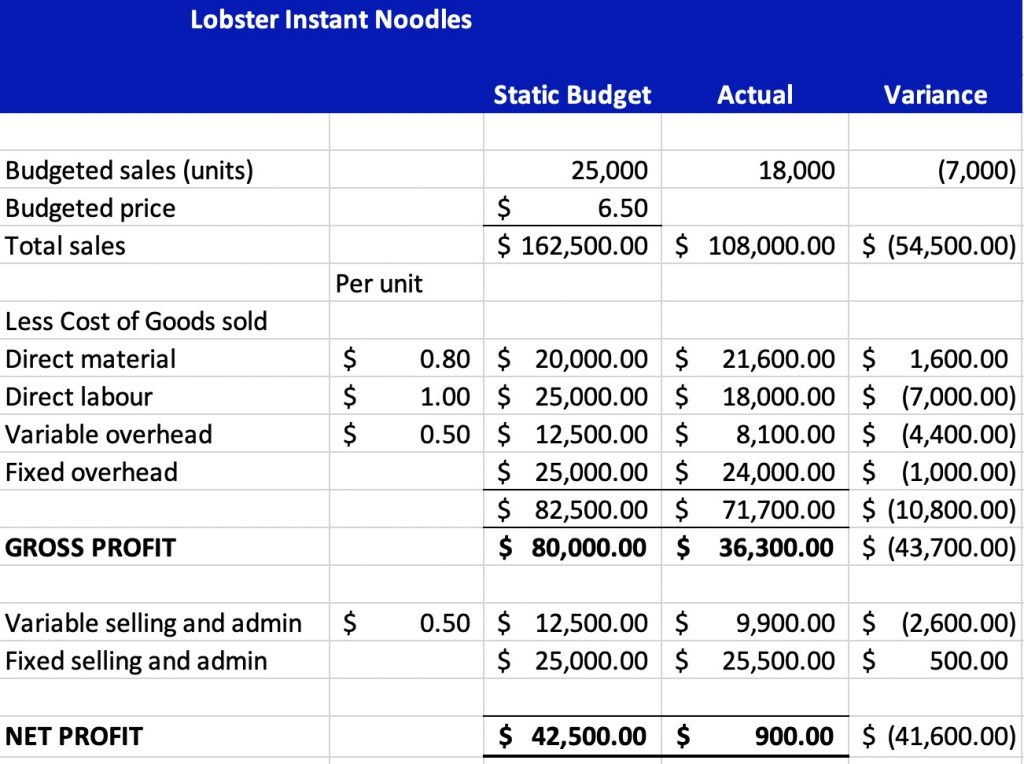

However, things did not go as plan in 2022. Lobster Instant Noodles faced significant issues related to their supply chain – delays in getting raw materials, employees who became unwell with COVID19 or needing to isolate resulted in performance less than what the business expected. The table below shows that Lobster Instant Noodles sold 7000 less units and instead of making a budgeted $42,500 of profit, instead made just $900. But is the comparison below fair? Of course, if you sell 18,000 less units, you would expect profit to be less – this is where the flexible budget comes in.

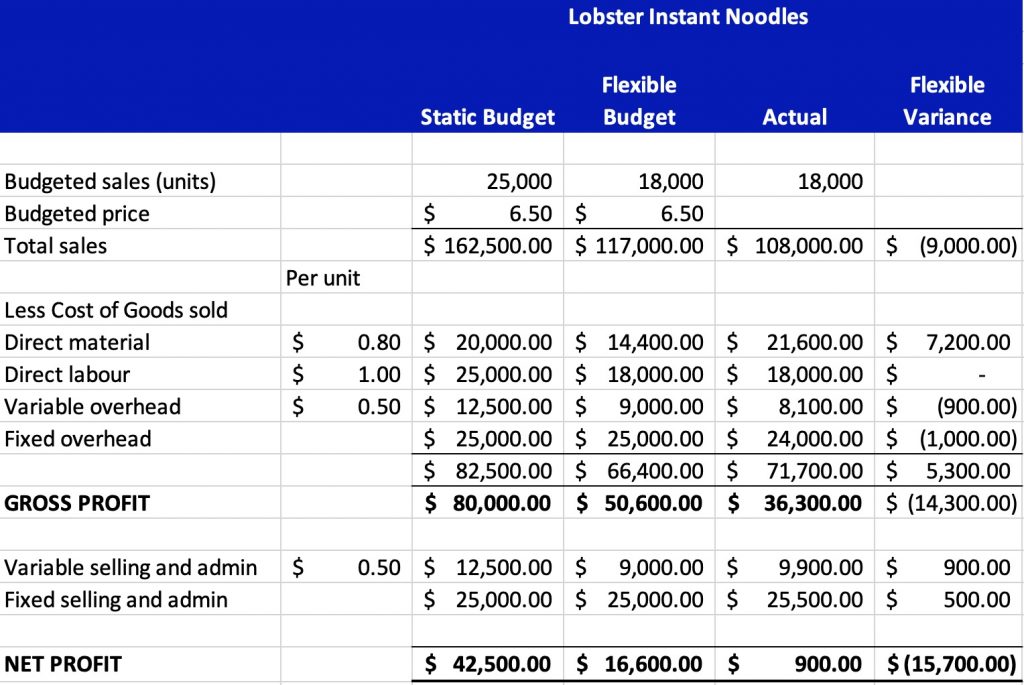

To create the flexible budget – we use the standard amounts for the sales price, materials, labour, overhead, and selling and administration costs. We can then compare our static budget, flexible budget and actual. This is shown below for Lobster Instant Noodles.

As you can see, the flexible budget indicates we should have made $16,600 in profit, a more reasonable number than $42,500 given the decrease in sales by 7,000 units.

Now that we know how to create the flexible budget, the next step is to understand the variance analysis – the comparison between the flexible budget and the business’s actual performance.