Analysing and recording business transactions

Amanda White; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

In the previous section, we gained a basic understanding of both the basic and expanded accounting equations, and looked at examples of assets, liabilities, and shareholders’ equity. Now, we can consider some of the transactions a business may encounter. We can review how each transaction would affect the basic accounting equation.

The first step in the accounting cycle is to identify and analyse transactions. Each original source transaction must be evaluated for financial implications. Meaning, will the information contained on this original source affect the financial statements? If the answer is yes, the business will then analyse the information for how it affects the financial statements. For example, if a business receives a cash payment from a customer, the business needs to know how to record the cash payment in a meaningful way to keep its financial statements up to date.

Here is a reminder of the common account names that we covered in the previous section

| Account name | Class of account | Description | Word hints* |

| Sales revenue | Revenue | When a business sells a good or service to a customer | Makes a sale, sells |

| Cost of sales | Expense | The cost of the goods sold to a customer or services provided | The inventory cost … |

| Investment income | Revenue | When a business earns revenue from its investments (such as shares owned in another business) | Received interest, received dividends |

| Distribution expense | Expense | Ship/deliver goods to customers | Shipping cost |

| Marketing expense | Expense | To convince customers to purchase your good or service | Advertising fees, social media marketing bill |

| Occupancy expense | Expense | Anything associated with the business’ main premise – rent or lease, utilities, council rates | |

| Depreciation expense | Expense | Recognition of the use of some part of a non-current asset like a machine | |

| Income tax expense | Expense | Taxes paid to government | |

| Wages expense | Expense | Remunerating employees for their work in the business | |

| Dividends | Expense | The reward due to shareholders for their investment in the business | Dividends paid |

| Cash | Asset | Cash held by the business in a bank account or in physical cash on the business premise | |

| Accounts receivable | Asset | The payment a customer has promised to made for goods or services already received | The customer purchased items and were billed.

The customer purchased “on credit” |

| Inventory | Asset | Items the business holds that they will sell in the future (to generate revenue and they will receive payment for) | |

| Prepayments | Asset | When a business has paid an expense in advance such as insurance. | A twelve month policy was purchased and paid for at the beginning of the year |

| Property, plant and equipment | Asset | Historically called “fixed assets” because they were fixed into place on the warehouse floor.

Items that help manufacture or support the manufacture of inventory or the provision of a good or service. This includes items like a bottling machine at a beverage business right through to office computers and printers. |

The business purchased a XYZ |

| Accounts payable | Liability | When the business purchases a good or service and promises to pay the supplier later | The purchase was made “on credit”

The business was billed for the item and will pay in 30 days |

| Unearned revenue | Liability | When a customer pays the business in advance for services or goods to be rendered in the future. | paid “in advance” or “payment upfront” |

| Borrowings | Liability | The business engages in a contract to borrow funds and repay those funds over time. | The business took out a bank loan. |

| Share capital – contributed capital | Equity | The net value of the firm attributed to its owners (shareholders) | The business issued shares to admit a new shareholder |

| Retained earnings | Equity | A place to hold the profits (or losses) the business made during the year | Retained earnings is not normally used in journal entries at the introductory level of accounting! |

In practice, there are many variations and sub-definitions under these main account names – so if you’ve look at some accounting information in your employment or volunteering experience – it may look similar but not identical. That is absolutely normal. The ‘Word hints’ are phrases you may see in the description of a transaction that will give you a hint to use this account. Not all accounts have word hints because many accounts are self-explanatory.

Example 1

You are the accountant for a startup mobile app developer, Kids Learn Online (KLO). Here are the business transactions from the current month:

- Issues $20,000 of share equity in exchange for cash.

- Purchases computer equipment on account (to be paid for later) for $3,500, payment due within the month.

- Receives $4,000 cash in advance from a customer for an app not yet developed (we will offer these services at a later date).

- Provides $5,500 in app development services to a customer on credit (the customer will pay the business at a later date)

- Pays a $300 electricity bill with cash.

- Distributed $100 cash in dividends to shareholders.

We now analyse each of these transactions, paying attention to how they impact the accounting equation and corresponding financial statements.

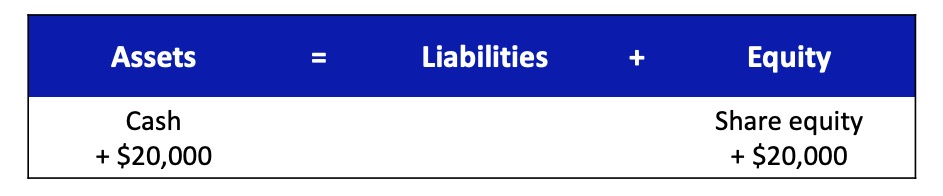

Transaction 1:

Issues $20,000 of share equity for cash.

Analysis: The business has received cash resulting in an increase in the assets. In exchange for the cash, the business has issued shares, thereby increasing equity (and the overall value of the business).

Transaction 2:

Purchases computer equipment on account (to be paid for later) for $3,500, payment due within the month.

Analysis: We know that the business purchased computer equipment, which is an asset. We also know that the business purchased the equipment on account, meaning it did not pay for the equipment immediately and asked for payment to be billed instead and paid later. Since the business owes money and has not yet paid, this is a liability, specifically labeled as accounts payable. There is an increase to assets because the business has equipment it did not have before. There is also an increase to liabilities because the business now owes money. The more money the business owes, the more that liability will increase.

The accounting equation remains balanced because there is a $3,500 increase on the asset side, and a $3,500 increase on the liability and equity side.

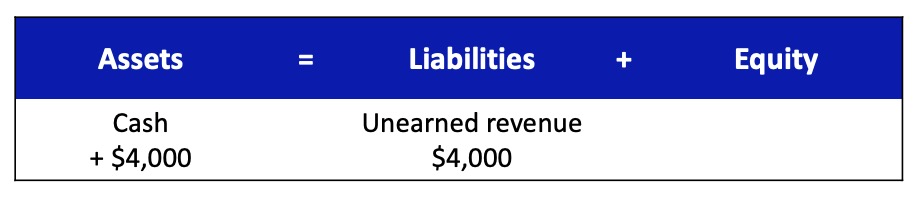

Transaction 3:

Receives $4,000 cash in advance from a customer for an app not yet developed

Analysis: We know that the business collected cash, which is an asset. This collection of $4,000 increases assets because money is coming into the business.

The business has yet to provide the app development service. According to the revenue recognition principle, the business cannot recognise that revenue until it provides the service. Therefore, the business has a liability to the customer to provide the service and must record the liability as unearned revenue. The liability of $4,000 worth of services increases because the business has more unearned revenue than previously.

The equation remains balanced, as assets and liabilities increase. The balance sheet would experience an increase in assets and an increase in liabilities.

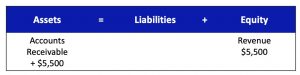

Transaction 4:

Provides $5,500 in app development services to a customer who asks to be billed for the services.

Analysis: The customer asked to be billed for the service, meaning the customer did not pay with cash immediately. The customer owes money and has not yet paid, signaling an accounts receivable. Accounts receivable is an asset that is increasing in this case. This customer obligation of $5,500 adds to the balance in accounts receivable.

The business did provide the services. As a result, the revenue recognition principle requires recognition as revenue, which increases equity for $5,500. The increase to assets would be reflected on the balance sheet. The increase to equity would affect three statements. The income statement would see an increase to revenues, changing net income (loss). Net income (loss) is computed into retained earnings on the statement of retained earnings. This change to retained earnings is shown on the balance sheet under shareholders’ equity.

Transaction 5:

Pays a $300 electricity (utility) bill with cash.

Analysis: The business paid with cash, an asset. Assets are decreasing by $300 since cash was used to pay for this utility bill. The business no longer has that money.

Utility payments are generated from bills for services that were used and paid for within the accounting period, thus recognised as an expense. The expense decreases equity by $300. The decrease to assets, specifically cash, affects the balance sheet and statement of cash flows. The decrease to equity as a result of the expense affects three statements. The income statement would see a change to expenses, changing net income (loss). Net income (loss) is computed into retained earnings on the statement of retained earnings. This change to retained earnings is shown on the balance sheet under shareholders’ equity.

Transaction 6:

Distributed $100 cash in dividends to shareholders.

Analysis: The business paid the distribution with cash, an asset. Assets decrease by $100 as a result. Dividends affect equity and, in this case, decrease equity by $100. The decrease to assets, specifically cash, affects the balance sheet and statement of cash flows. The decrease to equity because of the dividend payout affects the statement of retained earnings by reducing ending retained earnings, and the balance sheet by reducing shareholders’ equity.

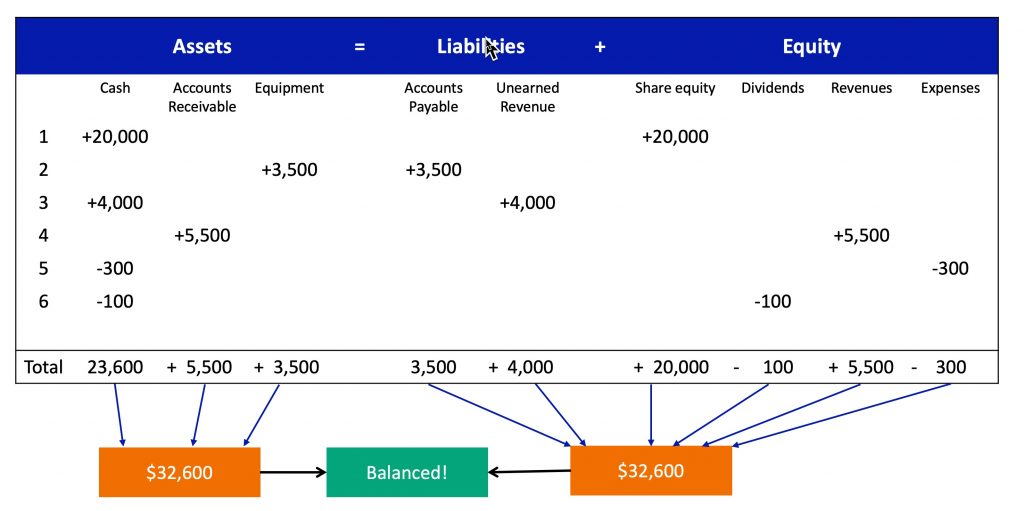

Let’s summarise the transactions and make sure the accounting equation has remained balanced. Shown are each of the transactions.

As you can see, assets total $32,600, while liabilities added to equity also equal $32,600. Our accounting equation remains balanced.

Are all business events recorded as transactions?

To determine which business events are to be recorded – always think back to the idea of inflows and outflows – is something flowing into the business? It could be cash, or some other asset. Or are there any outflows from the business to another party?

Let’s work through an example with Tiny Holidays – a relatively new business owned by Hazel Nguyen – that specialises in short breaks in tiny homes – ultra small accomodation – in remote rural locations. She has a collection of 6 tiny homes across 2 rural properties in New South Wales. An example of one of her tiny homes is in the photograph below.

Photo by Roberto Nickson on Unsplash

Tiny Holidays had the following transactions:

- Hazel ordered shelving worth $750.

- Hazel sells her accomodation service in her tiny homes for $199 per night, however, after checking out listings for other tiny homes, changes the nightly charge on her website to $250 per night.

- A customer pays for a weekend tiny home rental upon arrival at the rural location.

- The shelving is delivered with an invoice for $750.

Which events will be recorded in the accounting system?

Solution

- Hazel did not yet receive the shelving—it has only been ordered. As of now there is no new asset owned by the business. Since the shelving has not yet been delivered, Hazel does not owe any money to the other business. Hazel will not record the transaction.

- Changing prices does not have an impact on the business at the time the price is changed. No transaction is recorded

- Hazel now has a transaction to record. She has received cash in exchange for a weekend rental. She has an increase in one asset (cash) and an increase in her revenue (equity).

- Hazel has taken possession of the shelving and is the legal owner. She also has an increase in her liabilities as she accepted delivery of the shelving but has not paid for it. Hazel will record this transaction.

Test yourself

The following questions are adapted from the Principles of Accounting 1 into H5P format.