Describe how and why managers use budgets

Mitchell Franklin; Patty Graybeal; Dixon Cooper; and Amanda White

Why do managers need budgets?

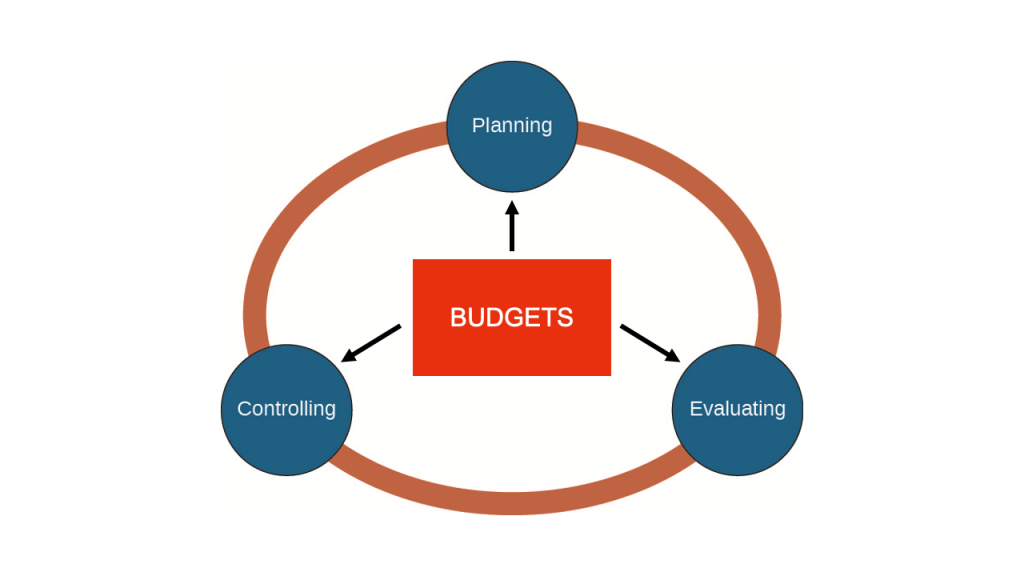

Implementation of a business’s strategic plan often begins by determining management’s basic expectations about future economic, competitive, and technological conditions, and their effects on anticipated goals, both long-term and short-term. As detailed in Chapter 7, planning involves developing future objectives, whereas controlling involves monitoring the planning objectives that have been put into place. Budgets play a role in planning, controlling and evaluating.

The business will develop strategies and plans to help them achieve these goals. Budgeting helps businesses consider the costs of their strategies and plans (over both the short and longer term). A good budgeting system will help a company reach its strategic goals by allowing management to plan and to control major categories of activity, such as revenue, expenses, and predicting and managing the cash required for these activities.

There are many advantages to budgeting, including:

- Communication

- Budgeting is a formal method to communicate a business’s plans to its internal stakeholders, such as executives, department managers, and others who have an interest in—or responsibility for—monitoring the business’s performance.

- Budgeting requires managers to plan for both revenues and expenses.

- Planning

- Preparing a budget requires managers to consider and evaluate

- The assumptions used to prepare the budget.

- Long-term financial goals.

- Short-term financial goals.

- The business’s position in the market.

- How each department supports the strategic plan.

- Preparing a budget requires departments to work together to

- Determine realisable sales goals.

- Compute the manufacturing or other requirements necessary to meet the sales goals.

- Solve bottlenecks that are predicted by the budget.

- Allocate resources so they can be used effectively to meet the sales and manufacturing goals.

- Compare forecasted or flexible budgets with actual results.

- Preparing a budget requires managers to consider and evaluate

- Evaluation

- When compared to actual results, budgets are early alerts and they forecast:

- Cash flows for various levels of production.

- When loans may be required or when loans may be reduced.

- Budgets show which areas, departments, units, and so forth, are profitable or meet their appropriate goals. Similarly, they also show which components are unprofitable or do not reach their anticipated goals.

- Budgets set defined benchmarks that may be used for evaluating business and management performance, including raises and bonuses, as well as negative consequences, such as firing.

- When compared to actual results, budgets are early alerts and they forecast:

As with every set of advantages, there are also disadvantages

- Budgets can be inflexible

- They are based on assumptions which may not turn out to be correct

- They can take a long time to create – especially in large organisations where each department must prepare a budget

To understand the benefits of budgeting, consider Big Bad Bikes, a company that manufactures high-end mountain bikes. The company will begin producing and selling bike trainers this year. Trainers are stands that allow a rider to ride their bike indoors similar to the way bikes are used in spinning classes. Big Bad Bikes has a 5-year plan and has always been successful in managing its budget. Managers participate in developing the budget and are aware that all expenses must be related to the company’s strategic plan. They know that managing their departments is much easier when the budget is developed to support the strategic plan.

The plan for Big Bad Bikes is to introduce itself to the trainer market with a sales price of $70 for the first two quarters of the year and then raise the price to $75 per unit. The marketing department estimates that sales will be 1,000 units for the first two quarters, 1,500 for the third quarter, and 2,500 per quarter through the second year. Management will work with each department to communicate goals and build a budget based on the sales plan. The resulting budget can be evaluated by all departments involved.

Budgets have the potential to impact employee behaviour

In the long run, proper budget reporting assists management in making good decisions. Management uses budgets to evaluate the performance of employees and their department. They can also use budgets to evaluate and benchmark the performance of a business unit in a large business or of the entire performance of a small entity. They can also use budgets to evaluate separate projects. In budgeting situations, employees may feel a tension between reporting actual results and reporting results that reach the predetermined goals created by the budget. This creates a situation where managers may choose to act unethically and pressure accountants to report favorable financial results not supported by the operations.

Accountants need to be aware of this circumstance and use ethical standards when assisting the development and creation of budgets. After a proper budget has been created, the reporting of the actual results will assist in creating a realistic and honest picture of the actual operations for the managers reviewing the budget. The budget accountant needs to take steps to ensure that employees are not trying to misreport the budget results; for example, managers might be tempted to set artificially low standards to ensure that targets are hit and significantly exceeded. Such results could lead to what might be considered as excessive bonuses paid to managers.

The basics of budgeting

All businesses – large and small – have limits on the amount of money or resources they can receive and pay out. How these resources are used to reach their goals and objectives must be planned. The quantitative plan estimating when and how much cash or other resources will be received and when and how the cash or other resources will be used is the budget. As you’ve learned, some of the benefits of budgeting include improved communication, planning, coordination, and evaluation.

All budgets are quantitative plans for the future and will be constructed based on the needs of the business for which the budget is being created. Depending on the complexity, some budgets can take months or even years to develop. The most common time period covered by a budget is one year, although the time period may vary from strategic, long-term budgets to very detailed, short-term budgets. Generally, the closer the business is to the start of the budget’s time period, the more detailed the budget becomes.

Management begins with a vision of the future. The long-term vision sets the direction of the company. The vision develops into goals and strategies that are built into the budget and are directly or indirectly reflected on the master budget.

Test your understanding

Try these questions about the theory behind using budgets