Recording the purchasing process

Amanda White

How to record transactions related to the purchasing process

To be able to generate revenue, a business will almost certainly need to purchase supplies. This could include office stationery, oil for manufacturing equipment or tea and coffee for the kitchen. If they are selling a good – items such as raw materials for manufacturing, or finished goods from a manufacturer – will also need to be purchased. In this section we will examine the purchasing process which will cover purchasing items, but also making payments to suppliers.

In this section we will examine a number of different purchase-related accounting processes including:

- Purchases for cash (quick recap)

- Purchases made on credit

- Making repayments for purchases on credit

- Prepayment of expenses

- Using up prepaid expenses

- Recognising when we use inventory

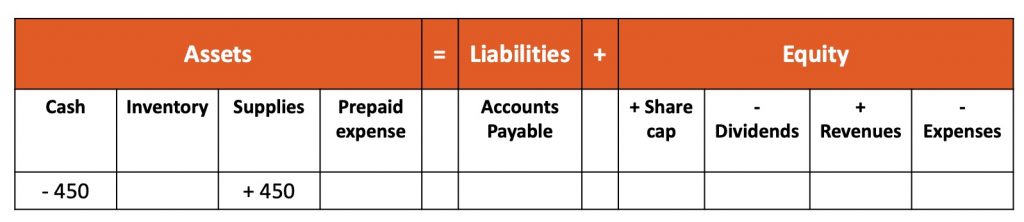

1. Purchases for cash

The easiest accounting transaction related to purchases is buying items for cash. We have a cash outflow, decreasing our cash asset, but an inflow of whatever we’ve purchased (supplies, inventory or a service). If we purchased $450 worth of paper for the printer, the transaction would be recorded as follows:

You can easily change the name of the account depending on what is purchased – it could be inventory, office supplies, packaging for goods or social media advertising. As you can see – the equation balances because the net change in assets is $0, which matches the $0 change in liabilities and equity.

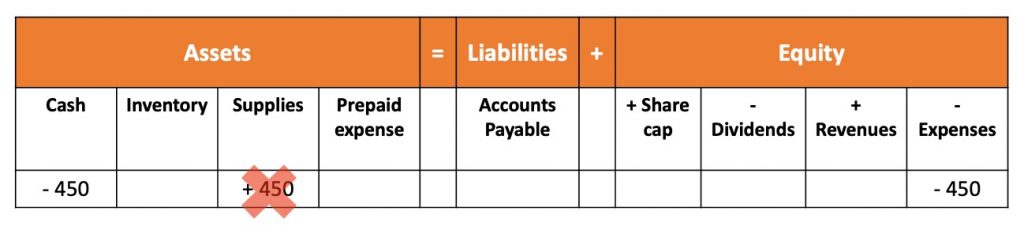

A note on recording purchases of office supplies and other consumable items

In the above example, the business has purchased paper and recorded it as an asset. Theoretically, this is correct – the paper is an asset. The business will only use that asset when it prints something on the paper. However, the accountants – in most businesses has better things to do that count how many pieces of paper were used out of a 240 sheet ream to ensure accurate accounting.

So what happens in real life? In practice?

Businesses record purchases for items that are almost certainly going to be used up in the next 12 months as expenses. There is a decrease/outflow in cash and an increase in the expense (a decrease on both sides of the equation).

But what happens if at the end of the year, some paper or pens or toilet paper haven’t been used? This is where an additional concept called “materiality” comes into play. For a business that makes $100,000 in revenue a year (or $5 million) – the appropriate accounting over a $5 ream of printer paper or a $3 packet of pens is deemed “immaterial”. That means the amount is relatively small and accounting for it in a technically correct manner would have very little impact on the overall profit and financial position/performance of the business.

Given the more practical approach to accounting being used in this textbook – we will be overriding the “technical” correctness of accounting and recording purchases of supplies such as toilet paper, printer paper, toner, stationery, tea, coffee, biscuits etc as EXPENSES, rather than as assets.

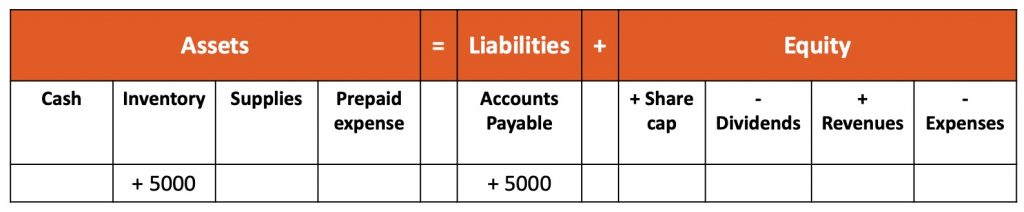

2. Purchases made on credit

For established businesses that have been operating for some time, it can be common for their suppliers to allow them to purchase items on credit. That is, they order and receive the goods now, and pay for them later. When are they paid for? It could be the end of the week, the end of the month, or a certain number of days (like 30) after the goods were delivered to the business. The contract between the business and the supplier will determine the payment terms. If we purchased $5000 worth of inventory on credit from our supplier, the transaction would be recorded as follows:

As you can see, we increase our assets (inventory) but also increase our liabilities (accounts payable). The transaction balances because both sides of the equation have an increase of the same amount.

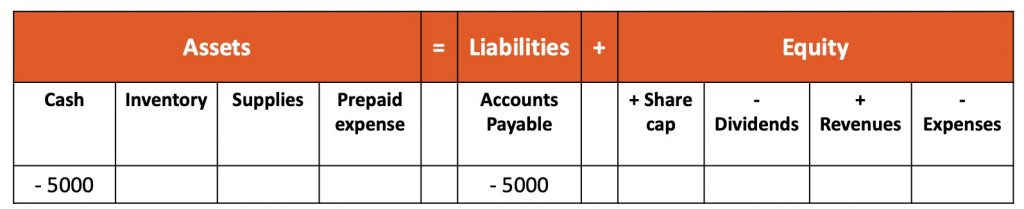

3. Making repayments for purchases on credit

Regardless of the terms of the contract between a business and its supplier, repayments must eventually be made. In the previous example, we are going to pay the supplier for the $5000 worth of inventory we received. The transaction would be recorded as follows:

We have reduced our liabilities by $5000 and also decreased the cash in our bank account by $5000. Again, the equation balances as both sides have a decrease of the same amount.

4. Prepayment of expenses

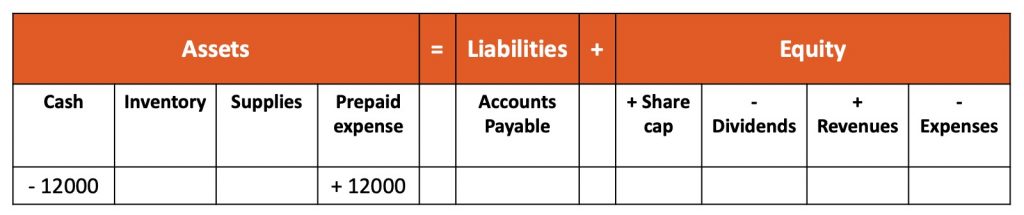

Some business expenses will need to be paid in advance. The most common type of prepayment is purchasing a year’s worth of insurance at one point in time. If a business had to pay a $12,000 insurance policy at the beginning of the year, the transaction would be recorded as follows:

Another might be a business that is required to pay rent quarterly. These have been labelled “prepaid expense” in our recording sheet, but you can customise it to be Prepaid Insurance, Prepaid Rent, Prepaid Social Media Marketing – whatever best suits the transaction. This transaction balances because both asset flows come to a sum of $0, and there are $0 transactions on the liabilities and equity side.

5. Using up prepaid expenses

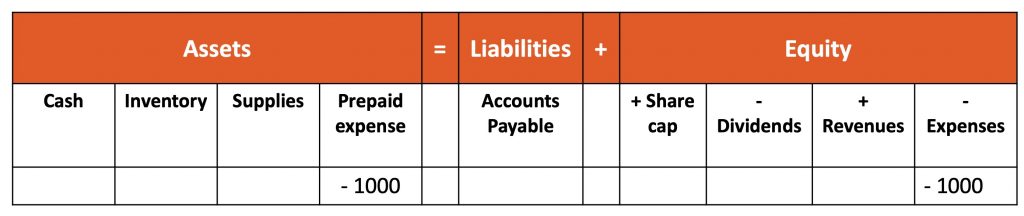

At the end of the month, a business should recognise that part of the prepaid insurance policy has actually been consumed or used during the month. Assuming that the $12,000 insurance policy covers 12 months, the transaction would be recorded as follows:

We have reduced our prepaid asset and increased our expenses (remember that expenses are naturally a negative account). The business would record this transaction at the end of every month until the prepaid asset is reduced to a balance of $0.

6. Recognising when we use inventory

When a business makes a sale that involves providing goods to a customer, it is similar to using a prepaid asset. However, there will be two transactions involved – the first is to recognise that the business has earned revenue and the second to recognise the use of the inventory asset. We have already covered how to record the Sales/Revenue part of the transaction – but not the inventory part of the transaction. In addition, you may have noticed that most of our prior examples are related to businesses that provide services rather than goods.

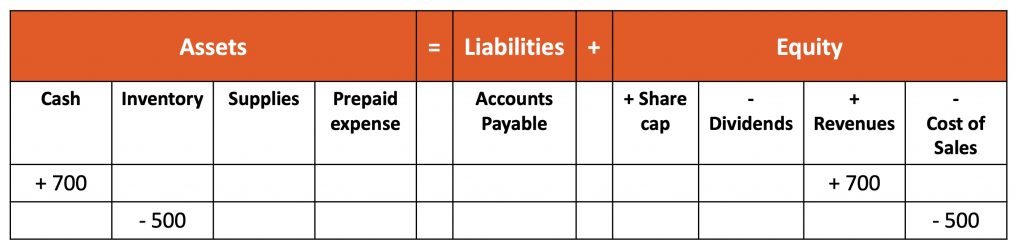

If a business makes a sale of goods for $700, and the inventory was purchased for $500, the transaction would be recorded as follows:

We have increased our cash and revenue, and also recognised that to generate that revenue – the business had to use some resources. That resource was inventory – we converted our inventory asset into an expense (remember that expenses are naturally a negative account, so we are increasing our expense – I have re-named the Expense column to be more specific – Cost of Sales).

Do service businesses have Cost of Sales?

This is a tricky question! Service businesses certainly do use resources to provide that service to customers – for example, an accounting practice will likely use office supplies like pens, printer toner and paper. However, it is difficult to figure out how much printer toner or paper was used to provide a specific service – so these costs are usually just recognised as Expenses rather than in Cost of Sales.

Other costs like wages for staff are also recognised as expenses rather than in Cost of Sales.