Recording employee wages and salaries

Amanda White

How to record transactions related to paying employees

Every business needs employees in some way – whether that is to liaise with customers, contact suppliers or oversee operations. It is rare to find a business that runs without employees!

Employees can be remunerated (or paid) in one of two ways:

- Wages – payment based on (usually) an hourly rate (but it could also be per delivery or per item manufactured)

- Salary – a fixed amount is agreed upon for the entire year

In this section we will examine a number of different employee remuneration-related transaction flows including:

- Paying wage-earning employees

- Paying salaried employees

- Recognising employee work at the end of the year

- Paying employees after recognising prior work

1. Paying wage-earning employees

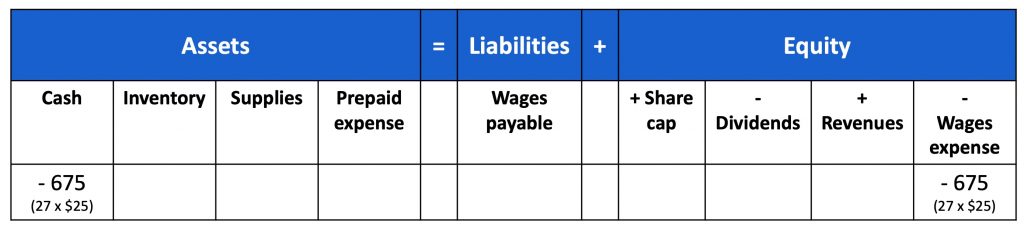

Employees who are paid an hourly rate will either have a business-wide agreement (called an Enterprise Agreement) or will rely on a government-mandated minimum hourly rate. Most businesses will pay their employees on a fortnightly basis. If employees at a business work 27 hours over a fortnight and the agreed pay rate is $25 an hour, the transaction will be recorded as follows:

We have a cash outflow of $675 and an increase in the expense of $675 (remember that the expense account is normally a negative). We have balanced the accounting equation because it is -$675 on both sides.

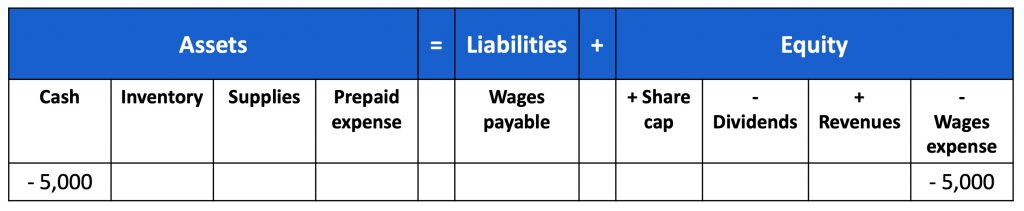

2. Paying salaried employees

Salaried employees earn the same amount no matter how many hours they work (though their contract will include a minimum number of hours expected). Salaries are usually quoted per annum – or the amount expected to be paid over the entire year. However, these employees receive payments on a monthly or fortnightly basis. If a business has a manager who is on a salary of $60,000 per annum, if payments are made monthly, the transaction would be recorded as follows:

What if the payment was made fortnightly? We would take our $60,000 salary and divide it by 26.

3. Recognising employee work at the end of the year

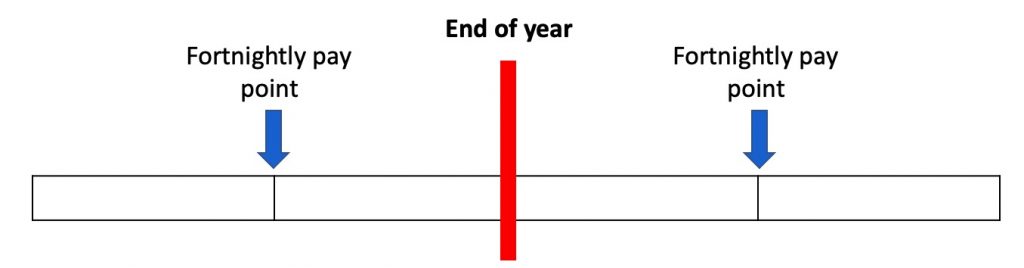

At some point, the business will reach the end of its financial year. In Australia, for most businesses that is 30 June. But what happens if the pay period doesn’t neatly align with the end of the financial year? In the diagram below, the fortnight of work is split by the end of the financial year.

The period concept requires that we have the same financial period of time for every year so that comparisons can be made. Therefore, we can’t move the end of the financial period (or year) to meet up with the pay points.

What should be done in this situation? We treat it just like if a business received goods from a supplier and you agree to pay them at a later date (you purchase goods on credit). Thus employees have worked and we must recognise that we owe them for their efforts.

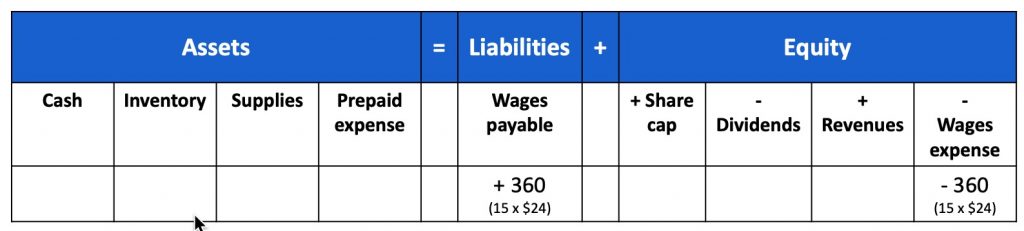

If a business had employees that worked 15 hours at a wage rate of $24 per hour by the time we reached the end of the financial year, then a transaction would be recorded as follows:

Note that we’ve increased our liability (wages payable) and increased our expense (wage expense). There has been NO cash outflow as a result of this transaction. You’ll notice that +360 (wages payable) and -360 (wages expense) add up to 0, balancing the equation and the fact there is 0 cash outflow on the asset side.

4. Paying employees after recognising prior work

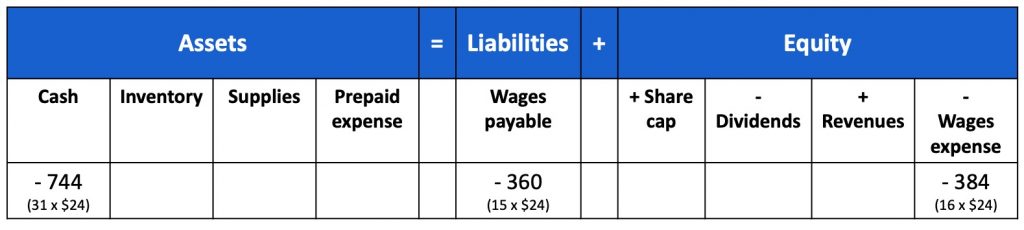

Once we get to the 2nd pay period from our timeline diagram – employees will have worked more hours and the business will need to pay them for the work they did prior to the end of the financial year and after. If the employees in the business worked 16 hours at a wage rate of $24 AFTER the end of the year, the transaction would be recorded as follows:

Note that the cash outflow is for the full fortnight worth of work (15 hours plus 16 hours = 31 hours). However, on the right hand side of the equation, we need to reduce the wages payable to 0 and increase the wages expense for the 16 hours worked AFTER the end of the year. The entire transaction balances since both sides add up to $744.

What about taxes and superannuation?

Every business is required to withhold income tax and superannuation from employee pay. Income tax is paid to the government and superannuation is transferred to an account in the employee’s name at a superannuation fund. In this introductory textbook, we will not delve into the accounting related to taxes and superannuation.