Keep or discontinue a segment/division or product/service

Mitchell Franklin; Patty Graybeal; Dixon Cooper; and Amanda White

The use of segments to organise a business

Companies tend to divide their organisation along product lines, geographic locations, or other management needs for decision-making and reporting. A segment is a portion of the business that management believes has sufficient similarities in product lines, geographic locations, or customers to warrant reporting that portion of the company as a distinct part of the entire company. For example, General Electric, Inc., has eight segments and the Walt Disney Company has four segments. The table below shows these segments.

| Examples of Company Segments | |

|---|---|

| General Electric Segments | Disney Segments |

|

|

As part of the normal operations of a business, managers make decisions such as whether to keep producing a product, whether to continue operating in certain areas, or whether to close entire segments of their operations. These are historically some of the most difficult decisions that managers make. Examples of these types of decisions include Macy’s decision to close 100 stores in 2016 due to increased competition from online retailers such as Amazon.com2 and Delta Airline’s decision to eliminate 16 routes to save costs.3 What information does management use in making these types of decisions?

As with other decisions, management must consider both the quantitative and qualitative aspects. In choosing between alternatives—that is, in choosing between keeping and eliminating the product, segment, or service – the relevant revenues and costs should be analysed. Remember that relevant revenues and costs are those that differ between alternatives. Often, the keep-versus-eliminate decision arises because the product or segment appears to be generating less of a profit than in prior periods or is unprofitable. In these situations, the product or segment may produce a positive contribution margin but may appear to have a lower or negative profit because of the allocation of common fixed costs.

Fundamentals of the decision to keep or discontinue a segment or product/service

Two basic approaches can be used to analyse data in this type of decision.

- Compare contribution margin and fixed costs

- Compare total net income if the segment/product/service is retained vs dropped.

Approach 1 – contribution margin and fixed costs

One approach is to compare contribution margins and fixed costs. In this method, the contribution margins with and without the segment (or division or product line) are determined. The two contribution margins are compared and the alternative with the greatest contribution margin would be the chosen alternative because it provides the biggest contribution toward meeting fixed costs.

Approach 2 – net income comparisons

The second approach involves calculating the total net income for retaining the segment and comparing it to the total net income for dropping the segment. The company would then proceed with the alternative that has the highest net income. In order to perform these net income calculations, the company would need more information than they would need in order to follow the contribution margin approach, which does not consider the costs and revenues that are the same between the alternatives.

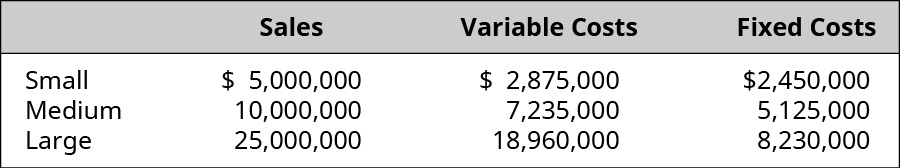

Acme, Co., has three retail divisions: Small, Medium, and Large. Sales, variable costs, and fixed costs for each of the divisions are:

Included in the fixed costs are $5,400,000 in allocated common costs, which are split evenly among the three divisions. Is an even split the best way to allocate those costs? Why or why not? What other ways might Acme consider using to allocate the common fixed costs? Other options could be based on volume of use of these common costs.

Example – SnowBucks

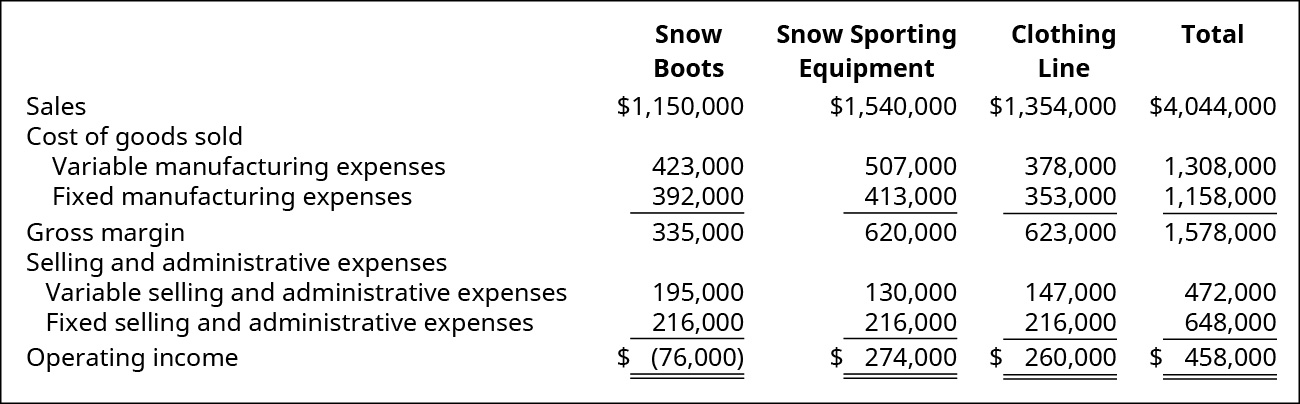

Suppose SnowBucks, Inc., has three product lines: snow boots, snow sporting equipment, and a clothing line for winter sports. It has been brought to senior management’s attention that the snow boot product line is unprofitable. The table below shows the data presented to senior management:

Upon initial review, it appears that the snow boot product line is unprofitable. Should this product line be eliminated? To adequately analyse this situation, a proper analysis of the relevant revenues and costs must be made. The income statement above does not separate relevant from non-relevant (also called irrelevant) costs.

In conducting the analysis, the accounting team discovers that each product line is allocated certain costs over which the product line managers have no control. These allocated costs are typically associated with areas of the company that do not generate revenue but are necessary for the running of the business, such as salaries for executives, human resources, and accounting at headquarters.

The cost of these parts of the business must somehow be shared with the revenue-generating portions of the business. Companies often allocate these costs to other parts of the business based on some formula, such as dividing the total costs by the number of divisions or segments, as percentage of total revenue, or as percentage of total square footage.

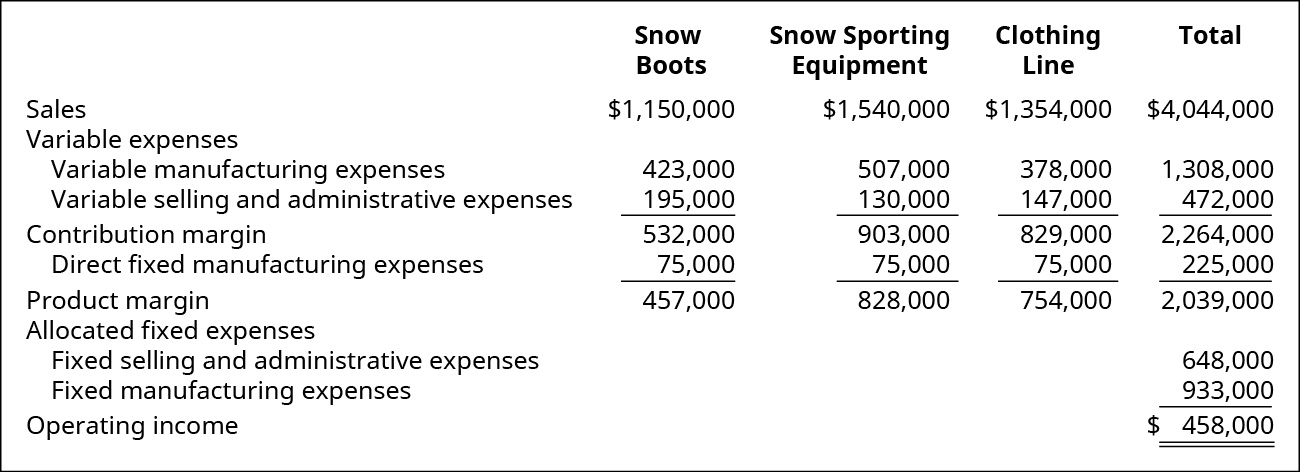

SnowBucks currently allocates these costs equally to the three product lines, and all the fixed selling and administrative expenses are considered allocated costs. In addition, the fixed manufacturing expenses represent factory rent, depreciation, and insurance, and all these costs will continue to exist regardless of whether the snow boot division continues. However, included in the fixed manufacturing expenses is the $75,000 salary of a sales supervisor for each division. This is an avoidable fixed cost as this cost would no longer exist if any division ceased operating.

SnowBucks worked example – using the contribution margin method

Based on the new information, a new analysis using a product line margin indicates the following:

Final analysis of the decision

This new analysis shows that when the relevant costs and revenues are considered, it is apparent the snow boot product line is contributing toward meeting the fixed costs of the business and therefore to overall corporate profitability. The reason the snow boot product line was showing an operating loss was due to the allocation of common costs. Consideration should be given to the way allocated costs are assigned to the various products to determine if the allocation is logical or if another allocation method, such as one based on each product line’s percentage of the total corporate sales, would provide a better matching of costs and services provided by corporate headquarters. Management should also consider qualitative factors, such as the impact of removing one product line on the overall sales of the other products. If customers commonly buy snow boots and skis together, then discontinuing the snow boot line could impact the sales of snow skis.