Identify relevant information for decision-making

Mitchell Franklin; Patty Graybeal; Dixon Cooper; and Amanda White

Choosing between alternatives

Almost everything we do in life results from choosing between alternatives, and the choices we make result in different consequences. For example, when choosing whether or not to eat breakfast before going to class, you face two alternatives and two sets of consequences. Eating breakfast means you must get up a little earlier, have food available, and be willing to prepare the food. Not eating means sleeping in longer, not having to plan food, and being hungry during class. Just as our lives are fraught with decisions large and small, the same is true for businesses. Almost every aspect of being in business involves choosing between alternatives, and each alternative typically has one or more consequences. Understanding how businesses make decisions paves the way not only to better decision-making processes but potentially to better outcomes.

Decisions made by businesses can have short-term effects or long-term impacts, or in some situations, both. Short-term decisions often address a temporary circumstance or an immediate need while long-term decisions align more with permanent problem solving and meeting strategic goals. These two types of decisions require different types of analyses and different types of accounting and non-accounting information.

What is considered short-term and what is considered long-term? Think back to our our accounting definition for current and non-current assets and liabilities. Current assets/liabilities are short-term items – and short term is interpreted as some time in the next 12 months. Non-current is longer term and is anything over or after 12 months from now. Accounting distinguishes between short-term and long-term decisions not only because of the difference in the general nature of these decisions but also because the types of analyses differ significantly between short-term and long-term decision categories. As the time horizon over which the decision will have an impact expands, more costs become relevant to the decision-making process. In addition, when a time element is considered, there will be additional factors such as interest (paid or received) that will have a greater influence on decisions. The table below provides examples of short-term and long-term business decisions.

| Examples of Short-Term and Long-Term Business Decisions | |

|---|---|

| Short-Term Business Decisions | Long-Term Business Decisions |

|

|

Short-term decision-making

Short-term decision-making is vital in any business. Considering the business challenges facing Gearhead Outfitters, a retailer sells men’s, women’s and children’s outdoor clothing, footwear, and accessories. Gearhead must carry a certain level and variety of inventory to meet the demands of its customers. The company will have to maintain appropriate accounting records to make proper business decisions to promote sustainability and growth.

How might Gearhead be able to compete with larger chains and remain profitable? Will every sale result in the anticipated profit to the company? Consider what specialised short-term decision-making processes the company may use to meet its goals. Should more of an item than normal be purchased for resale to receive a larger discount from the supplier? What information about cost, volume, and profit is needed to make a sound business decision in this case? Some items may be sold at a loss (or lesser profit) to attract customers to the store (often called loss-leaders in marketing terminology). What type of information and accounting system is needed to help in this situation? The company requires relevant, consistent, and reliable data to determine the proper course of action. But what information is considered “relevant”?

Relevant information for short-term decision-making

Business decision-making can be outlined as a process that is applied by management with each decision that is made. The process of decision-making in a managerial business environment can be summed up in these steps.

- Identify the objective or goal. For a business, typically the goal is to maximise revenues or minimise costs.

- Identify alternative courses of action that can achieve the goal or address an obstacle that is hindering goal achievement.

- Perform a comprehensive analysis of potential solutions. This includes identifying revenues, costs, benefits, and other financial and qualitative variables.

- Decide, based upon the analysis, the best course of action.

- Review, analyse, and evaluate the results of the decision.

The first step of the decision-making process is to identify the goal. In the decisions discussed in this course, the quantitative goal will either be to maximise revenues or to minimise costs. The second step is to identify the alternative courses of action to achieve the goal. (In the real world, steps one and two may require more thought and research that you will learn about in advanced cost accounting and management courses.). This chapter focuses on steps three and four, which involve short-term decision analysis: determining the appropriate information necessary for making a decision that will impact the company in the short term, usually 12 months or fewer, and using that information in a proper analysis in order to reach an informed decision among alternatives. Step five, which involves reviewing and evaluating the decision, is briefly addressed with each type of decision analysed.

Though these same general steps could be used in long-term decision analyses, the nature of long-term decisions is different. Short-term decisions are typically operational in nature: making versus buying a component of a product, using scarce resources, selling a product as-is or processing it further into a different product. It is relatively easy to change a short-term decision with minimal impact on the company. Long-term decisions are strategic in nature and typically involve large sums of money. The effects of a long-term decision can have significant financial impact on a company for years. Examples of long-term decisions include replacing manufacturing equipment, building a new factory, or deciding to eliminate a product line. Managers will need to carefully track and predict costs and revenues to make these decisions – this is because the goal of most businesses is profit maximisation, hence we need to examine the potential impact of a decision on revenues and expenses.

In carrying out step three of the managerial decision-making process, a differential analysis compares the relevant costs and revenues of potential solutions. What does this involve? First, it is important to understand that there are many types of short-term decisions that a business may face, but these decisions always involve choosing between alternatives. Examples of these types of decisions include:

- determining whether to accept a special order

- making a product or component versus buying the product or component

- performing additional processing on a product

- keeping versus eliminating a product or segment.

In each of these situations, the business should compare the relevant costs and the relevant revenues of one alternative to the relevant costs and relevant revenues of the other alternative(s). Therefore, an important step in the differential analysis of potential solutions is to identify the relevant costs and relevant revenues of the decision.

Identifying relevant revenues and costs

What does it mean for something to be relevant? In the context of decision-making, something is relevant if it will influence the decision being made. For example, suppose you have two options for a summer job—either directing traffic for a road safety and maintenance business or working for a landscaping company mowing lawns. For either job, you will be required to have industrial grade sound protectors (plugs or headphones) for your ears. This cost would not be relevant because it is the same under either alternative, so it will not influence your decision between the two jobs; it would be considered an irrelevant cost. You also believe your transportation costs will be the same for either job; thus this would also be an irrelevant cost.

However, if you are required to have steel-toed boots for the road work job but can wear any type of work boot for the landscaping job, you would need to consider the difference between the costs, or the differential cost, of these two types of boots. This difference in cost between the two pairs of boots would be designated as a relevant cost because it influences your decision.

The two jobs also may have differences in revenues, called a differential revenue. Because the differential revenue influences the decision, it is also a relevant revenue. If both jobs pay the same hourly wage, it would have an irrelevant revenue, but if the road safety job offers overtime for any time worked over 40 hours, then this overtime wage has the potential to be a relevant revenue if overtime is a likely occurrence. Looking only at these differences – of both costs and revenues – between the alternatives, is known as differential analysis.

In conducting these types of analyses between alternatives, the initial focus will be on each quantitative factor of the analysis – in other words, the component that can be measured numerically. Examples of quantitative factors in business include sales growth, number of defective parts produced, or number of labor hours worked. However, in decision-making, it is important also to consider each qualitative factor, which is one that cannot be measured numerically. For example, using the same summer job scenario, qualitative factors may include the environment in which you would be working (road dust and tar odors versus pollen and mower exhaust fumes), the amount of time exposed to the sun, the people with whom you will be working (working with friends versus making new friends), and weather-related issues (both jobs are outdoors, but could one job send you home for the day due to weather?). Examples of qualitative factors in business include employee morale, customer satisfaction, and company or brand image. In making short-term decisions, a business will want to analyse both qualitative and quantitative factors.

In short-term decision-making, revenues are often easier to evaluate than costs. In addition, each alternative typically only has one possible one revenue outcome even though there are many costs to consider for each alternative. How do we know if a cost will have an impact on the decision? The starting point is to understand the various labels that are attached to costs in these decision-making environments.

Avoidable versus unavoidable costs

Management must determine if a cost is avoidable or unavoidable because in the short run, only avoidable costs are relevant for decision-making purposes. An avoidable cost is one that can be eliminated (in whole or in part) by choosing one alternative over another. For example, assume that a bike shop offers their customers custom paint jobs for bikes that the customers already own. If they eliminate the service, the cost of the bike paint could be eliminated. Also assume that they had been employing a part-time painter to do the work. The painter’s compensation would also be an avoidable cost.

An unavoidable cost is one that does not change or go away in the short-run by choosing one alternative over another. For example, a company might sign a long-term lease on equipment or a production facility. These types of leases typically don’t allow for cancellation, so if this one does not, then their required payments are unavoidable costs for the duration of the lease.

Variable costs are avoidable costs, since variable costs do not exist if the product is no longer made, or if the portion of the business (such as a segment or division) that generated the variable costs ceases to operate. Fixed costs, on the other hand, may be unavoidable, partially unavoidable, or avoidable only in certain circumstances. Remember that fixed costs tend to remain constant for a period of time and within a relevant range of production and are not easily eliminated in the short-run. Therefore, most fixed costs also are unavoidable. If a fixed cost is specific only to one of the alternatives, then that fixed cost also may be avoidable. Avoidable costs are future costs that are relevant to decision-making. Past costs are never an avoidable cost.

Recall that we are using a short-term viewpoint to determine whether or not costs are avoidable. In the long run, virtually all costs are avoidable. For example, assume that a company has a long-term, ten-year lease on a production facility that cannot be cancelled. For the first ten years it would be noncancelable and thus unavoidable. But after ten years it would become avoidable.

Example: AlexCo’s Wagons

AlexCo produces collapsible wagons that are popular with beachgoers, shoppers, gardeners and parents. You can see an example of one in the picture.

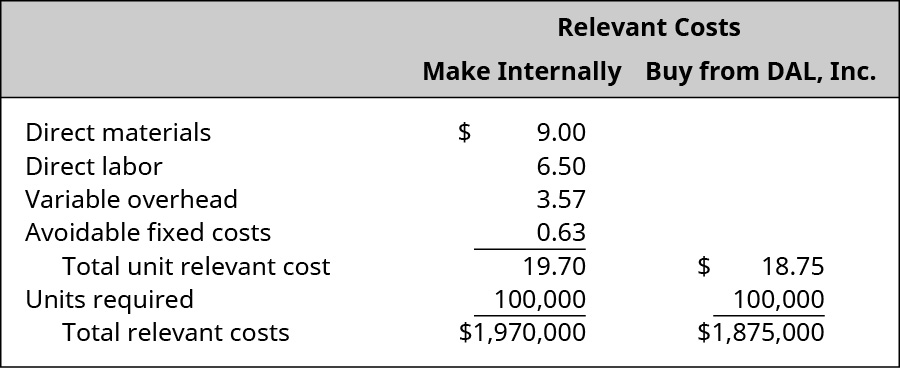

Annual sales have been 100,000 wagons per year. The retail selling price of each wagon is $67.00. To date, AlexCo has produced each of the components used in making the wagons but has been approached by DAL, Inc. with an offer to provide the axle and wheel assembly for $18.75 per assembly. AlexCo’s costs to produce the axle and wheel assembly are $9.00 in direct materials, $6.50 in direct labor, $3.57 in variable overhead, and $2.50 in fixed overhead. Twenty-five percent of the fixed overhead is avoidable if the assembly is produced by DAL. Should AlexCo continue to make the axle and wheel assembly or should it buy the assembly from DAL, Inc.?

Solution

Ignoring qualitative factors, it would be more cost effective for AlexCo to buy the axle and wheel assembly from DAL, Inc. However, AlexCo should be certain of any qualitative issues and not solely base their decision on the quantitative analysis. What is the quality of the axels and wheel assemblies from DAL? Will they deliver on time? Where are the parts made? (where it may be important to customers that goods be made within a specific country).

Sunk costs

A sunk cost is one that cannot be avoided because it has already occurred. A sunk cost will not change regardless of the alternative that management chooses; therefore, sunk costs have no bearing on future events and are not relevant in decision-making. The basic premise sounds simple enough, but sunk costs are difficult to ignore due to human nature and are sometimes incorrectly included in the decision-making process. For example, suppose you have an old car, a hand-me-down from your grandmother, and last year you spent $1,600 on repairs and new tires and were just told by your mechanic that the car needs $1,200 in repairs to operate safely. Your goal is to have a safe and reliable car. Your alternatives are to get the repairs completed or trade in the car for a newer used car.

From a quantitative perspective, you have gathered the following information to help with your decision. The trade-in value of your old car will be the minimum given by the dealer, or $200. The newer used car will require you to make monthly payments of $150 for two years. In analysing your two alternatives, what costs do you consider? Remember, the $1,600 you have already spent (note the past tense) is a sunk cost; it is a consequence of a past decision. In this example, the relevant costs for each alternative are the following: $1,200 in current repair costs to keep your current car or $3,400 (from the 24 payments of $150 minus $200 for the trade in) to buy a newer used car. Obviously, you also would consider qualitative factors, such as the sentimental value of your grandmother’s car, the excitement of having a newer car or the need for the reliability of a newer car.

Sunk costs are most problematic for business decisions when they pertain to existing equipment. The value of an asset in the accounting records is a sunk cost regardless of whether a business keeps the asset or disposes of it in some manner. The cost of the asset occurred in the past and therefore is sunk and irrelevant to the decision at hand. Mangers may be reluctant to ignore sunk costs when making decisions, especially if the prior decision to purchase the asset was an unwise one. Often, when management takes a path of action that is not achieving the desired results, managers may continue the same path in the hope that the effect of prior decisions will improve the results. The use of the word prior is a key indicator that information is nonrelevant to a current decision. Holding on to old decisions or old commitments is common because letting them go forces management to admit they made a bad decision.

Future costs that do not differ (irrelevant costs)

Any future cost that does not differ between the alternatives is not a relevant cost for the decision. For example, if a company is considering baking either bagels or doughnuts and both baked goods require $0.30 worth of flour, then the cost of flour would not be a relevant cost in determining which of the two had the highest production cost. As relevant information for short-term decision-making, the cost of sound protectors for your summer job would not be relevant to your decision because that cost exists in both scenarios. Another irrelevant cost would be your transportation cost, since that cost is also the same regardless of the job you choose. In another example, if a company is planning to produce either red widgets or blue wingdings and will need to hire 10 additional employees to produce either of the goods, the cost of those 10 employees is irrelevant because it does not differ between the alternatives.

Example: Johnson & Johnson’s 1982 Recall and Replacement of All Tylenol in the World

In 1982, Johnson & Johnson was faced with a large-scale business and ethical dilemma. During the course of several days beginning on September 29, 1982, seven deaths occurred in the Chicago area that were attributed to consuming capsules of Extra-Strength Tylenol. The painkiller was, at the time, Johnson & Johnson’s best-selling product. The company had to decide if the short-term cost of replacing the Tylenol was worth the future cost to their reputation and their customer’s health and safety. At tremendous expense, Johnson & Johnson “placed consumers first by recalling 31 million bottles of Tylenol capsules from store shelves and offering replacement product in the safer tablet form free of charge.”1

As it was later discovered, someone was lacing Tylenol capsules with cyanide and returning the pills in the original packages to store shelves. However, Johnson & Johnson’s decision to incur short-term costs by recalling all of their pills ultimately paid off, as in the long run, the company’s stock value increased and Tylenol sales recovered. One could look at the decision as an opportunity cost: Johnson & Johnson had to choose between two alternatives. The company could have chosen a short-term solution with reduced short-term losses, but by making an ethical business decision, the long-term rewards were greater than the short-term savings.

Opportunity costs

When choosing between two alternatives, usually only one of the two choices can be selected. When this is the case, you may be faced with opportunity costs, which are the costs associated with not choosing the other alternative. For example, if you are trying to choose between going to work immediately after completing your undergraduate degree or going on to study a masters program, you will have an opportunity cost. If you choose to go to work immediately, your opportunity cost is forgoing a masters degree and any potential job limitations or advancements that result from that decision. If you choose instead to go directly into a masters degree, your opportunity cost is the income that you could have been earning by going to work immediately upon graduation and employment experience that might be helpful in obtaining your next role.

Example: Costs and revenue at Sydney Sweets

Sydney Sweets is a lolly and candy manufacturer in a resort town, just bought a new candy machine for $27,000 and is planning to increase the production of their signature hard candy. Due to the increased production, Sydney Sweets is deciding between hiring two university students on a casual basis or one full-time employee. Each university student would work half days totalling 20 hours per week, and would earn $22 per hour. The full-time employee would work full days 40 hours per week and would earn $22 per hour plus the equivalent of $2 per hour in sick and annual leave. Each employee is given two t-shirts to wear as their uniform. The t-shirts cost Sydney Sweets $25 each. In addition, Sydney Sweets provides disposable hair coverings and plastic gloves for the employees. Each employee uses, on average, six sets of gloves per eight-hour shift or four sets per four-hour shift. One hair covering per shift per person is typical. The cost of the hair covering is $0.05 per covering and the cost of a pair of gloves is $0.02 per pair. Identify any relevant costs, relevant revenues, sunk costs, and opportunity costs that Carolina Clusters needs to consider in making the decision whether to hire two part-time employees or one full-time employee.

Solution

| Item | University student option (2 students) | Full time employee option | Relevant or not relevant? |

| New candy machine | $27000 | $27000 | Not relevant |

| Hourly rate | $22 | $22 | Not relevant |

| Hours worked per week | 20hrs x 2 = 40 hours | 40 hours | Not relevant |

| Sick and annual leave | $0 | $2 per hour x 40 hours = $80 | RELEVANT |

| Uniforms | 2 x $25 = $50 | 1 x $25 = $25 | RELEVANT |

| Gloves |

2 shifts per day, 4 sets of gloves, $0.02c per pair |

1 shift per day x 6 pairs of gloves, $0.02 per pair |

RELEVANT |

| Hair covering | 2 shifts x $0.05 = $0.10 | 1 shift x $0.05 = $0.05 | RELEVANT |

| Revenues | No information given – not relevant | ||

| TOTAL RELEVANT COSTS | Sick/annual leave + Uniforms + gloves + hair covering = $0 + $50 + $0.16 + $0.10 = $50.26 |

Sick/annual leave + Uniforms + gloves + hair covering = $80 + $25 + $0.12 + $0.05 = $105.17 |

Sunk costs: $27,000 for the candy machine – this does not change based on the employees

Opportunity costs: None

Test your understanding

Complete these multiple choice questions about the process of deciding between alternatives and relevant costing