Financial statement analysis

Amanda White; Mitchell Franklin; Patty Graybeal; and Dixon Cooper

What is financial statement analysis and why perform it?

Financial statement analysis reviews financial information found on financial statements to make informed decisions about the business. The income statement, statement of changes to equity, balance sheet, and statement of cash flows, among other financial information, can be analysed. The information obtained from this analysis can benefit decision-making for internal and external stakeholders and can give a business valuable information on overall performance and specific areas for improvement. The analysis can help them with budgeting, deciding where to cut costs, how to increase revenues, and future capital investments opportunities.

When considering the outcomes from analysis, it is important for a business to understand that data produced needs to be compared to others within industry and close competitors. The business should also consider their past experience and how it corresponds to current and future performance expectations. Three common analysis tools are used for decision-making; horizontal analysis, vertical analysis, and financial ratios.

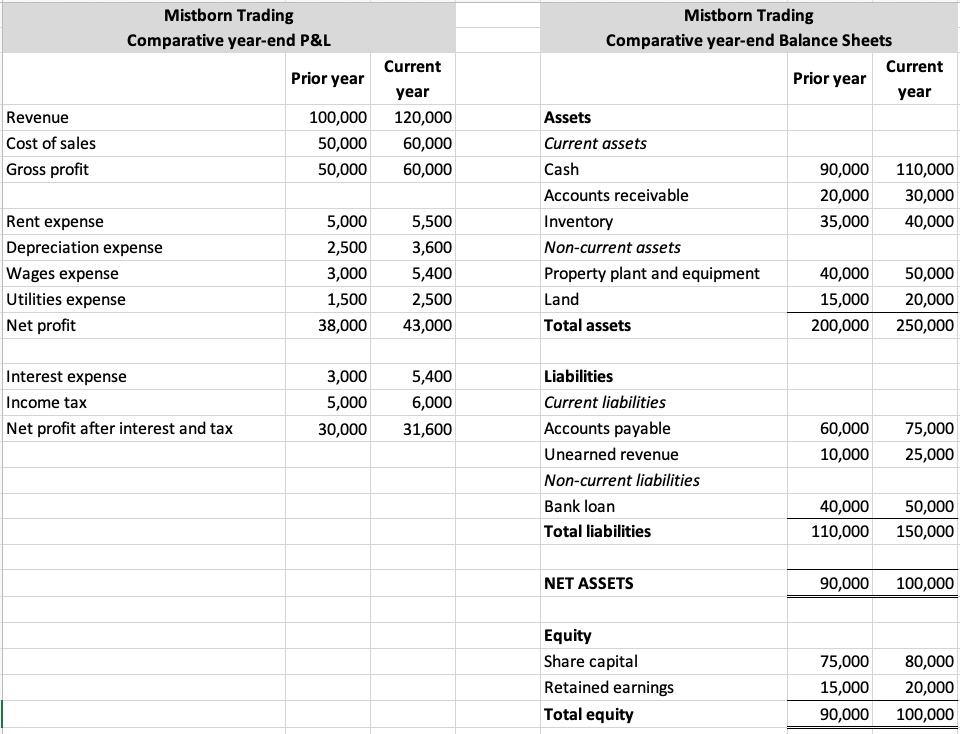

For our discussion of financial statement analysis, we will use Mistborn Trading. Mistborn Trading is a business that sells a variety of products related to steam punk fancy dress. The figure below shows the Comparative P&L/Income Statements and Balance Sheets for Mistborn Trading last 2 years of operations.

So that you can follow along with our analysis in the textbook – download this excel file of the table above.

Keep in mind that the comparative income statements and balance sheets for Mistborn Trading are simplified for our calculations and do not fully represent all the accounts a business could maintain.

Advantages and disadvantages of financial statement analysis

There are several advantages and disadvantages to financial statement analysis. Financial statement analysis can show trends over time, which can be helpful in making future business decisions. Converting information to percentages or ratios eliminates some of the disparity between competitor sizes and operating abilities, making it easier for stakeholders to make informed decisions. It can assist with understanding the makeup of current operations within the business, and which shifts need to occur internally to increase productivity.

A stakeholder needs to keep in mind that past performance does not always dictate future performance. Attention must be given to possible economic influences that could skew the numbers being analysed, such as inflation or a recession. Additionally, the way a business reports information within accounts may change over time. For example, where and when certain transactions are recorded may shift, which may not be readily evident in the financial statements.

A business that wants to budget properly, control costs, increase revenues, and make long-term expenditure decisions may want to use financial statement analysis to guide future operations. As long as the business understands the limitations of the information provided, financial statement analysis is a good tool to predict growth and business financial strength.

Using financial statement analysis as a vehicle for asking questions

The numbers and outputs from financial statement analysis alone cannot tell us exactly what is happening in a business. Instead it provides users of the financial statements with a way to analyse the data so that they can ask the most appropriate questions. For shareholders, this might be asking a question of management at an annual general meeting. For lenders, this could be probing deeper when they are asked to provide another loan or an alteration to a borrowing contract.

In reality, very few accountants or business people conduct the calculations you are about to learn by hand. Today, most users of such analysis obtain it from websites or service providers who use software and technology to remove the mundane actions of calculating these numbers. The key is to understand HOW the various forms of analysis are constructed so that you can INTERPRET the outputs and then develop good QUESTIONS to ask.