Accept or reject a special order

Mitchell Franklin; Patty Graybeal; Dixon Cooper; and Amanda White

Framework for evaluating whether to accept special orders

Both manufacturing and service companies often receive requests to fill special orders. These special orders are typically for goods or services at a reduced price and are usually a one-time order that, in the short-run, does not affect normal sales. When deciding whether to accept a special order, management must consider several factors:

- The capacity required to fulfill the special order

- Whether the price offered by the buyer will cover the cost of producing the products

- The role of fixed costs in the analysis

- Qualitative factors

1. Do we have capacity to fulfil the special order?

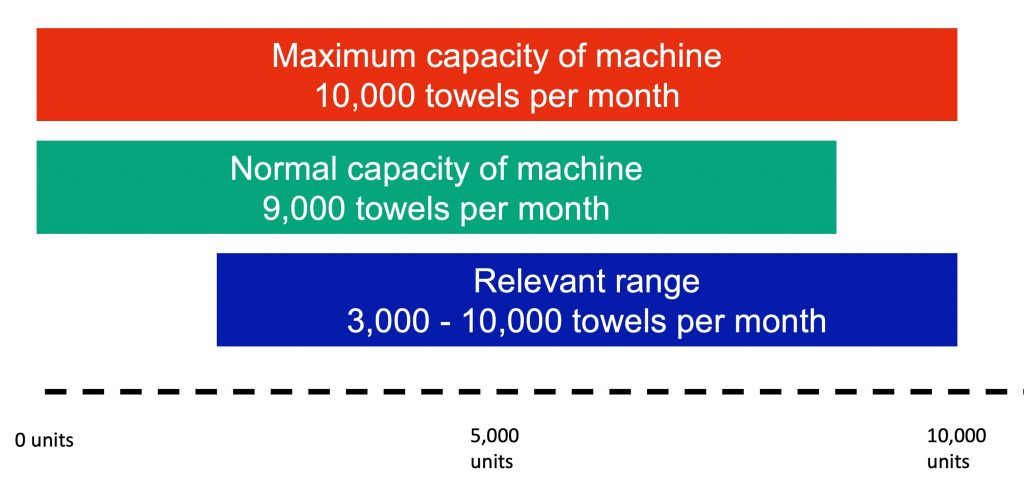

The starting point for making this decision is to assess the company’s normal production capacity. The normal capacity is the production level a company can achieve without adding additional production resources, such as additional equipment or labour. For example, if the company can produce 10,000 towels a month based on its current production capacity, and it is currently contracted to produce 9,000 a month, it could not take on a special one-time order for 3,000 towels without adding additional equipment or workers. Most companies do not work at maximum capacity; rather, they function at normal capacity, which is a concept related to a company’s relevant range. The relevant range is the quantitative range of units that can be produced based on the company’s current productive assets. These assets can include equipment capacity or its labor capacity. The diagram below demonstrates the difference between the maximum capacity, normal capacity and relevant range. Labour capacity is typically easier to increase on a short-term basis than equipment capacity. The recent example assumes that labour capacity is available, so only equipment capacity is considered. In the example below, there is a minimum which the machine must produce each month.

Example – capacity and range

Assume that based on a company’s present equipment, it can produce 20,000 units a month. Its relevant range of production would be zero to 20,000 units a month. As long as the units of production fall within this range, it does not need additional equipment. However, if it wanted to increase production from 20,000 units to 24,000 units, it would need to buy or lease additional equipment. If production is fewer than 20,000 units, the company would have unused capacity that could be used to produce additional units for its current customers or for new clients.

If the company does not have the capacity to produce a special order, it will have to reduce production of another good or service in order to fulfill the special order or provide another means of producing the goods, such as hiring temporary workers, running an additional shift, or securing additional equipment. As you will learn, not having the capacity to fill the special order will create a different analysis than it would if there is sufficient capacity.

2. Will the price asked by the buyer cover costs?

Next, management must determine if the price offered by the buyer will result in enough revenue to cover the differential costs of producing the items. For example, if price does not meet the variable costs of production, then accepting the special order would be an unprofitable decision.

3. Are there any implications for fixed costs?

Additionally, fixed costs may be relevant if the company is already operating at capacity, as there may be additional fixed costs, such as the need to run an extra shift, hire an additional supervisor, or buy or lease additional equipment. If the company is not operating at capacity—in other words, the company has unused capacity—then the fixed costs are irrelevant to the decision if the special order can be met with this unused capacity.

4. What qualitative issues might arise?

Several issues might arise. A logical issue is the concern for how existing customers will feel if they discover a lower price was offered to the special-order customer. For example, you normally sell an item to a regular customer for $25 each. Then the customer discovers one of their competitors put in a special order and received a price of $20.

A special order that might be profitable could be rejected if the company determined that accepting the special order could damage relations with current customers. The viral nature of complaints on social media platforms like TikTok, Instagram and Facebook means that the repetitional effect could be wide spread.

If the goods in the special order are modified so that they are cheaper to manufacture, current customers may prefer the modified, cheaper version of the product. Would this hurt the profitability of the company? What does this mean for longer term product development? Would it affect the reputation?

In addition to these considerations, sometimes companies will take on a special order that will not cover costs based on qualitative assessments. For example, the business requesting the special order might be a potential client with whom the manufacturer has been trying to establish a business relationship and the producer is willing to take a one-time loss. However, our coverage of special orders concentrates on decisions based on quantitative factors.

Example – Franco Pty Ltd

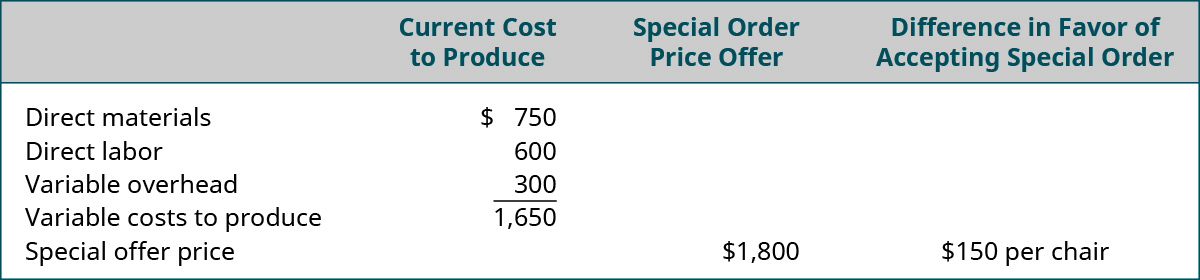

Franco Pty Ltd, produces dental office examination chairs. Franco has the capacity to produce 5,000 chairs per year and currently is producing 4,000. Each chair retails for $2,800, and the costs to produce a single chair consist of direct materials of $750, direct labour of $600, and variable overhead of $300. Fixed overhead costs of $1,350,000 are met by selling the first 3,000 chairs. Franco has received a special order from Ghanem, Inc., to buy 800 chairs for $1,800. Should Franco accept the special order?

Calculations Using Sample Data

Franco is not operating at capacity and the special order does not take them over capacity. Additionally, all the fixed costs have already been met. Therefore, when evaluating the special order, Franco must determine if the special offer price will meet and exceed the costs to produce the chairs. Analysis is provided in the table below.

Since Franco has already met his fixed costs with current production and since he has the capacity to produce the additional 800 units, Franco only needs to consider his variable costs for this order. Franco’s variable cost to produce one chair is $1,650. Ghanem is offering to buy the chairs for $1,800 apiece. By accepting the special order, Franco would meet his variable costs and make $150 per chair. Considering only quantitative factors, Franco should accept the special offer.

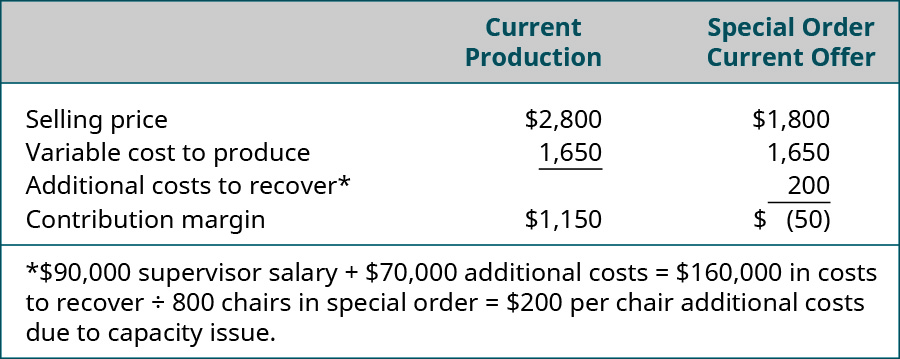

How would Franco’s decision change if the factory was already producing at capacity at the time of the special offer?

In other words, assume the business is already producing the most it can produce without working more hours or adding more equipment. Accepting the order would likely mean that Franco would incur additional fixed costs. Assume that, to fill the order from Ghanem, Franco would have to run an extra shift, and this would require him to hire a temporary production manager at a cost of $90,000. Assume no other fixed costs would be incurred. Also assume Franco will incur additional costs related to maintenance and utilities for this extra shift and estimates those costs will be $70,000. As shown in the table below, in this scenario, Franco would have to charge Ghanem at least $1,850 in order to meet his cost.

Final analysis of the decision

The analysis of Franco’s options did not consider any qualitative factors, such as the impact on morale if the company is already at capacity and opts to implement overtime or hire temporary workers to fill the special order. The analysis also does not consider the effect on regular customers if management elects to meet the special order by not fulfilling some of the regular orders. Another consideration is the impact on existing customers if the price offered for the special order is lower than the regular price. These effects may create a bad dynamic between the company and its customers, or they may cause customers to seek products from competitors. As in the example, Franco would need to consider the impact of displacing other customers and the risk of losing business from regular customers, such as dental supply companies, if he is unable to meet their orders. The next step is to do an overall cost/benefit analysis in which Franco would consider not only the quantitative but the qualitative factors before making his final decision on whether or not to accept the special order.