Recording transactions related to shareholders

Amanda White

How to record transactions related to shareholders

Investors would not invest their money into businesses without some form of reward or return. That return could be in the form of capital growth – the underlying value of the company grows, and so the value of the shares the shareholder owns increases. They can unlock this value when they sell their shares and convert them to cash.

Another form of reward is the payment of dividends to shareholders. This can happen at any time, but is usually announced after a business releases its end of year financial statements. Dividends can paid with cash, or with more shares in the company.

In this section we will examine a number of different shareholder-related transaction flows including:

- Issuing shares (simplified)

- Paying dividends to shareholders using cash

- Paying dividends to shareholders using shares

1. Issuing shares (simplified)

Issuing shares is a way that a business can receive an influx of cash (the other method is a bank loan which we covered earlier). The benefit of issuing shares over a bank loan is that no repayments are necessary and interest is not charged. However, shareholders do expect that the business will increase in value and if profits are made, that they should be rewarded for their investment through dividends.

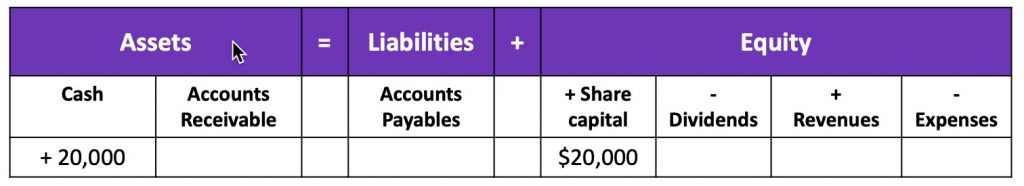

If a business issues 20,000 shares at $1 each, they should receive $20,000 from investors. The transaction would be recorded as follows:

2. Paying dividends using cash

There is a complex process where businesses “declare” a dividend (creating a payable / liability) and then a few weeks later, make a cash payment to shareholders. In this textbook, we will be using a simplified process where dividends are simply paid without the “declaration” component.

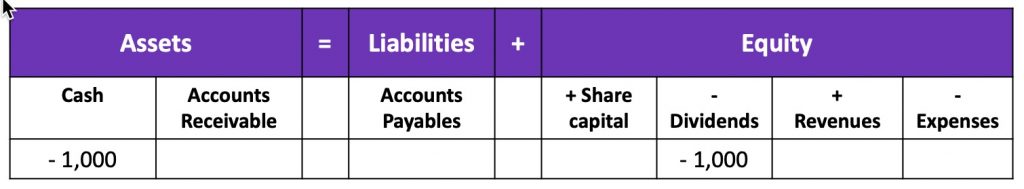

Dividends are paid per share, not per shareholders. Continuing our prior example, with 20,000 shares issued, if a business pays a dividend of $0.05 per share, the transaction to pay $1,000 in dividends would be recorded as follows:

There is a cash outflow of $1,000 and an increase in the dividend expense of $1,000. The equation balances because both sides are -$1,000.

3. Paying dividends using shares

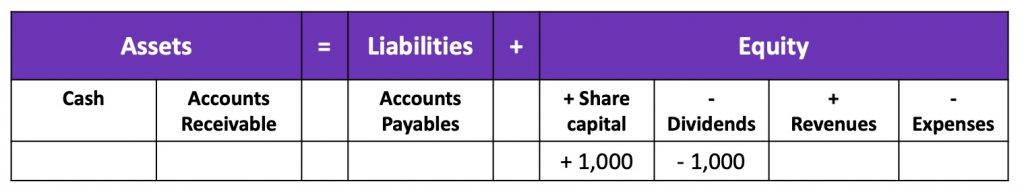

If a company wishes to reward shareholders but not spend its cash, the other way to pay for a dividend is with more shares. Thinking back to our company with 20,000 shares and dividend of $0.05 per share, worth $1000 in cash. If we wish to pay using shares, the transaction would be recorded as follows:

Notice that there is no cash movement on the left hand side, however we are increasing our share capital and increasing our dividend expense. The equation balances because the equity transactions add up to $0, which matches the assets side which has had $0 movement.

What happens when a shareholder sells their shares?

Absolutely nothing is recorded in the accounting systems when a shareholder sells their shares to someone else. Yes, in the system that contains shareholder details (called a Share Registry), changes are made – but the shares are still recorded at the same $1 because of the historical cost principle, even if the person selling the shares sold them for $10 each! That $9 profit they made is owed to the individual and does not go to the business.