Understanding the structure of budgets

Mitchell Franklin; Patty Graybeal; Dixon Cooper; and Amanda White

The structure of budgets

The master budget is exactly as the term describes – the budget that exists above all others. It will contain every source of revenue coming into the business and every cost the business will need to pay for.

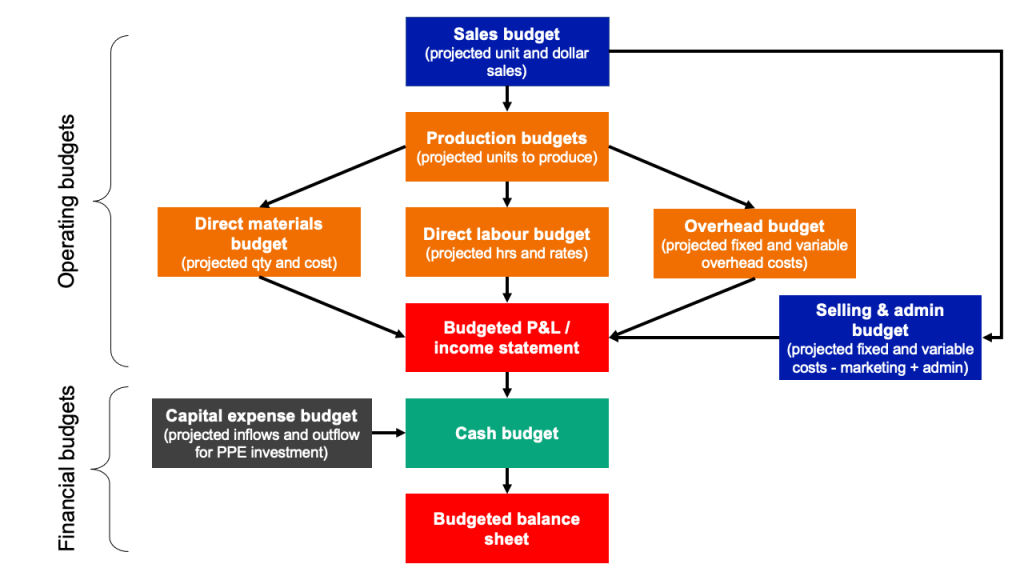

The master budget has two major categories: the financial budget and the operating budget. The financial budget plans the use of assets and liabilities and results in a projected balance sheet. The operating budget helps plan future revenue and expenses and results in a projected income statement. The operating budget has several subsidiary budgets that all begin with projected sales. For example, management estimates sales for the upcoming few years. It then breaks down estimated sales into quarters, months, and weeks and prepares the sales budget. The sales budget is the foundation for other operating budgets. Management uses the number of units from the sales budget and the company’s inventory policy to determine how many units need to be produced. This information in units and in dollars becomes the production budget.

The production budget is then broken up into budgets for materials, labour, and overhead. The materials are variable cost raw materials used to manufacture the item. Labour is the variable cost of people used to manufacture the item. Overhead is generally the fixed costs that support manufacturing – such as rent for the premises, costs to maintain machines, power to run machines. To create these budgets we use information such as the standard quantity and standard price for raw materials that need to be purchased, the standard direct labour rate and the standard direct labour hours that need to be scheduled, and the standard costs for all other direct and indirect operating expenses. Companies use the historic quantities of the amount of material per unit and the hours of direct labour per unit to compute a standard used to estimate the quantity of materials and labour hours needed for the expected level of production. Current costs are used to develop standard costs for the price of materials, the direct labour rate, as well as an estimate of overhead costs.

The figure below lays out how operating budgets and financial budgets are related within a master budget.

How are budgets developed?

The budget development process results in various budgets for various purposes, such as revenue, expenses, or units produced, but they all begin with a plan. To save time and eliminate unnecessary repetition, management often starts with the current year’s budget and adjusts it to meet future needs.

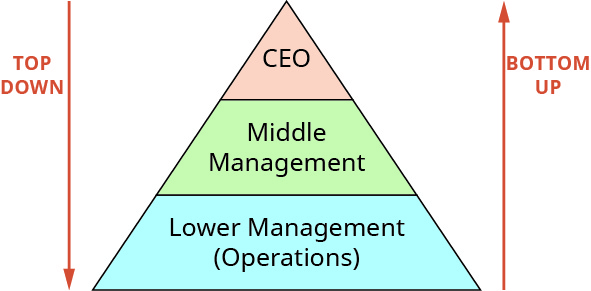

There are various strategies companies use in adjusting the budget amounts and planning for the future. For example, budgets can be derived from a top-down approach or from a bottom-up approach. (Figure) shows the general difference between the top-down approach and the bottom-up approach. The top-down approach typically begins with senior management. The goals, assumptions, and predicted revenue and expenses information are passed from the senior manager to middle managers, who further pass the information downward. Each department must then determine how it can allocate its expenses efficiently while still meeting the company goals. The benefit of this approach is that it ties in to the strategic plan and company goals. Another benefit of passing the amount of allowed expenses downward is that the final anticipated costs are reduced by the vetting (fact checking and information gathering) process.

In the top-down approach, management must devote attention to efficiently allocating resources to ensure that expenses are not padded to create budgetary slack. The drawback to this approach to budgeting is that the budget is prepared by individuals who are not familiar with specific operations and expenses to understand each department’s nuances.

The bottom-up approach (sometimes also named a self-imposed or participative budget) begins at the lowest level of the company. After senior management has communicated the expected departmental goals, the departments then plans and predicts their sales and estimates the amount of resources needed to reach these goals. This information is communicated to the supervisor, who then passes it on to upper levels of management. The advantages of this approach are that managers feel their work is valued and that knowledgeable individuals develop the budget with realistic numbers. Therefore, the budget is more likely to be attainable. The drawback is that managers may not fully understand or may misunderstand the strategic plan.

Other approaches in addition to the top-down and bottom-up approaches include:

- the combination approach – guidelines and targets are set at the top while the managers work to develop a budget within the targeted parameters.

- zero-based budgeting approach – budgeting begins with zero dollars and then adds to the budget only revenues and expenses that can be supported or justified. (For those wishing to learn more – check out Investopedia’s zero based budgeting page)

- rolling budget approach – budget is adjusted monthly, and a new month is added as each month passes.

The role of the master budget

Most organisations will create a master budget—whether that business is large or small, public or private, or a merchandising, manufacturing, or service company. A master budget is one that includes two areas, operational and financial, each of which has its own sub-budgets. The operating budget spans several areas that help plan and manage day-to-day business. The financial budget depicts the expectations for cash inflows and outflows, including cash payments for planned operations, the purchase or sale of assets, the payment or financing of loans, and changes in equity. Each of the sub-budgets is made up of separate but interrelated budgets, and the number and type of separate budgets will differ depending on the type and size of the business. For example, the sales budget predicts the sales expected for each quarter. The direct materials budget uses information from the sales budget to compute the number of units necessary for production. This information is used in other budgets, such as the direct materials budget, which plans when materials will be purchased, how much will be purchased, and how much that material should cost. We will demonstrate how to create each of these sub-budgets in later sections.

The role of operating budgets

An operating budget consists of the sales budget, production budget, direct material budget, direct labour budget, and overhead budget. These budgets serve to assist in planning and monitoring the day-to-day activities of the organisation by informing management of how many units need to be produced, how much material needs to be ordered, how many labour hours need to be scheduled, and the amount of overhead expected to be incurred. The individual pieces of the operating budget collectively lead to the creation of the budgeted income statement. For example, Big Bad Bikes estimates it will sell 1,000 trainers for $70 each in the first quarter and prepares a sales budget to show the sales by quarter. Management understands that it needs to have on hand the 1,000 trainers that it estimates will be sold. It also understands that additional inventory needs to be on hand in the event there are additional sales and to prepare for sales in the second quarter. This information is used to develop a production budget. Each trainer requires 3.2 kilograms of material that usually costs $1.25 per kilogram. Knowing how many units are to be produced and how much inventory needs to be on hand is used to develop a direct materials budget.

The direct materials budget lets managers know when and how much raw materials need to be ordered. The same is true for direct labour, as management knows how many units will be manufactured and how many hours of direct labour are needed. The necessary hours of direct labour and the estimated labour rate are used to develop the direct labour budget. While the materials and labour are determined from the production budget, only the variable overhead can be determined from the production budget. Existing information regarding fixed manufacturing costs are combined with variable manufacturing costs to determine the manufacturing overhead budget. The information from the sales budget is used to determine the sales and administrative budget. Finally, the sales, direct materials, direct labour, fixed manufacturing overhead budget, and sales and administrative budgets are used to develop a pro-forma income statement.

The role of financial budgets

A financial budget consists of the cash budget, the budgeted balance sheet, and the budget for capital expenses. Similar to the individual budgets that make up the operating budgets, the financial budgets serve to assist with planning and monitoring the financing / cash requirements of the business. High profits may not always mean high levels of cash in the business’s bank accounts. Management must plan carefully how much cash is anticipated to come in from sales and customers each month, and what cash may be paid out. If a business is unable to pay their bills when they are due – they may be trading while insolvent, which is illegal in Australia.

The business may also need to consider its plans for property plant and equipment (often called “capital assets” or “capital expenditure”, sometimes shortened to “capex”). It may take time to save cash to spend on capex, or the business may need to apply for loan. The cash budget will also assist management in helping them determine whether they will have sufficient cash to repay such loans.

A business might also want to keep a minimum level of cash in case of emergencies.

Key concepts and summary

- A good budgeting system assists management in reaching their goals through the planning and control of cash inflows through revenue and financing and outflows through payment and expenses.

- There are various budgeting strategies including bottom-up, top-down, and zero-based budgeting.

- A static budget is prepared at one level of activity, while a flexible budget allows the variable expenses to be adjusted for various levels of activity.

- A master budget includes the subcategories of operating budgets and financial budgets.

- A master budget is developed at the estimated level of activity.