Make or buy a component

Mitchell Franklin; Patty Graybeal; Dixon Cooper; and Amanda White

Do it ourselves or outsource?

One of the most common outsourcing scenarios is one in which a company must decide whether it is going to make a component that it needs in manufacturing a product or buy that component already made. For example, all of the components of the iPhone are made by companies other than Apple.

Toyota purchases some components from other manufacturers and makes other parts themselves. Samsung Electronics provides many of the components for in-car infotainment systems (the screen that controls your maps, music etc). Other companies provide vehicle exhaust systems, bearings, seals and gaskets. Toyota also manufactures some parts themselves including all engines. So how does Toyota decide whether to make a component themselves or buy? They must evaluate both quantitative and qualitative data to make such a decision.

This type of analysis is also relevant to the service industry; for example, TOA Global is an Australian firm that offers outsourcing for the accounting industry – providing services including accounting, bookkeeping, taxation for accounting firms across Australasia. A law firm may decide to hire certain research activities to be completed by outside experts rather than hire the necessary staff to keep that function in-house. These are all examples of outsourcing. Outsourcing is the act of using another company to provide goods or services that your company requires.

Many companies outsource some of their work, but why? Consider this scenario: Today, while driving home from class, one of my car’s engine warning lights goes on. I will most likely take my car to a local car repair chain (eg Ultra Tune) to have it analysed and repaired. However, my dad (who trained as a mechanic at TAFE and worked in car servicing at Peter Warren Motors in Western Sydney for over a decade) will likely pop the hood, diagnose the problem by combining his own experience and YouTube, and then fix the problem himself. Why? It is often a matter of expertise and sometimes simply a matter of cost benefit.

In my dad’s time, car engines were more mechanical and less electronic, which made learning to repair cars a simpler process that required less expertise and only basic tools. Today, cars have many electronic components and often requires sophisticated monitors to assess the problem and may involve the replacement of computer chips or electronic sensors. Thus, I opt to outsource the repair of my car to someone who has the knowledge and facilities to provide the repair more cost effectively than I could if you did it myself. My dad likely could have made the repair to his car a few decades ago as cheaply as the mechanic with only a sacrifice of his time.

Companies outsource for the same reasons. Many companies have found that it is more cost effective to outsource certain activities, such as payroll, data storage, and web design and hosting. It is more efficient to pay an outside expert than to hire the appropriate staff to keep a particular task inside the company. In some instances, even accounting is outsourced – with many small businesses using sophisticated accounting software like Xero or MYOB, adding or connecting a range of apps for processes like sales or inventory management – and then rather than having an accountant hired within the business – outsource to one who checks in on them once a week, fortnight or month.

Fundamentals of the decision to make or to buy

As with other decisions, the make-versus-buy decision involves both quantitative and qualitative analysis. The quantitative component requires cost analysis to determine which alternative is more cost effective. This cost analysis can be performed by looking at the cost to buy the component versus the cost to produce the component, which allows us to make a decision based on an analysis of unavoidable costs. For example, the costs to produce will include direct materials, direct labor, variable overhead, and fixed overhead. If the business chooses to buy the component instead, the avoidable costs will go away but unavoidable costs (remember these from earlier in the chapter?) will remain and would need to be considered as part of the cost to buy the component.

Make or buy example – Thermal Mugs Inc

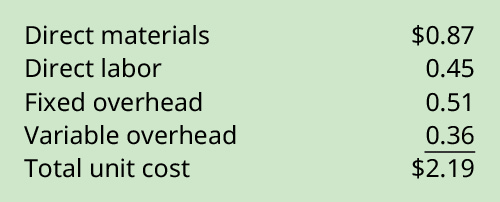

Thermal Mugs, Inc., manufactures various types of leak-proof personal drink carriers. Thermal’s T6 container, its most insulated carrier, maintains the temperature of the liquid inside for 6 hours. Thermal has designed a new lid for the T6 carrier that allows for easier drinking and pouring. The cost to produce the new lid is $2.19:

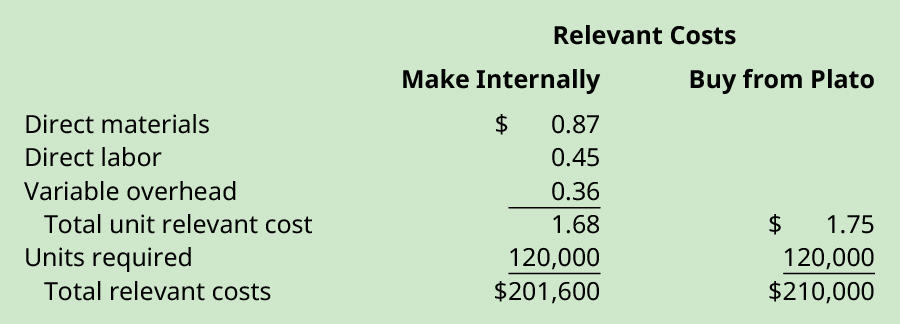

Plato Plastics has approached Thermal and offered to produce the 120,000 lids Thermal will require for current production levels of the T6 carrier, at a unit price of $1.75 each. Is this a good deal? Should Thermal buy the lids from Plato rather than produce them themselves? Initially, the $1.75 presented by Plato seems like a much better price than the $2.19 that it would cost Thermal to produce the lids. However, more information about the relevant costs is necessary to determine whether the offer by Plato is the better offer. Remember that all the variable costs of producing the lid will only exist if the lid is produced by Thermal, thus the variable costs (direct materials, direct labor, and variable overhead) are all relevant costs that will differ between the alternatives.

What about the fixed costs? Assume all the fixed costs are not tied directly to the production of the lid and therefore will still exist even if the lid is purchased externally from Plato. This means the fixed costs of $0.51 per unit are unavoidable and therefore are not relevant.

Calculations using sample data

Calculations show that when the relevant costs are compared between the two alternatives, it is more cost effective for Thermal to produce the 120,000 units of the T6 lid internally than to purchase it from Plato.

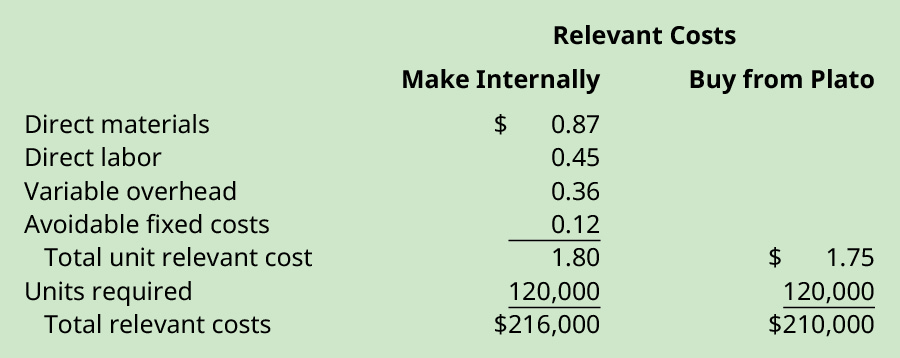

By producing the T6 lid internally, Thermal can save $8,400 ($210,000 − $201,600). How would the analysis change if a portion of the fixed costs were avoidable? Suppose that, of the $0.51 in fixed costs per unit of the T6 lid, $0.12 of those fixed costs are associated with interest costs and insurance expenses and thus would be avoidable if the T6 lid is purchased externally rather than produced internally. How does that change the analysis?

In this scenario, it is more cost effective for Thermal to buy the T6 lid from Plato, as Thermal would save $6,000 ($216,000 − $210,000).

Final analysis of the decision

The difference in these two presentations of the data emphasises the importance of defining which costs are relevant, as improper cost identification can lead to bad decisions.

These analyses only considered the quantitative factors in a make-versus-buy decision, but there are qualitative factors to consider as well, including:

- Will the T6 lid made by Plato meet the quality requirements of Thermal?

- Will Plato continue to produce the T6 lid at the $1.75 price, or is this a teaser rate to obtain the business, with the plan for the rate to go up in the future?

- Can Plato continue to produce the quantity of the lids desired? If more or fewer are needed from Plato, is the adjusted production level obtainable, and does it affect the cost?

- Does using Plato to produce the lids displace Thermal workers or hamper morale?

- Does using Plato to produce the lids affect the reputation of Thermal?

In addition, if the decision is to buy the lid, Thermal is dependent on Plato for quality, timely delivery, and cost control. If Plato fails to deliver the lids on time, this can negatively affect Thermal’s production and sales. If the lids are of poor quality, returns, replacements, and the damage to Thermal’s reputation can be significant. Without long-term agreements on price increases, Plato can increase the price they charge Thermal, thus making the entire drink container more expensive and less profitable. However, buying the lid likely means that Thermal has excess production capacity that can now be applied to making other products. If Thermal chooses to make the lid, this consumes some of the productive capacity and may affect the relationship Thermal has with the outside supplier if that supplier is already working with Thermal on other products.

Make versus buy, one of many outsourcing decisions, should involve assessing all relevant costs in conjunction with the qualitative issues that affect the decision or arise because of the choice. Although it may appear that these types of outsourcing decisions are difficult to resolve, companies throughout the world make these decisions daily as part of the company’s strategic plan, and therefore, each company must weigh the advantages and disadvantages of outsourcing production of goods and services. Some examples are shown in the table below.

| Advantages and Disadvantages of Outsourcing | |

|---|---|

| Advantages of Outsourcing | Disadvantages of Outsourcing |

|

|

1. When you are outsourcing, you will need to specify amounts of components or parts well ahead of time. If you wish to change your production schedule at the last minute, increasing the number of units, you may not be able to source an increased quantity of components from your supplier. If you were wanting to decrease production suddenly, you may also be required to purchase the quantity in your contract with the supplier – even if it is not all needed at that time.

In an outsourcing decision, the relevant costs and qualitative issues should be analysed thoroughly. If there are no qualitative issues that affect the decision and the leasing or purchasing price is less than the relevant (avoidable) costs of producing the good or service in house, the company should outsource the product or service. The following example demonstrates this issue for a service entity.

Toyota makes some components in- house – the ones that require the highest levels of precision and contribute greatly to product longevity. Quantitatively – they may be able to get them made cheaper elsewhere, but qualitatively – the business believes it is important to have more control over certain components that go into their motor vehicles.

However, rhe iPhone is the ultimate example of outsourcing. Though created in the United States, it is produced all around the globe, with thousands of parts supplied by over 200 suppliers – none of which is Apple. Read this article from The New York Times on where parts for the iPhone are made to learn how an iPhone gets from the design phase in the United States to production of components around the world, to assembly in China, and then back to the United States for sale in a retail store.

Key concepts and summary

- Deciding to outsource a component of the operations or manufacturing of a business is a choice between alternatives.

- Choosing whether to make or to buy a product, or choosing to have services performed by an outside company, are outsourcing decisions.

- Outsourcing decisions involve comparing the cost to keep the product or service in-house to the cost of buying the product or service from an outside party.

- An important consideration in these types of decisions is unavoidable costs.

Test your understanding

Ensure that you understand the basic theory related to the make or buy decision by attempting these multiple choice questions.