Conducting a variance analysis using the static and flexible budget

Amanda White; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

Why compare the static and flexible budgets

As you’ve learned, an advantage of budgeting is evaluating performance. Having a strong understanding of their budgets helps managers keep track of expenses and work toward the company’s goals. Companies need to understand their revenue and expense details to develop budgets as a tool for planning operations and cash flow. Part of understanding revenue and expenses is evaluating the prior year. Did the company earn the expected profit? Could it have earned a higher profit? What expenses or revenues were not on the budget? Critically evaluating the actual results versus the estimated budgetary results can help management plan for the future.

The variance is the difference between the flexible budgeted performance and the actual performance. Identifying the variances do not necessarily tell us what is causing the issues, but highlights the issue so that management and the business can investigate the cause. Variances are categorised as either favourable or unfavourable. A favourable variance is when revenue is higher than budgeted or expenses are lower than budgeted. An unfavourable variance is when revenue is lower than budgeted or expenses are higher than budgeted.

| Comparing Favourable to Unfavourable Variances | |

|---|---|

| Favourable | Unfavourable |

| Actual Sales > Budgeted Sales | Actual Sales < Budgeted Sales |

| Actual Expenses < Budgeted Expenses | Actual Expenses > Budgeted expenses |

It is easy to understand that an unfavourable variance may be a problem. But that is not always true, as a higher rate for wages may mean the company has a higher quality employee who is able to waste less material. Likewise, having a favourable variance indicates that more revenue was earned or less expenses were incurred but further analysis can indicate if costs were cut too far and better materials should have been purchased.

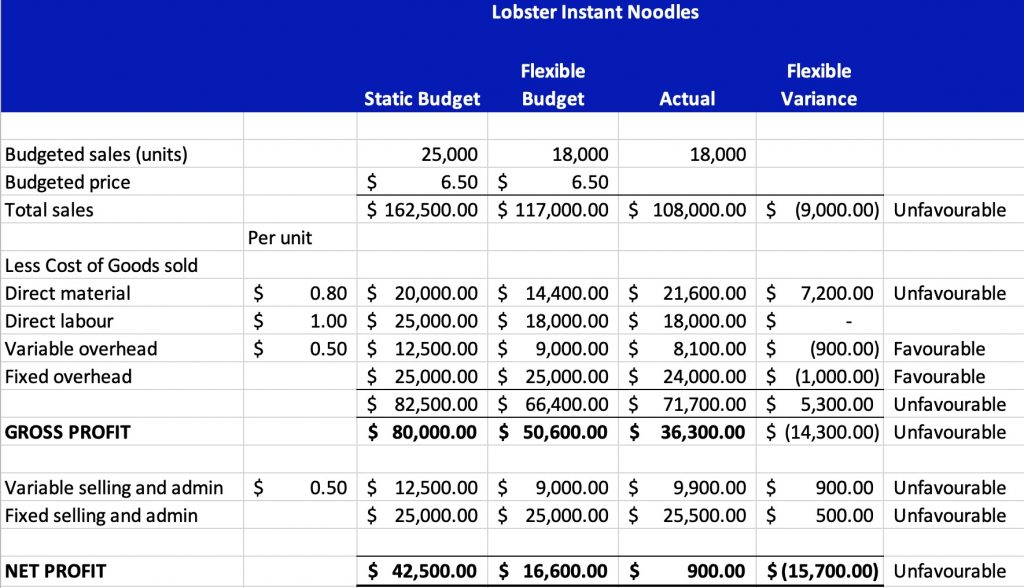

Example – Lobster Instant Noodles

The Lobster Instant Noodles variance analysis has been updated to include whether the variances are favourable or unfavourable. Remember – a negative variance doesn’t mean unfavourable – remember to think about the item – a negative variance for revenue means that we earned less than expected. However a negative variance for an expense means that we spent less than expected – that is a good thing!

For Lobster Instant Noodles, we can see that we spent more on direct materials, but less on manufacturing overhead. We spent more on selling and administration costs overall. Variable analysis is like a torch. It spotlights for us where the issues may be – but we must evaluate whether the variance is significant (is it big enough to warrant investigation) and then conduct further analysis.

What caused us to spent $7,200 more on direct materials during the year than our original forecast? How did we make a saving on fixed overhead? The critical skill for employees of a business is knowing how to read a variance analysis and then ask the right questions of the right people to determine whether you have a problem.