Identifying the causes of variances

Amanda White

Why identifying the causes of variances is important

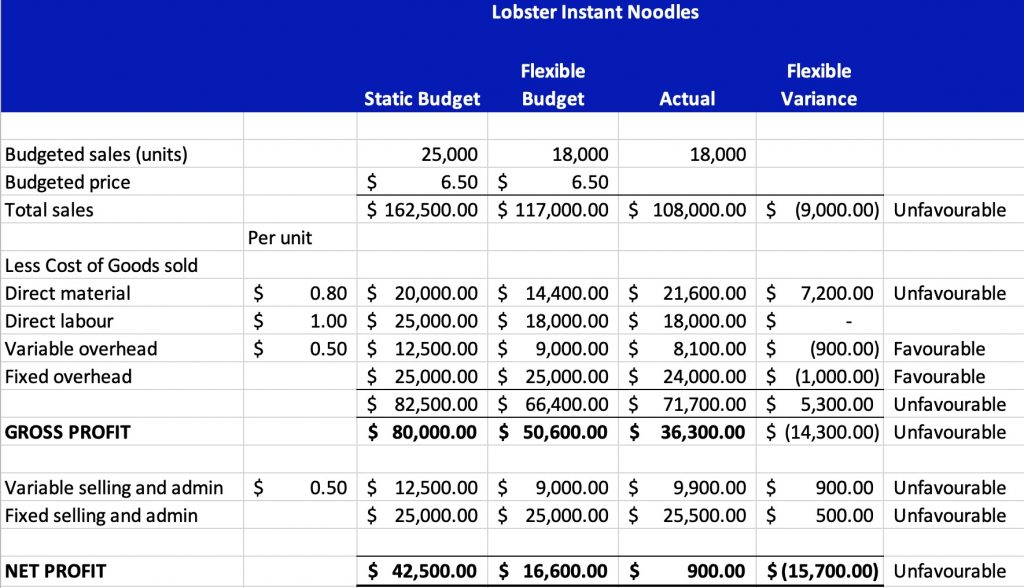

As we’ve discussed many times in this textbook, simply being able to calculate or report accounting figures is an important skill – but more important is knowing how to USE accounting information to help a business achieve its objectives. Therefore, at Lobster Instant Noodles, knowing the business is making a profit or loss is an important fact. But MORE important is understanding WHY the business is making such a small profit in comparison to its flexible budget.

Remember that understanding accounting information is important because it helps us ask the right QUESTIONS, so that we may get ANSWERS to assist a business in making its next decisions. Thinking about Lobster Instant Noodles – we want to know WHY we had to spend more on direct materials, but less on overhead, and why more on selling and administration?

If you choose to enter the accounting major or specialise in accounting – those further studies will cover how we analyse variances in much greater detail than is covered in this text. The approach taken here is to help you understand the underlying theory behind variance analysis without going into complicated formulas and terminology.

Sales-related variances

Think back to how we create the sales budget as shown in the formula below. Our budgeted sales is calculated by multiplying our predicted sales (developed by marketing and management) by the sales price.

Our flexible budget uses the same units sold as the actual sales for the year. This means that the only other factor that could result in actual performance being different from budgeted performance is the Sales Price. If we work backwards, $108,000 divided by 18,000 units provides us with an Actual Sales Price of $6.00. This is $0.50 less than our original budget of $6.50.

Our next step would be to investigate why the sales price was dropped. We may need to meet with the Sales Manager, or Marketing team to find out the reason for the price drop. This could include reasons such as (but not limited to):

- The business was loosing customers to a competitor who was charging less than $6.50

- The economic impact of COVID19 meant that customers were not willing to pay the original budgeted price

Material-related variances

When preparing the budget for our direct materials, we take our predicted sales and multiply this by the budgeted materials used per unit and the price of raw materials. In our Lobster Instant Noodles example, we haven’t been provided with this information so far. However, if we compare our actual direct materials per unit and our budgeted raw materials per unit, there is a difference.

Lobster Instant Noodles budgeted for $0.80 per unit of raw materials (mostly wheat for the noodles, flavour powder and the packaging for the cup). However, the business actually used $1.20 of raw materials ($21,600 in total raw materials divided by 18,000 units = $1.20 per unit). The business spent 50% more on raw materials than the budget.

Presume we are given the following new information

- the raw materials were priced at $0.40 per 100g and each cup should use 200g of raw materials

- raw material prices did not change since the budget was prepared

Then we can deduce that the business must have used 300g of raw materials to make each cup of noodles ($1.20 per unit total DM cost and $0.40 per 100g). Why did the business use more raw materials? Potential reasons could include (but are not limited to)

- the raw materials were of poorer quality and there was more wastage

- the production process had become more inefficient

Business employees and owners can take action on these issues and look at changing suppliers to one that provides a better quality product, or investigate how they can reduce wastage of the raw materials going into the product.

Alternatively, the purchasing managers who arrange to buy the wheat and cups tell us that due to the worldwide supply chain issues and also the Russian invasion of Ukraine, wheat prices have increased significantly. The business still uses 200g of raw materials, but the prices went up $0.60 per 100g of materials. The key action the business might take here is to try and find a cheaper supplier.

Labour-related variances

When preparing the budget for our direct labour, we take our predicted sales and multiply this by the budgeted labour hours used per unit and the rate of pay for our labour / employees.

In our Lobster Instant Noodles example, we haven’t been provided with this information so far. However, if we compare our actual and flexible budget for direct labour – you’ll notice that nothing has changed. There is 0 variance. What does this mean? It could mean one of a few options:

- That the business used the expected number of labour hours per unit and the rate of pay is as expected

- We could be paying employees more per hour, but they may be more efficient – resulting in less hours but at a higher rate, and the same total wage bill

- We could be paying employees less per hour, but they may be inefficient – resulting in greater hours, but at a lesser rate, and the same total wage bill.

Globally, there is a world wide shortage of labour due to COVID19 illness and the need for employees to take sick leave or isolation leave. This has left many businesses – from supermarkets, to restaurants, retail stores and manufacturing facilities short of employees. This has meant that the hourly rate of pay has increased in many industries. However, we have also seen the opposite – with many employees having lost their jobs during COVID19 and looking for work – some businesses may be paying less per hour because more labour is available.

Overhead and selling and administration-related variances

As you can see from the Lobster Instant Noodles variance analysis, the business saved money on variable overhead and fixed overhead. The overhead costing process is quite complicated and we have not gone into detail as to how overhead is calculated. Therefore, we do not expect students to be able to conduct variance analysis in any great detail for overhead and selling and administration-related variances. Simply understanding favourable and unfavourable and being able to brainstorm potential reasons for overall changes is sufficient. Some ideas have been provided below:

| Overhead variances | Selling and administration variances |

|

|