Recording bank loans and long term borrowings

Amanda White

How to record transactions related to long term loans process

To start a business, the owners may already have cash or assets to contribute (and become Equity). Sometimes a business may require more cash than they can currently generate. The business may wish to buy a new manufacturing machine to allow them to increase the inventory they can create and then sell. Or to open a new sales office in another state or country, to again, help them generate more sales. A bank loan is one way to obtain the funds to achieve these objectives (another is to slowly save the cash a business has left over after paying suppliers over time and then purchase or spend what is required, but a bank loan gets businesses the funds faster!).

Associated with having a loan from a bank or other non-bank lender is the requirement to may repayments on that loan. Accounting for long term loans (which are classified as non-current liabilities) can be complicated – but in this introductory textbook, we will take a more simplified approach.

In this section we will examine a number of different loan-related transaction flows including:

- Receiving the funds from a bank loan

- Making loan repayments

- Making interest-only repayments

- Repaying an interest-only loan at the end of the loan term

In reality, loan repayments are often made up of interest and principal (reducing the amount owed to the lender) and require more complicated accounting and the use of something called adjusting entries. That is beyond the scope of introductory accounting, however if you do become an accountant, these accounting transactions are relatively easy to learn.

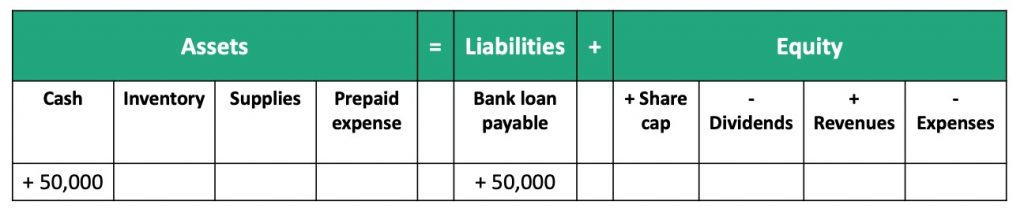

1. Receiving the funds from a bank loan

The process of applying for a bank loan and all of the administrative work that goes with it is not recorded in our accounting records. This is because there is no FLOW of resources within or into or out of the business. The first point at which we will record a transaction is when the funds for the loan are deposited in our bank account. If a business borrows $50,000 from the bank, the transaction would be recorded as follows:

The transaction balances because there is an increase of $50,000 on both sides of the equation.

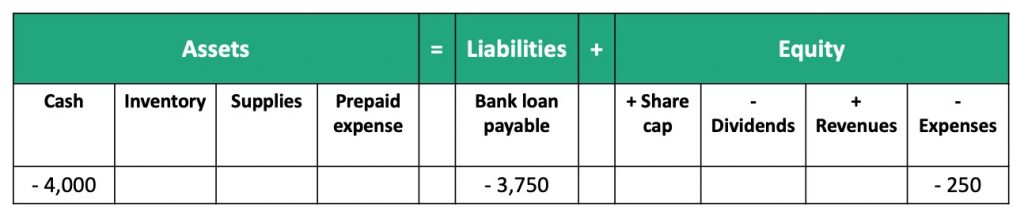

2. Making loan repayments

The contract between the business and the bank will set the conditions of the loan – the total length of the loan (often called the term, such as 5 years), how often repayments are made and how much the minimum repayment should be each period. The most common period of time is monthly repayments. If the business is required to make repayments of $4,000 per month on the loan of $50,000. However, it isn’t as simple as paying creditors (decrease cash, decrease accounts payable) because technically, the repayments a business makes will often be repaying both loan principal and interest.

In real life, accounting for interest and splitting a payment into interest and principal can be quite complicated. However, in this introductory text – we will simplify this process and assume that the interest is given to you each time.

For our example of a $4,000 repayment, assume $250 is interest and the remainder comes off the balance of the loan. The transaction would be recorded as follows:

Even though the right-hand side of the equation has two entries and the left-hand side only one, the transaction balances because the bank loan and interest expense transactions add up to -$4000 which matches the asset side of the transaction.

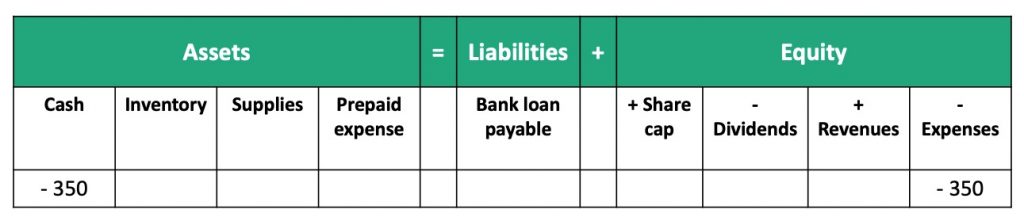

3. Making interest-only repayments

There are some bank loans where the business will make repayments that are interest-only. This means at the end of the term (or life) of the loan, the entire original sum borrowed must be repaid. Each month, if a business had a $20,000 interest- only loan for a term of 4 years and was required to make interest-only payments of $350 per month, the transaction would be recorded as follows:

The transaction balances because there is a negative on both sides of $350. Remember that increases in expenses are negative transactions.

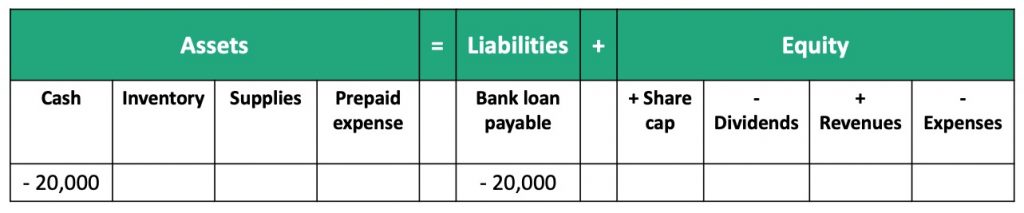

4. Repaying an interest only loan at the end of the loan term

In the prior example, at the end of the loan term (after 4 years), the business would need to repay the entire loan, the transaction would be recorded as follows:

The transaction balances because there is a negative $20,000 on both sides of the transaction.