Preparing a cash budget

Mitchell Franklin; Patty Graybeal; Dixon Cooper; and Amanda White

Why we need to prepare a cash budget

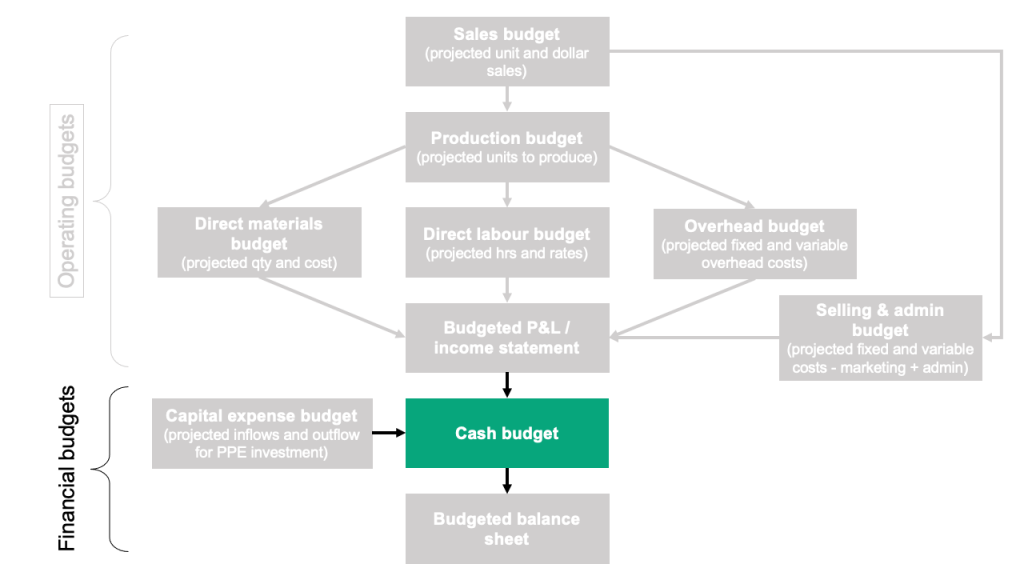

The financial budgets involves examining the expectations for financing the operations of the business and planning for the cash needs of the business. The budget helps estimate the source, amount, and timing of cash collection and cash payments as well as determine if and when additional financing is needed or debt can be paid.

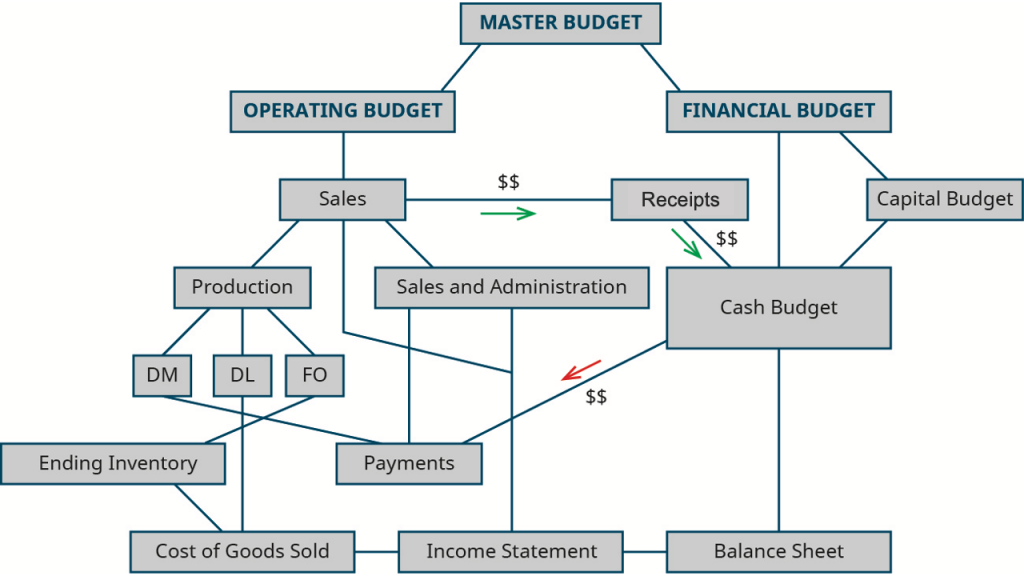

We will focus on preparing the cash budget as shown in the master budget diagram below (preparing a capital expense budget and budgeted balance sheet is beyond the introductory scope of this text). It is critical for the business to understand how much cash is going to be received and why, as well as the size and timing of payments to suppliers and employees. Remember that trading while insolvent (that is, trading while unable to pay your debts) is against the law. For incorporated entities – Directors can face serious penalties if found to have been trading a business and incurring new debts when they knew that existing debts could not be paid (refer to ASIC’s guide to insolvency for directors if you would like to extend your understanding further).

Preparing a cash budget

The cash budget is the combined budget of all inflows and outflows of cash. It should be divided into the shortest time period possible, so management can be quickly made aware of potential problems resulting from fluctuations in cash flow. One goal of this budget is to anticipate the timing of cash inflows and outflows, which allows a company to try to avoid a decrease in the cash balance due to paying out more cash than it receives. In order to provide timely feedback and alert management to short-term cash needs, the cash flow budget is commonly geared toward monthly or quarterly figures. (Figure) shows how the other budgets tie into the cash budget.

Because the cash budget accounts for every inflow and outflow of cash, it is broken down into smaller components. The cash receipts schedule includes all of the cash inflow expected to be received from customer sales, whether those customers pay at the same rate or even if they pay at all. The cash receipts schedule includes all the cash expected to be received and does not include the amount of the receivables estimated as uncollectible. The cash payments schedule plans the outflow or payments of all accounts payable, showing when cash will be used to pay for direct material purchases. Both the cash receipts schedule and the cash payments schedule are included along with other cash transactions in a cash budget. The cash budget, then, combines the cash collection schedule, the cash payment schedule, and all other budgets that plan for the inflow or outflow of cash. When everything is combined into one budget, that budget shows if financing arrangements are needed to maintain balances or if excess cash is available to pay for additional liabilities or assets.

The operating budgets all begin with the sales budget. The cash receipts schedule does as well. Since purchases are made at varying times during the period and cash is received from customers at varying rates, data are needed to estimate how much will be collected in the month of sale, the month after the sale, two months after the sale, and so forth. Bad debts also need to be estimated, since that is cash that will not be collected.

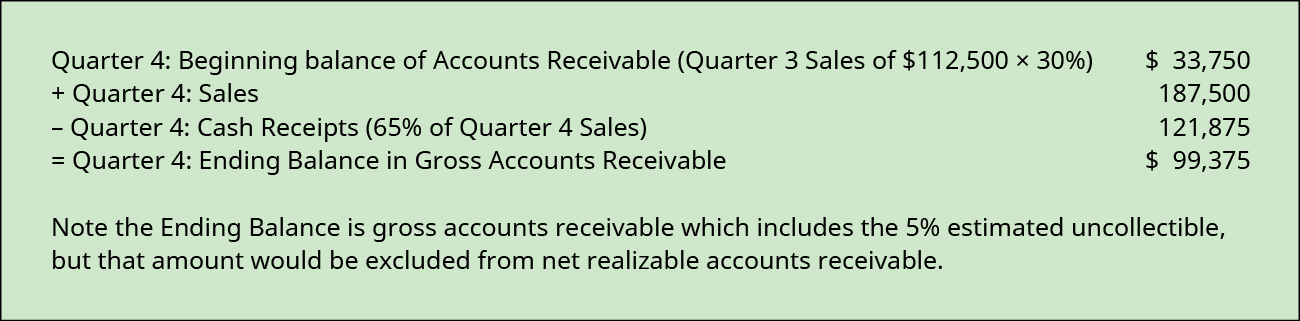

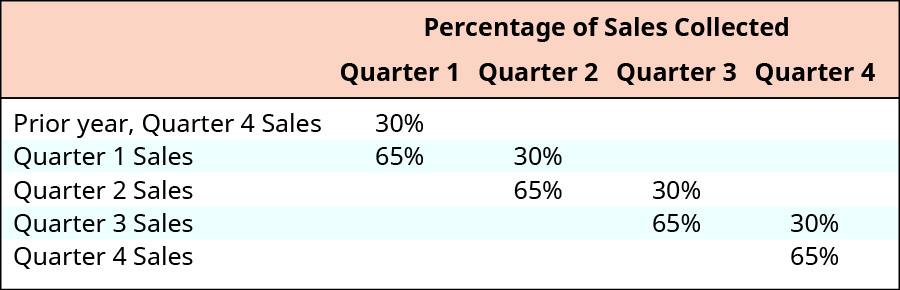

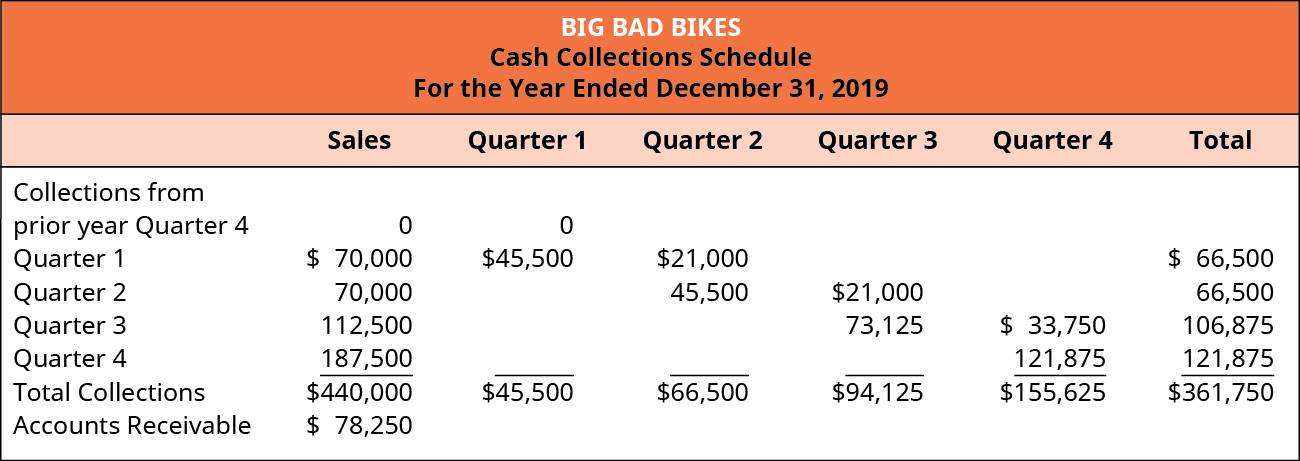

To illustrate, let’s return to Big Bad Bikes. They believe cash collections for the trainer sales will be similar to the collections from their bicycle sales, so they will use that pattern to budget cash collections for the trainers. In the quarter of sales, 65% of that quarter’s sales will be collected. In the quarter after the sale, 30% will be collected. This leaves 5% of the sales considered uncollectible. Uncollectible sales are those accounts receivables that cannot be collected and must be converted from an asset (Accounts receivable) to an Expense. These uncollectible sales are called bad debts and we will explore these in more detail in the follow up textbook, Accounting Business and Society.

The diagram below illustrates when each quarter’s sales will be collected. An estimate of the net realisable balance of Accounts Receivable can be reconciled by using information from the cash collections schedule:

For example, in quarter 1 of year 2, 65% of the quarter 1 sales will be collected in cash, as well as 30% of the sales from quarter 4 of the prior year. There were no sales in quarter 4 of the prior year so 30% of zero sales shows the collections are $0. Using information from Big Bad Bikes sales budget, the cash collections from the sales are shown in (Figure).

When the cash collections schedule is made for sales, management must account for other potential cash collections such as cash received from the sale of equipment or the issuance of stock. These are listed individually in the cash inflows portion of the cash budget.

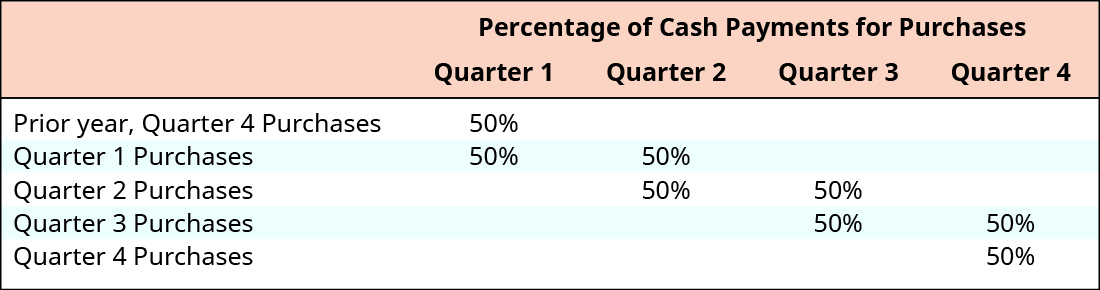

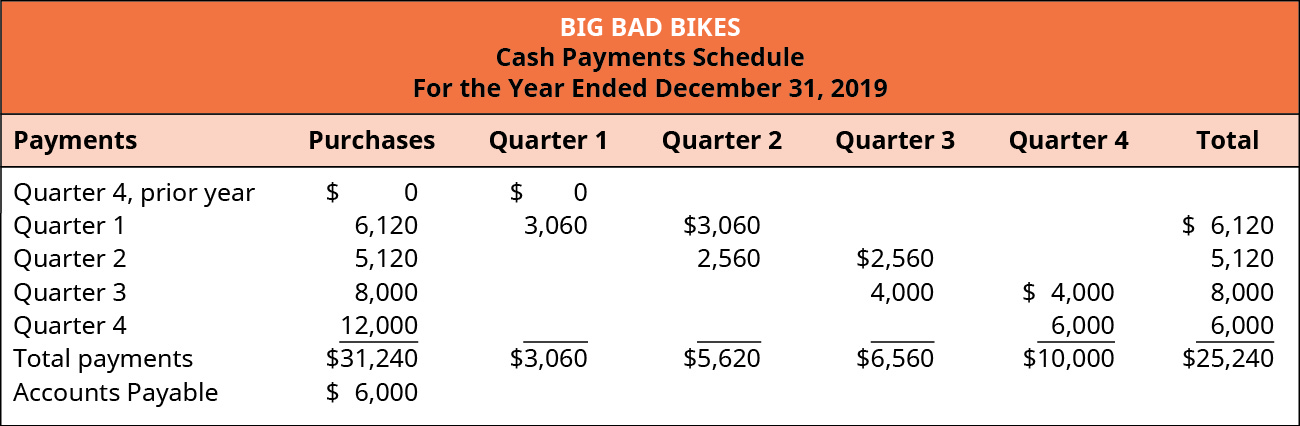

The cash payments schedule, on the other hand, shows when cash will be used to pay for Accounts Payable. One such example are direct material purchases, which originates from the direct materials budget. When the production budget is determined from the sales, management prepares the direct materials budget to determine when and how much material needs to be ordered. Orders for materials take place throughout the quarter, and payments for the purchases are made at different intervals from the orders. A schedule of cash payments is similar to the cash collections schedule, except that it accounts for the company’s purchases instead of the company’s sales. The information from the cash payments schedule feeds into the cash budget.

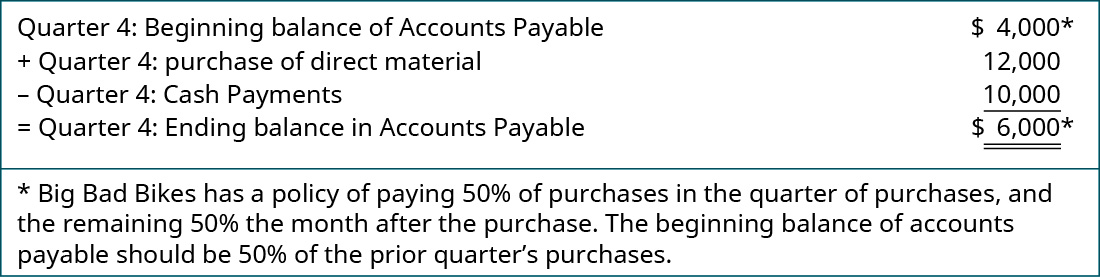

Big Bad Bikes typically pays half of its purchases in the quarter of purchase. The remaining half is paid in the following quarter, so payments in the first quarter include payments for purchases made during the first quarter as well as half of the purchases for the preceding quarter. (Figure) shows when each quarter’s purchases will be paid. Additionally, the balance of purchases in Accounts Payable can be reconciled by using information from the cash payment schedule as follows:

The first quarter of the year plans cash payments from the prior quarter as well as the current quarter. Again, since the trainers are a new product, in this example, there are no purchases in the preceding quarter, and the payments are $0. (Figure).

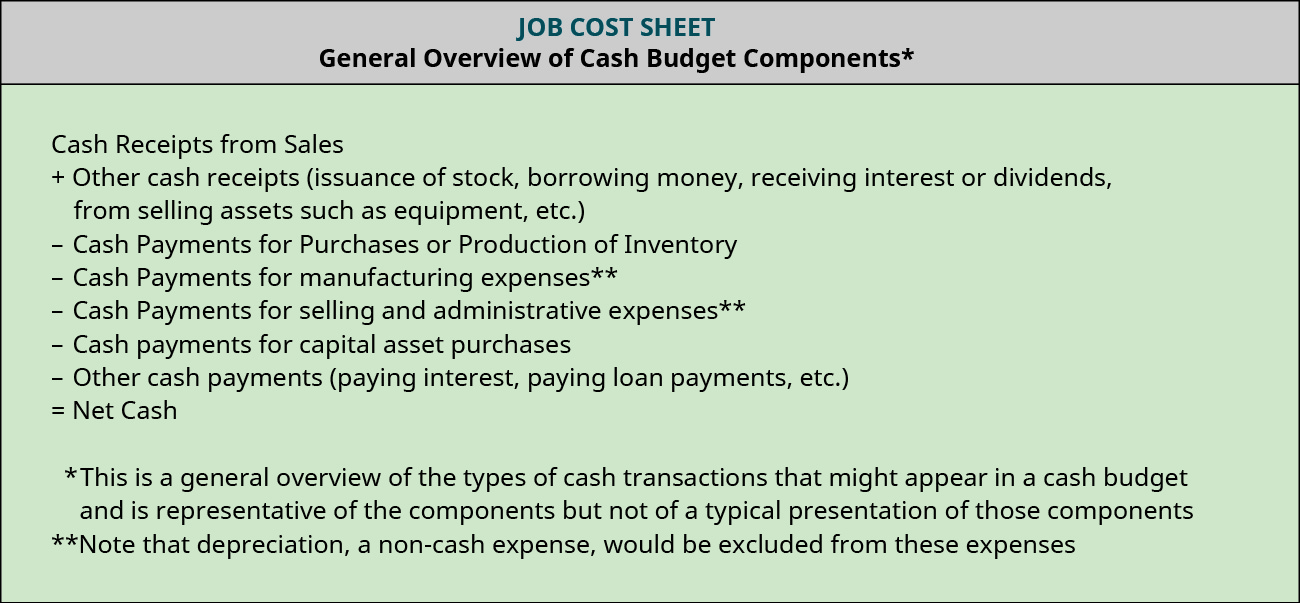

While the cash payments schedule is made for purchases of material on account, there are other outflows of cash for the company, and management must estimate all other cash payments for the year. Typically, this includes the manufacturing overhead budget, the sales and administrative budget, the capital asset budget, and any other potential payments of cash. Since depreciation is an expense not requiring cash, the cash budget includes the amount from the budgets less depreciation. Cash payments are listed on the cash budget following cash receipts. (Figure) shows the major components of the cash budget.

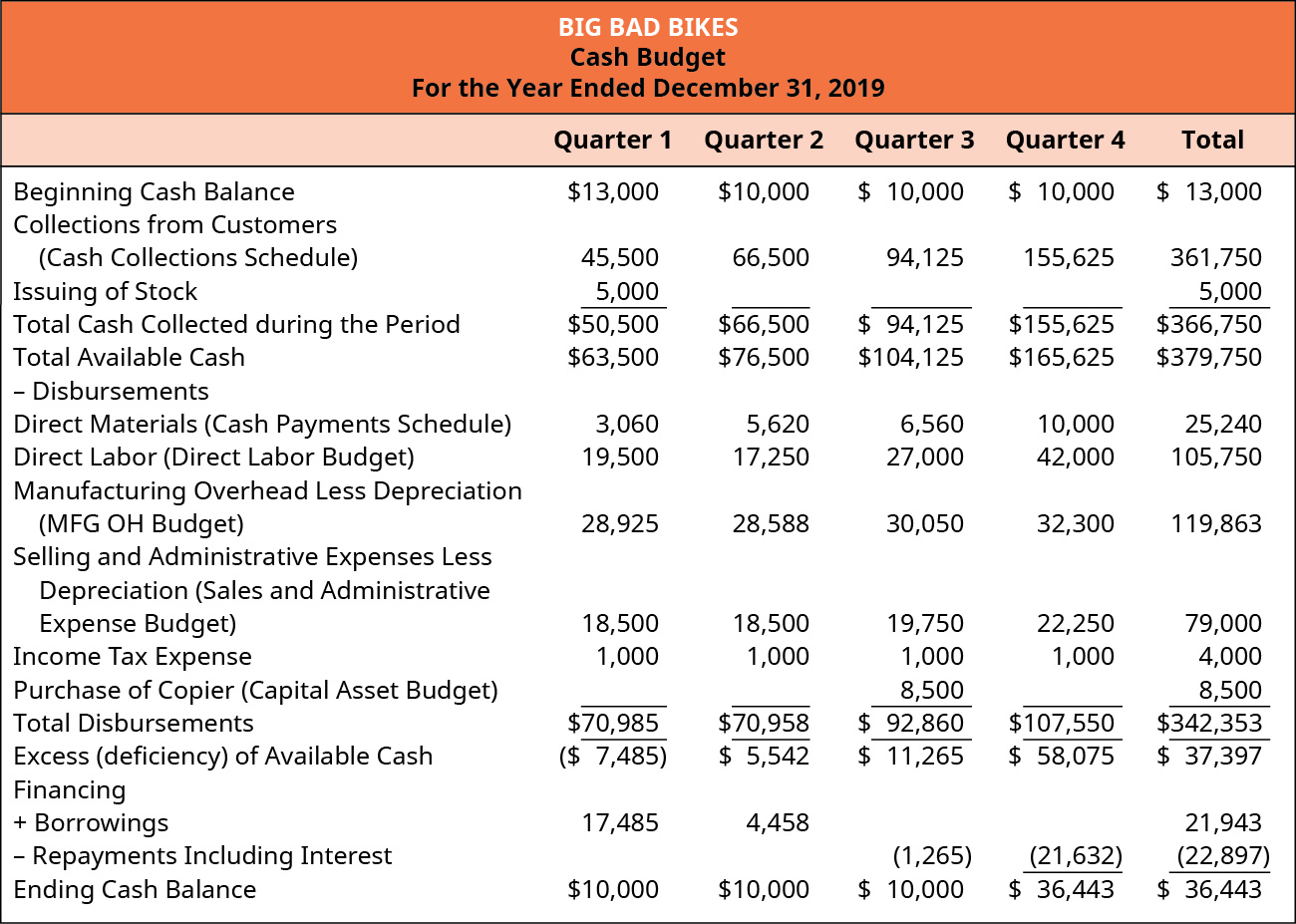

The cash budget totals the cash receipts and adds it to the beginning cash balance to determine the available cash. From the available cash, the cash payments are subtracted to compute the net cash excess or deficiency of cash for the quarter. This amount is the potential ending cash balance. Organizations typically require a minimum cash balance. If the potential ending cash balance does not meet the minimum amount, management must plan to acquire financing to reach that amount. If the potential ending cash balance exceeds the minimum cash balance, the excess amount may be used to pay any financing loans and interest.

Big Bad Bikes has a minimum cash balance requirement of $10,000 and has a line of credit available for an interest rate of 19%. They also plan to issue additional capital stock for $5,000 in the first quarter, to pay taxes of $1,000 during each quarter, and to purchase a copier for $8,500 cash in the third quarter. The beginning cash balance for Big Bad Bikes is $13,000, which can be used to create the cash budget shown in (Figure).

Budgeted balance sheet

The cash budget shows how cash changes from the beginning of the year to the end of the year, and the ending cash balance is the amount shown on the budgeted balance sheet. The budgeted balance sheet is the estimated assets, liabilities, and equities that the company would have at the end of the year if their performance were to meet its expectations. Creating a budgeted balance sheet is a more advanced skill not covered in this text.

If you want to learn more about this – please refer to the OpenStax textbook Principles of Financial Accounting 2 and section 7.3 (this textbook uses Principles of Financial Accounting 1 and 2 as a source of material – however our budgeting chapter has been adjusted for an introductory audience).