Using budgets to evaluate performance

Amanda White

Comparing budget vs actual performance

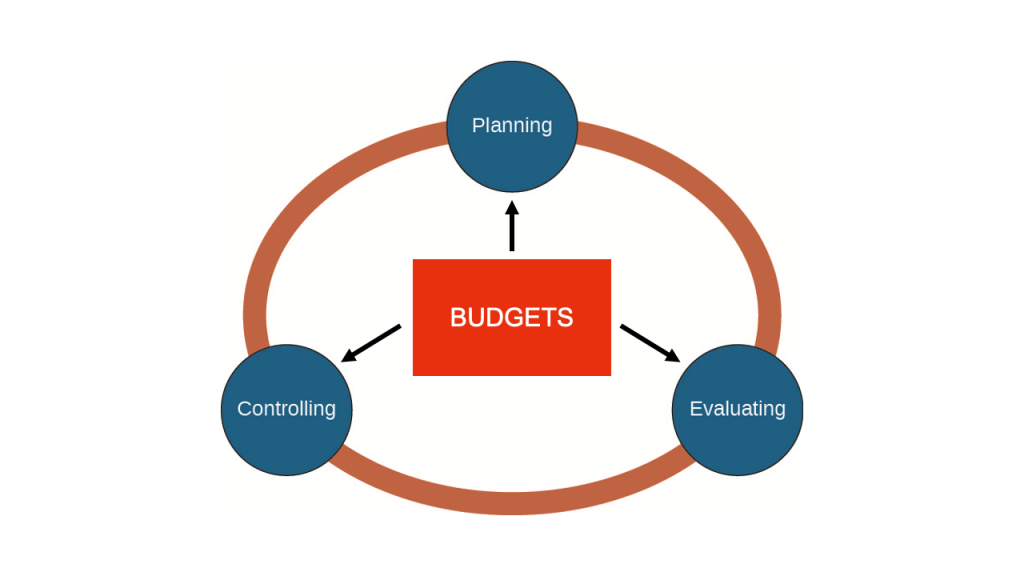

Remember that budgets are used as part of management’s three responsibilities – they help management create specific plans to meet strategic objectives and that has been the focus of this chapter. However, budgets also also play a role in evaluating business performance by comparing actual performance to our plan or budget.

Our budgets are created using a number of assumptions including those related to:

- customer demand

- economic sentiment

- price of raw materials

- availability of raw materials

- pay rates of labour

- prices of overheads and selling and administration costs

However, as the COVID19 pandemic clearly illustrated, budgets and plans may need to be adjusted due to changes in an industry, a country’s economic situation or in reaction to global events. A budget prepared in December 2019 for the period January to December 2020 would not be useful when comparing to ACTUAL financial results for January to December 2020. The original budget produced for planning is called a static budget.

As a result of this potentially unfair comparison, businesses use a technique called flexible budgeting – where an original budget can be adjusted for changes in sales volume or activity. A flexible budget adjusts the cost of goods produced for varying levels of production and is more useful than a static budget, which remains at one amount regardless of the production level. A flexible budget is created at the end of the accounting period, whereas the static budget is created before the fiscal year begins.

In our next chapter, we will learn how to create a flexible budget so that we can then perform evaluation of business performance in a fair and equitable way.