Recording the sales process

Amanda White

How to record transactions in the sales process

Generating sales is the lifeblood of any business – without revenue, a business will not be able to pay their debts as they fall due and will not remain a going concern. In talking about the sales process, we refer to not only making the sale, but also receiving payment from the customer.

In this section we will examine a number of different sales-related processes including:

- Sales for cash (quick recap)

- Sales made on credit

- Customer repayments for sales on credit

- Sales made in advance

- Completing the job for sales made in advance

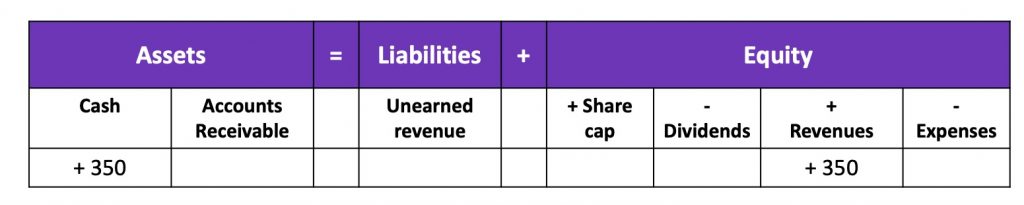

1. Sales for cash

For most retail businesses, this is the most common form of revenue generation. And whether you receive physical or electronic cash, it is all the same Cash account in our transaction recording. If $350 worth of goods are sold for cash, the transaction would be recorded as follows:

The accounting equation balances because it is increasing by $350 on both sides.

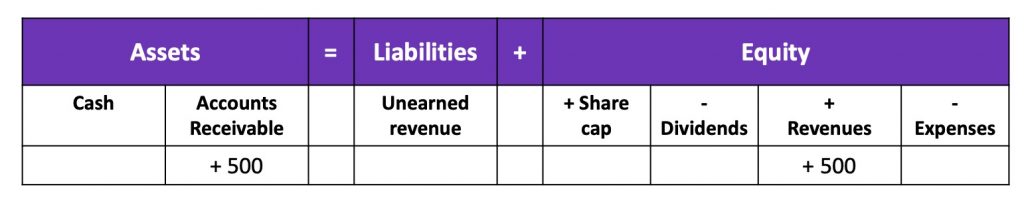

2. Sales made on credit

For many wholesale businesses, sales are made on credit. That is, the business has regular customers that it trusts to sell goods and receive payment at a later date. That later date is usually within 30 days, though in some industries it can be up to 90 days.

If $500 worth of goods are sold on credit, the transaction would be recorded as follows:

The asset of accounts receivable increases – future value will be gained when the accounts receivable is exchanged for cash – and revenue increases, therefore the equation is balanced.

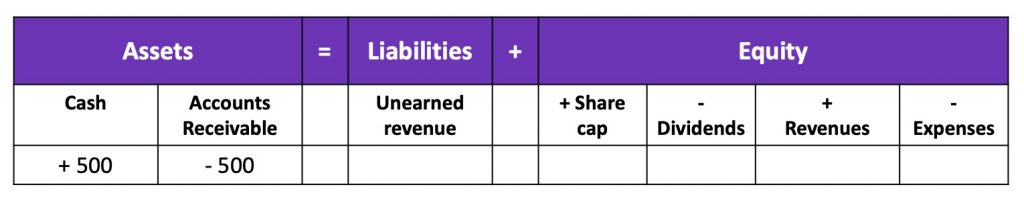

3. Customer repayments for sales on credit

Customers who purchase goods on credit will (hopefully) make their repayments within the timeframe set by the business. We’ll get into what happens when businesses do not pay for sales on credit in our 2nd text, Accounting, Business and Society.

For the previous example, when the customer pays their accounts receivable of $500 in full, the transaction would be recorded as follows:

Note that there is no change in Revenue. It has already been recorded. Now all that is happening in the business is that we are transforming one asset (Accounts Receivable) into another (Cash). The equation is balanced because the total change in assets is $0 and the change in liabilities and equity is also $0.

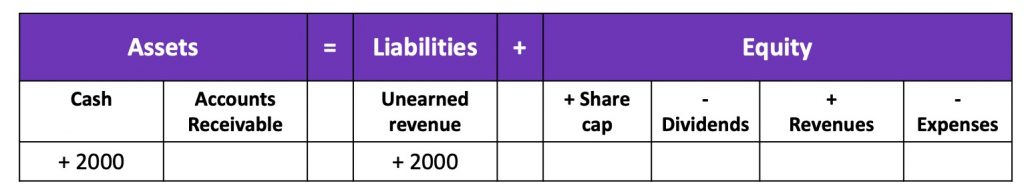

4. Sales made in advance

It can be common for a popular business to ask customers to pay in advance. This may be for a custom order, or for a good that is in high demand.

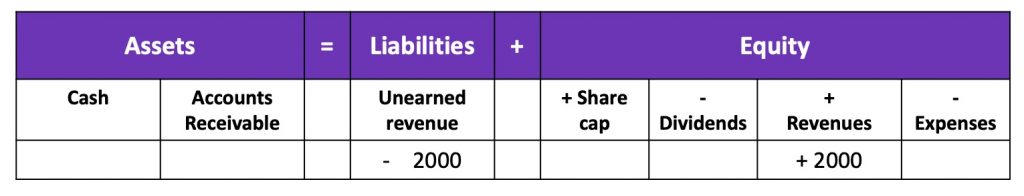

A customer orders a $2,000 item that will be delivered in 2 months time. The transaction would be recorded as follows:

We’ve increased our assets by receiving cash, but we’ve also generated an obligation (unearned revenue liability) to provide the item to the customer in the future.

Technically, when you purchase goods through an online store – you pay for those goods in advance. It takes time for the business to get your order ready and then ship your order to you. If you want to be really accounting nerdy – the business doesn’t technically earn the revenue until your order is delivered to you!

5. Completing the job for sales made in advance

Imagine it is now 2 months later and we now have the item that the customer paid in advance for and we deliver it to them. The transaction would be recorded as follows:

Note that there is no change to our assets. The cash is still in our bank account and nothing has changed. When we deliver the item to the customer, we are fulfilling our obligation (hence the decrease of $2000 in unearned revenue) and can now recognise the revenue of $2000. The equation balances because the liabilities and equity side comes to a sum of $0 and the change in assets is also $0.